Markets shake off Italy woes (for now). Going down the options staircase in German Banks and adding to shorts on US REITs

Portfolio News

Europe Muddles The Italy saga continues with the new PM-designate failing to agree a cabinet with the President.

The two Populist parties start working on another plan to see if they can form a government. That sounds like a lack of progress to me. Markets did not see it that way. They were helped by a successful auction of 5 and 10 year bonds by the Italian government. The markets rebounded and recovered most of the prior day losses on the back of a surge in oil prices. Maybe oil is the piper and not Italy.

I did share to my investing group 3 charts showing the reversal in short term interest rates in US, Europe and Japan. I will share one here - Europe. Despite all the turmoil and the fall in German Bond yields, the short term rates did go up. These markets really do tell you a lot about sentiment.

Market Jitters I wrote yesterday that it would be good to see markets get back to data. Earnings from Dicks Sporting Goods (DKS) did some of that with a strong earnings report showing that stopping gun sales was not as bad as the analysts feared.

Shares jumped 23% to close at $38.35 which is above the sold leg on the bull call spread I bought in December 2017 (see TIB152). Options I am holding jumped 112%.

https://www.cnbc.com/2018/05/30/dicks-sporting-goods-q1-2018-earnings.html

A quick look at the chart shows that the price scenario I modeled in TIB152 did not exactly follow the past patterns. It went sideways a bit before making the jump on earnings. I will close the trade overnight as maximum profit has been reached.

Bought

Commerzbank AG (CBK.DE): German Bank. In one of my small portfolios, I was looking to replace a US bank trade on Fifth Third Bancorp (FITB) that I had closed out a while ago. I did put a bid on a Commerzbank option on the big selloff on Tuesday. That bid was taken up the day after the selloff. My thinking was to run a new trade at the next step down in a staircase of options. I bought December 2020 strike 10 call options for €1.33 premium. Premium is a bit higher than I like to pay but lower than the last one I bought in this account (December 2016). I was happy to take the opportunity as share price has just to return to levels seen a few months ago to get to 200% profit.

The chart tells the story. It is an update on a previous chart. I have slotted in the new contract (the pink rays) showing the bought call and 200% profit line which matches the top of the trading range.

Shorts

Direxion Daily MSCI Real Est Bear 3X ETF (DRV): US Real Estate. IN TIB235, I laid out the ways to short Real Estate Investment Trusts to trade the switch from high risk yield to lower risk yield. One of those options was to buy call options on an inverse leveraged ETF. I mapped out the profit potential from a bull call spread as offering over 600%. I did put a bid in then which was taken up overnight. I bought November 2018 12/16 bull call spread. [Means: Bought strike 12 call options and sold strike 16 call options with the same expiry] for a net premium of $0.55 for 627% maximum profit if price reaches sold strike ($16) on or before expiry.

Let's look at the chart which shows the bought call (12) as a blue ray and the sold call (16) as a red ray with the expiry date the dotted red line on the right margin.

The halfway mark from the bought strike and the top of the range is also shown and equates to a 218% profit. When price moves on this ETF, it moves with some speed. We see two moves both of the same size and steepness. I need a repeat of one of those to get close to the maximum profit. There is risk in this trade that the Federal Reserve does not make its two rate hikes this year. I will be monitoring the possibilities and will look to roll the trade onto 2019 expiries if that happens when they become available.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $286 (3.8% of the high) for a day of low volatility. Price did just squeak out higher than the day before in early trade before giving up a lot of the advance to drop back to the support level

Note: 4 hour chart

CryptoBots

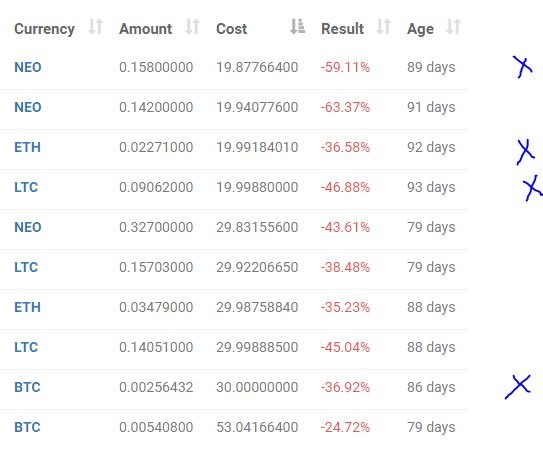

Outsourced Bot No closed trades with new ADA trade just in positive territory on this account (207 closed trades). Problem children was unchanged (>10% down) - (15 coins) - ETH, ZEC, DASH (-45%), BTS, ICX, ADA, PPT, DGD (-44%), GAS (-48%), STRAT, NEO (-48%), ETC (-42%), QTUM, BTG (-49%), XMR.

BTG still the worst at -49%. NEO/GAS are not far behind.

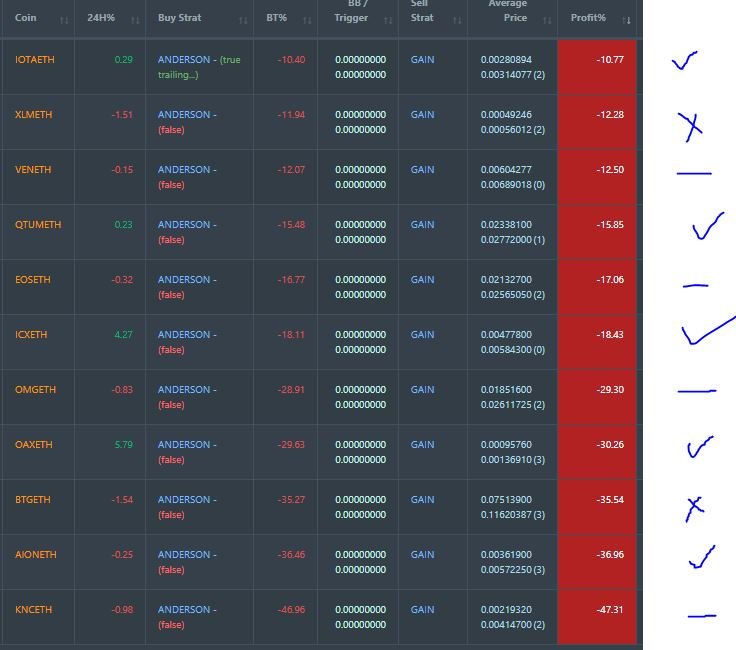

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was reduced by one with NULS coming off (but not closed yet) to 11 coins with 5 coins improving, 4 trading flat and and 2 worse. Apart from NULS all the moves were modest.

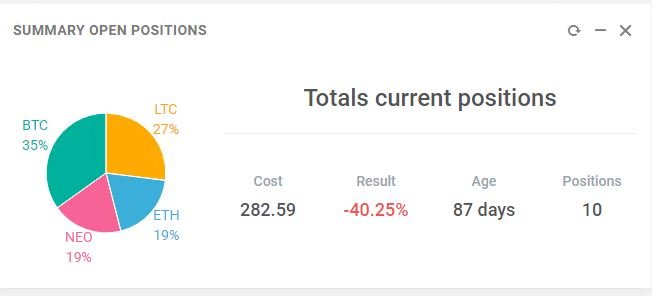

New Trading Bot Positions dropped 2 points to -40.3% (was -38.4%).

All coins traded worse by about 2 points.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 13.2% (higher than prior day's 12.3%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 30, 2018

timely reminder to pay for the Keytone Dairy shares I hope to get

Upvoted ($0.16) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

@OriginalWorks

Very important information my friend, I am very impressed with your post, amazing.

Will the Direxion Daily MSCI Real Est Bear 3X ETF deteriorate in price if the price doesn't move fast enough in one direction?

Price needs to move in a direction strongly as borrowing costs for the shorts are not trivial. I have watched short position fees balloon in my portfolios on stocks that I own and lend out

a timely reminder of information to pay for Keytone Dairy's stocks that everyone is always waiting for @carrinm

I traying to learn how to start trading and how to predict but I don't understand it all..stupid me😊

Keep reading and watching

Yes I will. Thank you

thank you for the info @carrinm I really like and always follow you because the post means a lot to me