The markets week ended better than I expected. Not a lot of trade action in my accounts - a French supermarket looks more like a dog than a thing to buy and the crypto trading bot is starting to claw back losses. I have some concerns about the fallout from the Mueller Russian meddling indictments - more than the market is letting on.

Portfolio News

Market Jitters - Tariff Tantrum Markets are focused on data and appear to have priced in future tariff risks.

S&P500 closed above the round number 2800 which has been a ceilng on price moves for some time. Banks started reporting earnings with JP Morgan Chase (JPM) ahead of expectations and Citigroup (C) and Wells Fargo (WFC) behind. This was a drag on the otherwise perky markets.

What is emerging thus far is banks have not been building capital, though they did all pass stress tests (other than Deutsche Bank).

https://www.cnbc.com/2018/07/16/dick-bove-on-us-bank-earnings-stock-prices.html

The article below has a good summary of the fears the market has faced and has priced in somehow. Tariffs, yield curve, Federal Reserve, mid-term elections, strengthening US Dollar all point to the potential end of the economic expansion. Not yet say the markets.

Read the article

Tariffs are making waves that will take some time to work into the numbers as China takes action to shift supply chains.

There is a flurry of activity between China and Germany though Germany has many of the same problems with China as Donald Trump has - access to markets and stolen (copied) technology

World Cup

Google search for Russia for the past few days focuses on the upcoming summit.

No mention is made in the headlines of the Mueller indictment on 12 Russian agents and the conspiracy led by Russia during the 2016 US Election. The SBS, the Australian broadcaster, headline is very misleading - the search headline says Russia is the foe. The article headline says EU is the foe.

And the article labels Russia, EU and China as foes, which is what Donald Trump said. Foe is a strong word for a competitor - he used that too.

https://www.sbs.com.au/news/trump-brands-eu-foe-as-he-lands-in-helsinki-for-putin-summit

There is a subtext in the CNN article on the indictments.

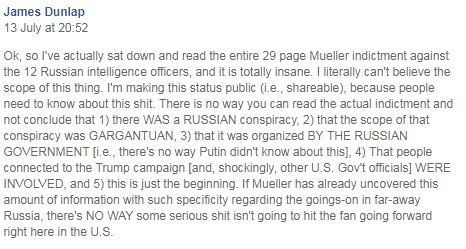

A friend of a friend has read through the 29 pages of the indictment materials. It is clearly a way bigger and complicated matter than anyone imagined.

Image pasted from Facebook.com. I will cut and past the full text onto Steemit to preserve it from censorship

And there are lots of questions that have not been answered like putting names out for the Americans involved - that may come when the matter comes before a court. I am surprised the markets are that sanguine through it all. Surreal the summit will be if Trump and Putin do surreal.

And on the football fields, a great football tournament came to an end in grand style and with a Pussy Riot.

France won somewhat against the play I thought but they knew how to finish. We will find out in due course how free Russians really are - protesting is not allowed in the same way as we see elsewhere in the world - e.g., look at the protests in UK about Donald Trump.

My team were dismantled in 3rd/4th place playoff. Well done Belgium and England.

Bought

Carrefour SA (CA.PA): French Supermarket. I chose to take dividend as a stock dividend - 2% extra stock plus a small residual received as cash. Time to review what I was thinking when I bought the initial stock (see TIB163) and find out what has happened. I bought the stock (and options) in January 2018. I wrote then that price was "showing signs of life" through it had not made a higher high.

The chart shows that price did go onto make a higher high BUT it did not reach the downtrend line before it collapsed. Price has fallen 35% since the February higher high. French people do need to eat but it seems that Carrefour is not their favourite place for doing just that.

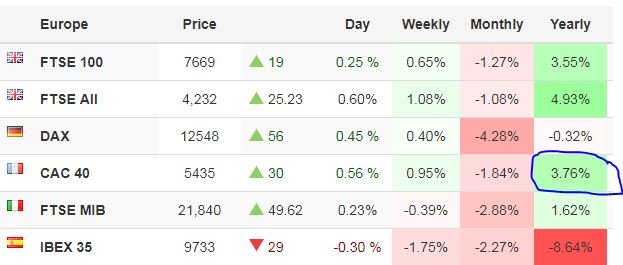

I also compared Carrefour to its main competitor, Casino Guichard, in TIB163. This time I do the comparison from the 2015 highs. Carrefour (black bars) has outperformed but both have ended in much the same place with both making steady work down. That suggests the problem lies in France - this is surprising as the French index (CAC) has been strong in major European markets in 2018, ahead of Germany, Spain and Italy but behind UK.

UK index is weighted heavily by global mining stocks which makes this level of comparison not quite apples and apples.

https://tradingeconomics.com/stocks

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $276 (4.6% of the low). Price respected the support level and after two inside bars (marked with the arrow) broke higher. No Friday and weekend blues this week.

Ethereum (ETHUSD): Price range for the weekend was $32 (7.6% of the low). Ethereum is proving a lot more volatile than Bitcoin. Price did much the same thing though - two inside bars and a break higher but all still in "no mans land".

CryptoBots

Outsourced Bot No closed trades. (213 closed trades). Problem children was unchanged (>10% down) - (18 coins) - ETH, ZEC (-48%), DASH (-52%), LTC, BTS, ICX (-54%), ADA (-44%), PPT (-60%), DGD (-55%), GAS (-66%), SNT, STRAT (-56%), NEO (-61%), ETC, QTUM (-53%), BTG (-60%), XMR, OMG.

ZEC, ADA made solid moves up of 4 and 5 points. BTG let go its last place in favour of GAS (-66%). Binance API problems have been fixed and trading can recommence (once the problem children do some recovery work). Support from Binance team was good once they believed the details I was telling them about an email blacklist decision on their side.

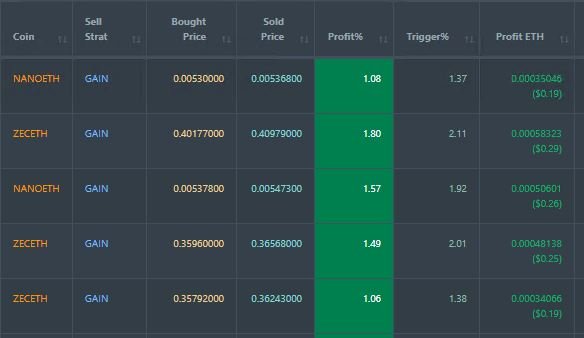

Profit Trailer Bot Five closed trades on NANO and ZEC (1.40% profit) bringing the position on the account to 0.45% profit (was 0.41%) (not accounting for open trades).

Whitelist trading has almost recovered the stop loss on NEO made last week.

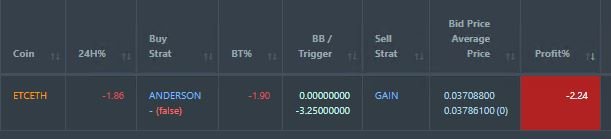

There is now one coin on the Dollar Cost Average (DCA) list with ETC moving on but it has not yet DCA'ed

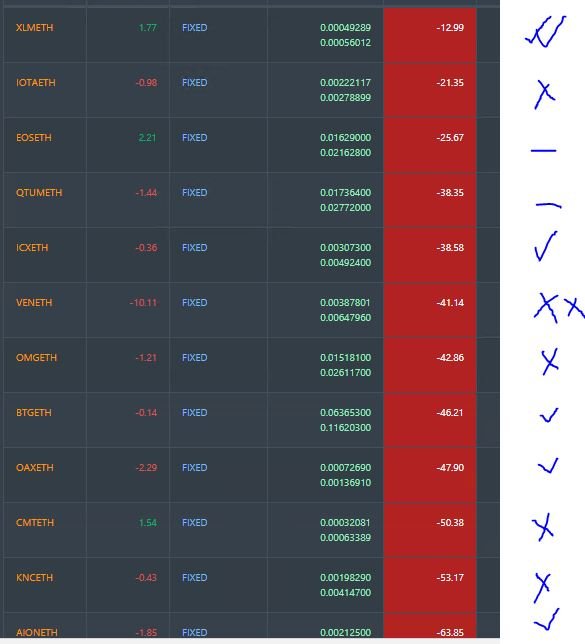

Pending list remains at 12 coins with 5 coins improving, 2 coins trading flat and 5 worse. XLM improved dramatically and VEN collapsed again.

The charts show volume changes characteristic of pump and dump (4 hour charts).

The VEN chart shows a big fall in price on normal volume and then a spike of volume to arrest the drop in price (see the two long tailed green bars) = looks like a lot of bargain seekers. Then there is another spike in volume and price is dumped.

The XLM chart shows a spike in volume which drives price up. Do not be surprised to see a dump coming along.

I added TRX to the whitelist.

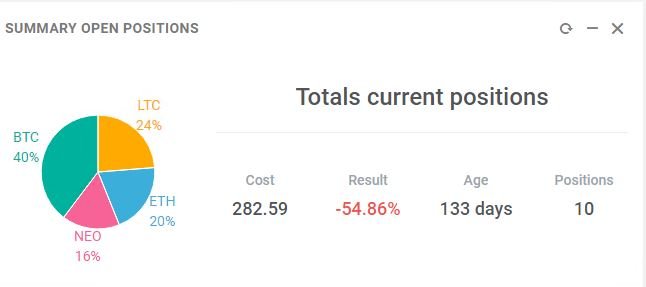

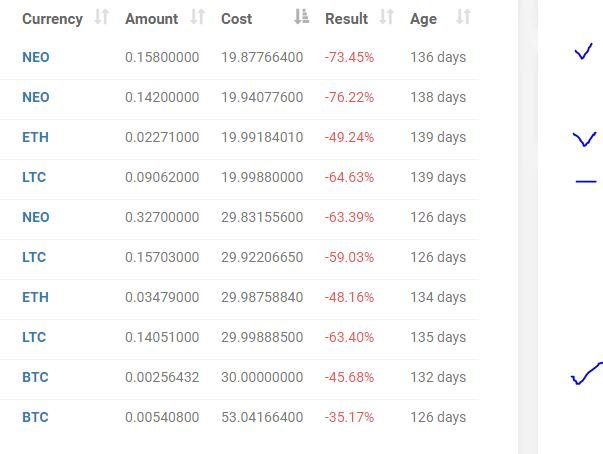

New Trading Bot Positions improved 1/2 point to -54.9% (was -55.6%)

LTC traded flat since last report and ETH, NEO and BTC all went up a little.

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 3.7% (higher than prior day's 3.2%).

Outsourced MAM account Actions to Wealth closed out 2 trades for 0.38% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and SBS. Mueller image comes from Facebook.com. Europe stocks image comes from TradingEconomics.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

July 13, 2018

sir , now what is the future you predicted about cryptocurrency ? specially bitcoin and ripple ? please suggest.

I do not make predictions and certainly not for Ripple. All I will say is that crypto that has a solid application idea, a good team and can deliver will have a good future. On Bitcoin, I do not expect the price to be lower than it is today in 5 years time - not much of a prediction but it is something of a prediction. Implicit in that is a belief that regulators will not be able to restrict access to fiat currency from Bitcoin. There will always be somebody ready to exchange crypto for cash or goods.

This post has received a 5.0 % upvote from @boomerang.