Markets ignore the Putin-Trump summit's nuances. Oil prices come under pressure to drag markets down a little. Trade action is profit taking in Europe and more shorts on a reversal in short term US interest rates. Bitcoin gets a welcome fillip as world's largest fund manager pays attention, at last.

Portfolio News

Market Jitters US markets were mixed but mostly lower

What is totally clear is that the markets were not fussed by the outcomes of what one headline labelled the "disgusting" press conference run by Donald Trump and Vladimir Putin after the Helsinki summit. The market's focus was on earnings and upcoming Federal Reserve Congressional testimony. Most important for my portfolio was Bank of America (BAC). They produced solid results with improved lending results and benefits from the tax reforms. Some of those benefits will be ploughed back into digital technology in their platforms.

I did answer a question about US Banks from @rollandthomas in a post yesterday. Is it time to sell US Banks? I will repeat it here as the BAC results reinforce what I was thinking (I wrote it before the results came out)

3 charts starting with your short idea - Financials (XLF) - lower lows and lower highs suggests a short.

Stripping out insurance and especially Berkshire Hathaway to banks ETF - KBE. We get a triangle with lower highs and higher lows = a level of indecision.

Now getting down to real banks that depend on interest rates and not trading and not M&A, the regionals - KRE

I see higher highs and higher lows and a MACD that is dropping but still bullish. We cannot say from technicals that regional banks are ready to cave.

As I look at banks - KBE, I cannot say they are ready to cave until I see the 0.618 and the 0.768 Fibonacci levels broken. This is the level they have been testing. Same applies to Financials XLF testing the 0.618 again on a weekly chart.

Now there are two, maybe 3, questions that arise from the charts.

- What is dragging the XLF down because it is not the big banks and not the regional banks? Maybe those are the candidates to short now - my last screens showed brokerage companies under pressure - with high PE ratios. Maybe the insurers too though a rising stock market and rising economy is good for their numbers.

- What do you believe the 10 year yield is going to do especially against the backdrop of a growing deficit? If you believe that it is going to stay at current levels of 2.85% or lower, then short the banks. If you think it is going back over 3% stay long or just reduce exposure.

There is a 3rd question relating to trading income and M&A deal flow. All the results reported show this is going up. Maybe not the time to short the money centre banks just yet. As to my portfolios, my most recent trade is long XLF for a bounce back to recent highs. I continue to write calls against my longs in Bank of America and Wells Fargo. I will let the market choose the exit point.

New World Order

As to the Putin-Trump press conference, I will leave it to the headlines

https://www.businessinsider.com.au/trump-putin-press-conference-republicans-respond-2018-7

I go back to the question I asked yesterday about the election interference, "Who knew? Who paid?" What is emerging in my head is that we seem to be heading to a new world order that is aiming to replace the established oligarchies (in Russia and in US and maybe even in Europe).

While the press conference did not move markets, a new world order will.

A friend posted this insightful article from the Irish Times. Read it and be warned - and it is not only in the US that this is playing out.

I can remember this stuff happening in the South Africa I grew up in, in the 70s and 80s (before I exiled myself to Europe in 1987)

https://www.irishtimes.com/opinion/fintan-o-toole-trial-runs-for-fascism-are-in-full-flow-1.3543375

Crypto Craze Bitcoin price jumps 4% in a short time and is followed by Ethereum and Ripple

The timing is related to release of information that Blackrock, the leading fund manager, had appointed a working party to study blockchain and cryptocurrency. That was confirmed by Blackrock in a statement. Why is this important?

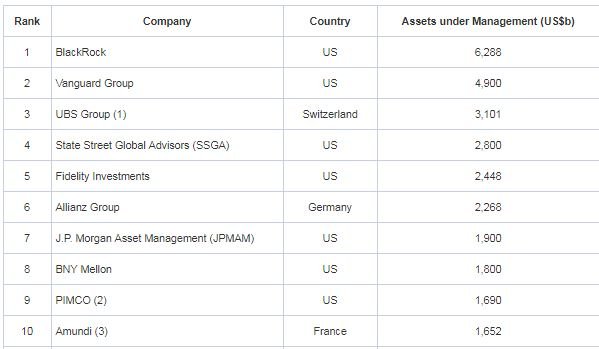

- Blackrock is the largest global fund manager

- The CEO, Larry Fink, had previously called Bitcoin "an index of money laundering". He must have changed his mind

https://www.relbanks.com/rankings/largest-asset-managers

In a separate advance, the CFA Institute which has trained 150,000 finance professionals worldwide added crypto to its syllabus for the 2019 examinations.

Sold

iShares Europe ETF (IEU.AX): Europe Index. I needed some cash to cover renovation costs. I sold a portion of my Australian holdings in this Europe ETF for 20% blended profits on shares bought in January 2015 and February 2016. A quick look at the charts shows the US version of that ETF (IEV - black bars)- i.e., all in US Dollars. It improved 7.66% from January 2015 and 23% from the 2016 lows. The difference to what I achieved is what the Australian Dollar dropped

The disapointing part of the investment is S&P500 (orange line) improved 36% in the same time with less volatility.

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): With Bitcoin and Ethereum price rising hard, I had more margin to play with in my IG Markets accounts. I watched the 4 hour chart make a reversal and trade sideways for a couple of bars. I set out a trade to capture the next break lower and hit the trade with the big drop (see blue arrow).

This drop is the 2nd largest drop we have seen in a 4 hour session since mid June (directly after the Federal Reserve meeting). Rates are still holding that 9700 handle implying a 3% short term interest rate market in December 2019.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $422 (6.6% of the low). Price moved ahead hard on positive news flow from Blackrock, the large ETF provider. I have put a stochastic momentum indicator on the chart (lower window). When the signal line (blue line) crosses the orange line from below in the oversold area, there are pretty solid buy signals.

A seasoned reversal trader will see that from price action as well - just study the bars.

Ethereum (ETHUSD): Price range for the day was $36 (8.1% of the low). Price made its way out of "no mans land" to reach a resistance level set in December 2017. If price makes a higher high and clears the next resistance level up (dotted green line), we are off to the races.

CryptoBots

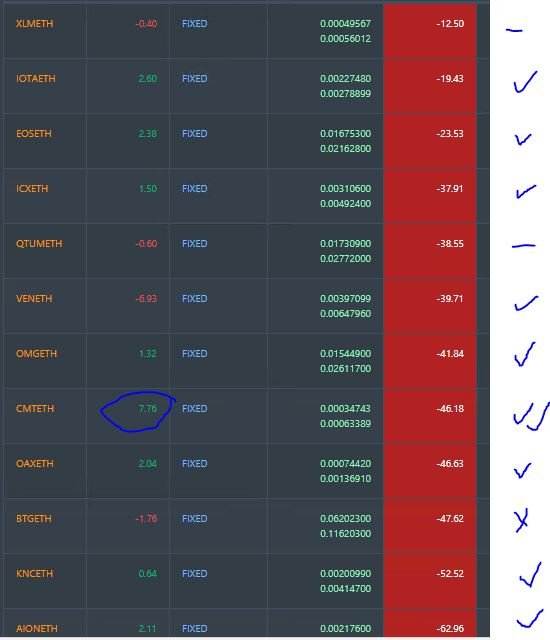

Outsourced Bot No closed trades. (213 closed trades). Problem children was reduced by one with BTS (-5%) making a solid move. (>10% down) - (17 coins) - ETH, ZEC (-48%), DASH (-51%), LTC, ICX (-53%), ADA (-42%), PPT (-60%), DGD (-54%), GAS (-65%), SNT, STRAT (-54%), NEO (-59%), ETC, QTUM (-52%), BTG (-61%), XMR, OMG.

NEO gave up its 60% down membership and GAS (-65%) remains the worst

Profit Trailer Bot No closed trades. I added POWR to the whitelist a day late as it jumped 17% in the last 24 hours.

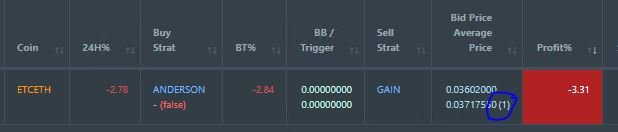

ETC remains the only coin on the Dollar Cost Average (DCA) list and has now completed one level of DCA. I am hoping it does not do a NEO and drop to 10% down. It was down as far as 4.5% down - holding thumbs.

Pending list remains at 12 coins with 9 coins improving, 2 coins trading flat and 1 worse (BTG).

CMT was the biggest improver with a 7.76% rise on the day

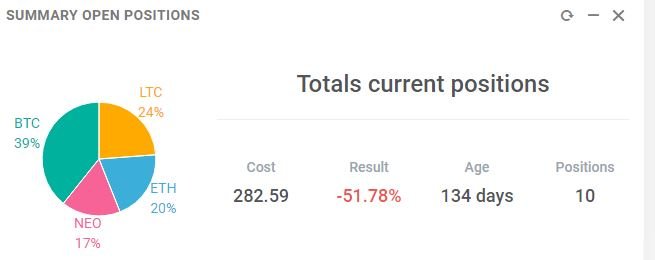

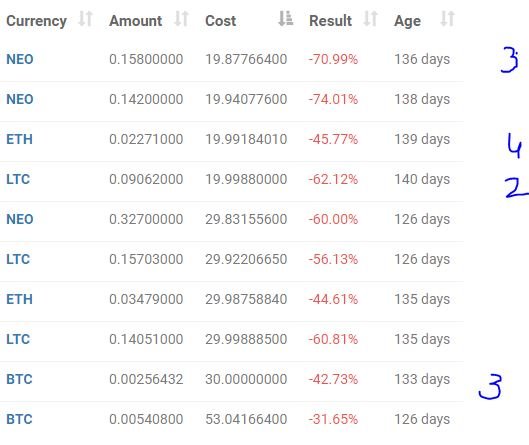

New Trading Bot Positions improved 3 points to -51.8% (was -54.9%)

All coins improved at least 3 points with ETH the best at 4.

Currency Trades

Australian Dollar (AUDUSD): Sold US Dollars for Australian Dollars to fund some bills. Been waiting for a dip in Aussie Dollar to transfer funds. Trade made at 0.74106

Forex Robot did not close any trades and is trading at a negative equity level of 3.4% (lower than prior day's 3.7%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and The Irish Times. Funds image is credited below the image. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

July 16, 2018

A very helpful post.

Terikasih @ carrinm

Great insights as usual! I think that the fact that the Financial sector are giving so many mixed signals is a sign not to touch them. I think there is too much uncertainty and the whales can fool you into a long position so they can get out before the collapse. Retail investors are the last to get into a rally which seems to be what has happened in the US market the last couple of weeks. I am steering clear for a bit...

I have been invested in a few of the banks since 2009 (BAC, JPM, WFC) - finding the right time to exit is almost as hard. There is no way back in if they rally further.

✅ @makemony, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Asking for upvotes is a good way to get flagged. Even more so when you say you have upvoted and you have not. Here is the evidence.

I did go over to your page. First suggestion for you is to use more tags on your posts so that they can be found by more readers. Five tags are allowed.

Build a following using the content you are already posting. That is much more effective than asking for votes and following