Staying away from the markets during the selloff other than trades that may be less correlated to market factors - people have to eat and corn gets a break in China

Portfolio News

Market Selloff

US markets started heading lower and kept falling

There could be some light as S&P 500 pushed lower through to prior lows at 2532 and then bounced off those levels in the last 30 minutes of trade.

Selling was right across the markets. This follows record fund and ETF outflows by retail investors last week. The fund managers have to sell across all the indices - all stocks get hit. The market has become a stock pickers markets.

In my portfolios top 7 performing trades were all hedge trades (SPY puts, QQQ puts, Gold, DRV, XLU shorts). My January 2019 SPDR S&P 500 ETF (SPY) bear put spreads have now hit maximum profit - I will be closing them out overnight and will look to set up again on any rebound.

Bought

ETFS Corn ETC (CORN.L): China increased orders for US Corn as part of trade concessions made at the weekend. I added to my long exposure through this London listed ETF (listing is in US Dollars). Price on US corn futures has shown a long bottoming process and an inkling it wants to break higher.

China demand for corn is expected to rise longer term. From TIB245, when I first set up the trade

- China is moving to a market price for corn (i.e., away from subsidies)

- Land available to corn farming is dropping

- China has mandated a 10% use of ethanol for gasoline by 2020. Generally when China mandates it happens

- As wealth grows the consumption of meat increases and specifically there is an important increase in the pig herd in China.

- The inventory of corn in US is currently low compared to use.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $409 (12.8% of the low). I wrote yesterday that price was in a "Do or Die" zone. It decided to DO and pushed up hard to test the underside of the short term channel it had been in a month ago just under $3600. Futures expiry is coming up on January 1, 2019

Ethereum (ETHUSD): Price range for the day was $13 (16% of the low). Price pushed up to test the resistance level around $100. This move did not surprise me as last two days had made higher lows.

CryptoBots

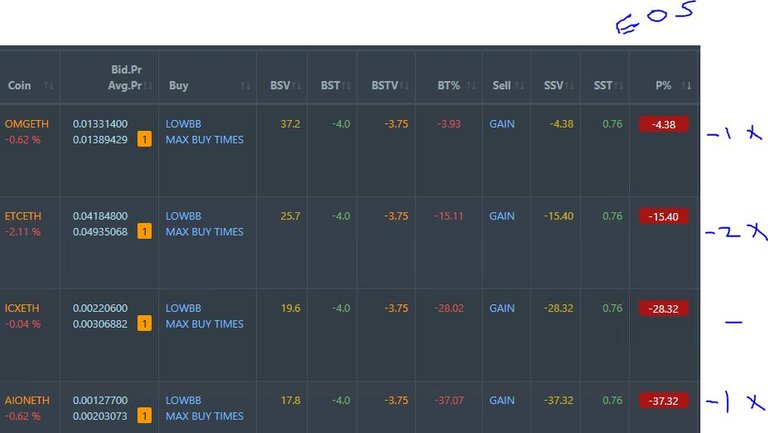

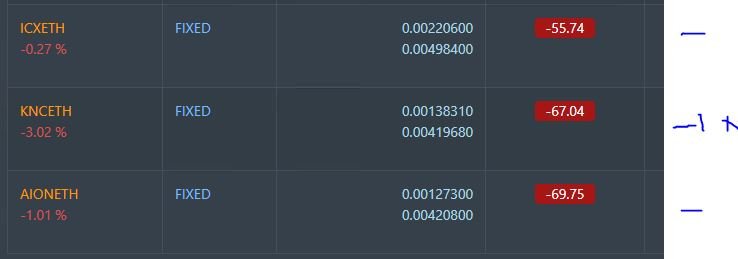

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - DASH (-73%), ETH (-74%), ZEC (-70%), AE (-41%), LTC (-51%), BTS (-66%), ICX (-87%), ADA (-77%), PPT (-86%), DGD (-87%), GAS (-89%), SNT (-68%), STRAT (-76%), NEO (-86%), ETC (-68%), QTUM (-77%), BTG (-72%), XMR (-55%), OMG (-78%).

Coins moved in a tight band of 1 or 2 points, mostly up. QTUM improved 3. GAS (-89%) remains the worst coin. ZEC (-70%) dropped a level and QTUM (-77%) improved a level

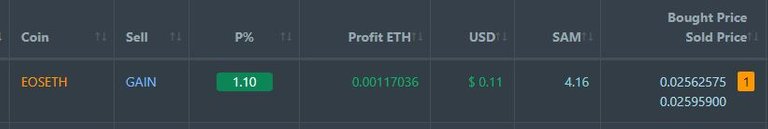

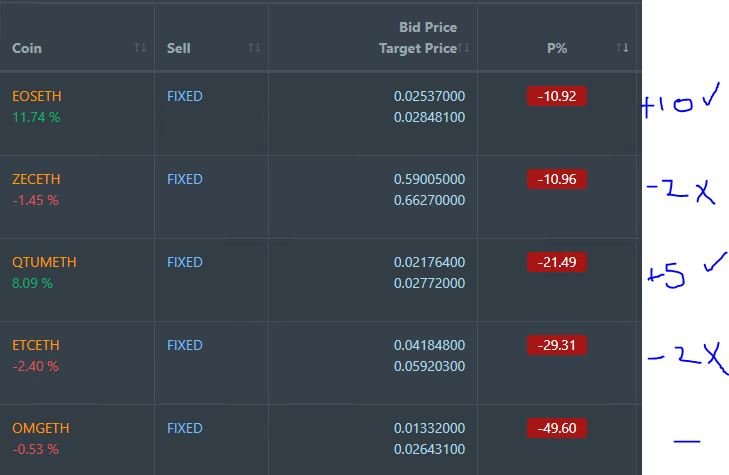

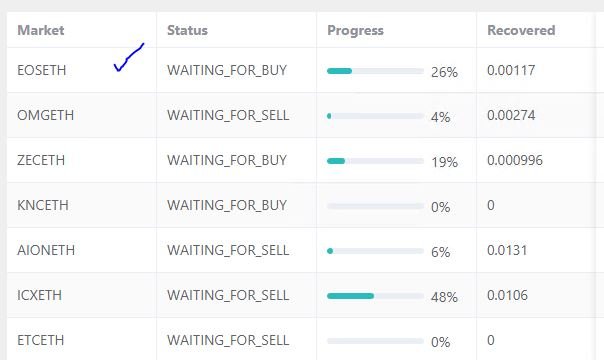

Profit Trailer Bot One closed trade - EOS from DCA list (1.10% profit) bringing the position on the account to 4.94% profit (was 4.92%) (not accounting for open trades).

Dollar Cost Average (DCA) list drops to 4 coins with EOS moving off and onto profit after one level of DCA.

Pending list remains at 8 coins with 2 coins improving, 3 coins trading flat and 3 worse.

PT Defender continues defending 7 coins with EOS completing a defence trade.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 2.4% (lower than prior day's 2.6%).

Outsourced MAM account Actions to Wealth closed out 2 trades for 0.03% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

December 17, 2018

Will be interesting to see how the market reacts to Fed Speak this week as there may be a potential for them to pull back on their tone of rate hikes given the political pressure and market moves. I feel that they have been influenced by the Twitter speak of the President... that could spell trouble over time!

Posted using Partiko iOS

If they are seen to be bowing to pressure it will be a mess. The market is already nervous. If the Fed shows they are nervous too, markets will collapse. They said they would be data dependent. The data is telling us the growth and wage growth is solid. Now they do have wriggle room as lower oil prices will take a bit of the edge out of the inflation expectations. That is what I would be saying. Economy is strong. Wage growth is strong. Inflation is being moderated by lower oil prices. Here is your December rate hike. End of speech.