So far, all is happening very good – said the falling optimist in the air by the 2nd floor, falling from the 15th floor. I’m writing here since some months about investments (and travel and sometimes cryptos), and I feel it’s time to make some accounting or overview.

Double-edged

The big advantage of writing to a blockchain shall be, that it never gets lost, stays there forever on the blockchain. And the big disadvantage of writing to a blockchain shall be, that it never gets lost, stays forever on the blockchain.

You can’t say later: that wasn’t me, you remember it wrong, I didn’t tell that. Or, “I ‘ll better delete this blog post”, that was a mistake. You wrote it, and everyone can see how it was. A huge responsibility, but also and a big opportunity. If you are right, you can say easily in the future: I told you. Here’s the link, you can read it, it can’t be changed anymore.

Theory and reality

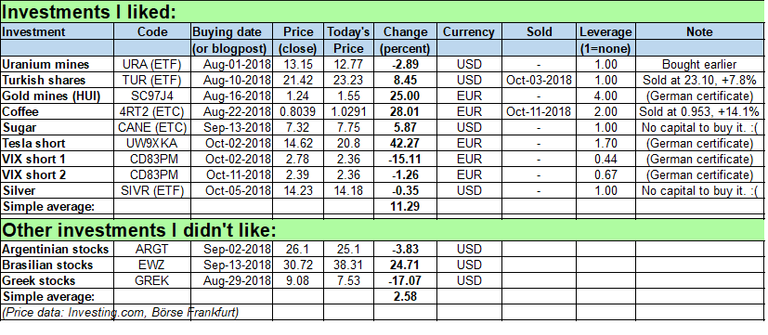

I decided to take the risks and I made my first accounting, based on my blog posts, to see later how many times I was right and wrong. Mostly, it’s very early to judge, some investments have only 1-2 weeks – I invest mostly for some months or 1-2 years.

Some of this investments I couldn’t make in real life, mostly lacking on resources. And Uranium ETF, in reality, I bought much earlier, last year, April 2017. I couldn’t buy silver now, but I have gold mines and many of them are producing also silver, so I have silver exposure, too.

Too many risks

But this table can be useful to review and to think. For example to notice that I have far too much commodity risks. But maybe it can be interesting for others, too (links to the blog posts at the end):

- Yesterday, Thursday the HUI gold mines index was 7 percent up, in only one day. That helped a lot, but basically Gold is continuing to struggle by 1200 USD and mines shares are very volatile.

- I sold my Turkish shares and the coffee to make liquidity, and also because both seemed to be stuck on some levels. Now coffee is climbing again, and Turkey freed detained US pastor. Index in Istanbul has jumped two percent today. (BIST 100) If I had had more money, I left these winning investments to grow more, I suppose.

- Uranium mines are continuing to suffer. I have to read more about the Uranium industry. The real recovery isn’t coming, but the URA ETF seems to have some strong support somewhere near 12 USD.

- Sugar was a great opportunity, but some weeks earlier. I noticed it too late. Maybe that’s because I didn’t buy it, in reality, may be due lack of capital. I didn’t want it really.

- Gold/silver ratio is even higher, 83,50. I think, if it surges further to 90, I must buy silver. But I know it can take months, or even 1-2 years to see a real turnaround.

- I was really lucky with my Tesla shorts, but I think it should be a longer-term trade of 2-3 years. When strong competitors are flooding the market, like Daimler and Audi, or alliances of competitors are constructing large charger station grids, Tesla can go much lower. There is also a chance for financial problems.

- Volatility jumped this week, and today still climbing, and with US indexes in green. Strange. VIX settlements curve is inverted (backwardation) on near end of the curve, that’s bad news for short sellers.

I sold more VIX yesterday, but I am continuously monitoring the situation. I wanted to buy ZIV ETF (to short the less volatile middle term VIX months), but it wasn’t possible in Europe. :( (Mifid 2)

Chart courtesy of StockCharts.com

- I mentioned Argentinian, Brazilian, Greek stocks (and Venezuelan ones), without the intention to buy them. None of this ETF’s seemed to be really cheap, and I’m hunting mostly investments on 10-15 years lows. Brazil seems to have been a great opportunity, as the ETF jumped 25 percent in only some weeks (due to the elections mostly). But the result is almost the same as it was by the coffee or the sugar, see the chart above.

I have so many ideas, but not enough time to research and so few money to invest. But this is really “the game of the games” (J. Livermore). Nothing else can be so exciting like the world of investments.

Posts in this series:

- Is This Indicator Really Predicting A Huge Rally? – Silver, Gold

- Bye, Bye, Tesla – Why Am I A Happy Short Seller

- Black Sugar, Baby, And Hot Money – Sugar and Coffee

- And The Very Best Stock Market In The World Was…

- Tales From The Crypt – Greek Blood On The Streets

- Deadly Coffee, With Cocoa Flavour

- 8 Reasons Why Gold Mines Can Rally Again

- Buying At Prices Of 2009? – Turkey

- The Curse Of The Disaster – Uranium mining

Disclaimer:

I am not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think, entertain, increase testosterone and adrenaline level. Consult your advisers before making any decision.

Info:

You can message me in Discord.

(Cover photo: Pixabay.com)

gread post!

You got a 52.63% upvote from @bdvoter courtesy of @deathcross!

Delegate your SP to us at @bdvoter and earn daily 100% profit share for your delegation & rewards will be distributed automatically daily.

500 SP, 1000 SP, 2500 SP, 5000 SP, 10000 SP.

If you are from Bangladesh and looking for community support, Join STEEM.com.bd Discord Server & If you want to support our service, please set your witness proxy to BDCommunity.

awesome post! :D

Congratulations @deathcross! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

verygood