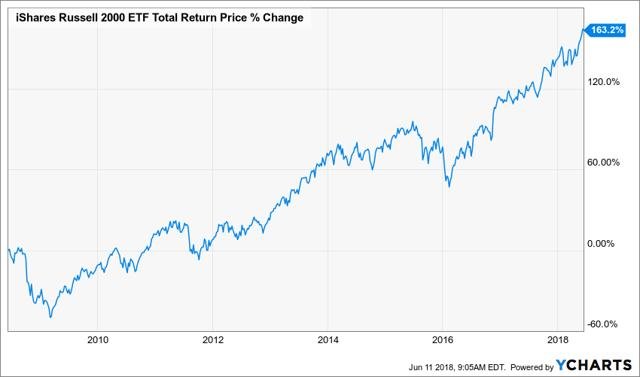

The Russell 2000 is an index of the top small-cap public companies in the stock market. This year that means companies with a market cap of $159.2M to $5B.

On May 11th they took the days ending price and used that data for their annual rebalancing – known as the “Russell Shuffle.”

Since index investing is a large chunk of the market nowadays, this means that they will become buyers of any new additions so that they stay true to their index. The new additions are also potential “up and comers” as they have increased in value enough to rise above the rest of the small and micro-cap pack.

Last Friday, June 8th, the initial list of the new additions was released. It will be scrutinized and an updated list will be available this Friday. After one last round of analysis, the finalized list will be made public on Friday the 22nd and the new Russell 2000 index will be set for the next year.

So we have the potential to pick out some of the best new additions and profit. Not only will index funds be buyers (and sellers of those that dropped off the list), being added to the list also increases the chances of high-profile analysts starting to follow the stock.

I have personally reviewed the list and picked out five stocks that I think will be winners over the long-term.

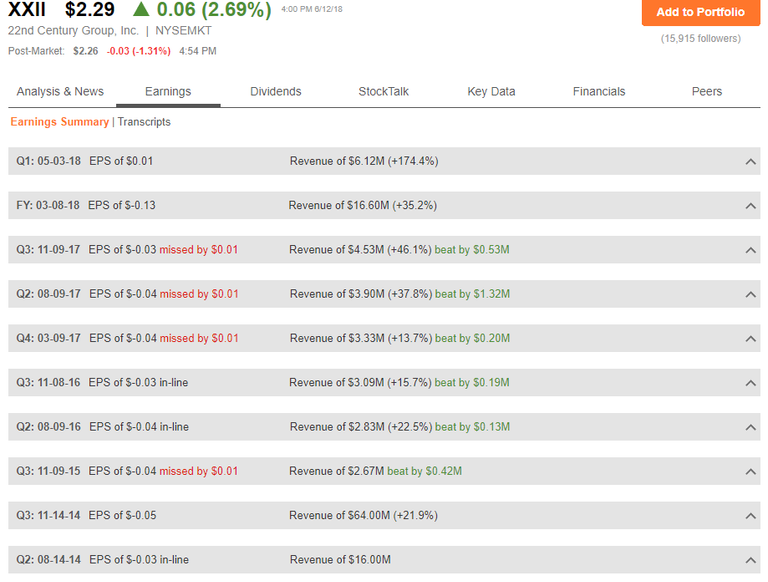

22nd Century Group (XXII) - $2.29

22nd Century is a plant biotechnology company that is working in the field of tobacco and cannabis plants through genetic engineering and plant breeding. They are able to increase or decrease the amount of nicotine and cannabinoids within the leaves.

The FDA recently announced they are proposing to allow only the sale of low nicotine cigarettes in the USA by 2021 or 2022. They believe that lowering nicotine will make cigarettes less addictive and decrease the number of smokers, or at least push them toward vaping which is considered less harmful.

They are currently selling very low nicotine cigarettes for research projects under the SPECTRUM brand, and internationally under different labels. They are also developing a smoking cessation aid cigarette called X-22.

They have also developed a strain of hemp that has zero THC and “are developing additional novel hemp plant streams with other highly desirable cannabinoid profiles.”

Financially, they are in good shape for a young company developing a new product. They have $59 million in cash, no long-term debt, and are currently only losing $1 million per year. Earnings are growing at a nice rate and they could potentially be profitable in the not too distant future.

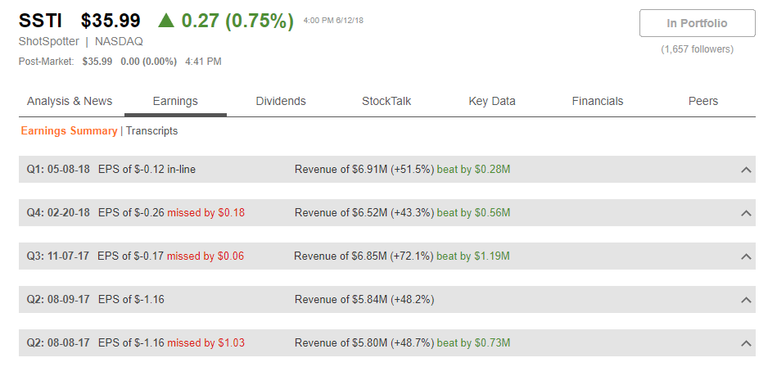

ShotSpotter (SSTI) - $35.99

ShotSpotter is a company in the unique niche of locating precisely where a gun was fired. Using sensors installed in a covered area the system is able to detect gunshots with a 90%+ accuracy rate in less than 60 seconds. This is a market with no real competitors.

Currently in use by over 90 US cities and Cape Town South Africa, there is still plenty of potential customers. ShotSpotter estimates that they have penetrated less than 5% of their target market.

They make money by offering the system as a subscription service and customers seem to love the service as churn is very low. That means once the system is in place and the police come to rely on it, ShotSpotters’ system becomes very ‘sticky.’ In fact, the customer often asks for coverage over a larger area after seeing the benefits.

Since that lowers the cost of customer acquisition, margins can increase. In 2017 margins were 49% and are projected to rise to over 65% in the long-term.

With a world more concerned with gun violence more than ever before, I can see this company occupying a very profitable niche.

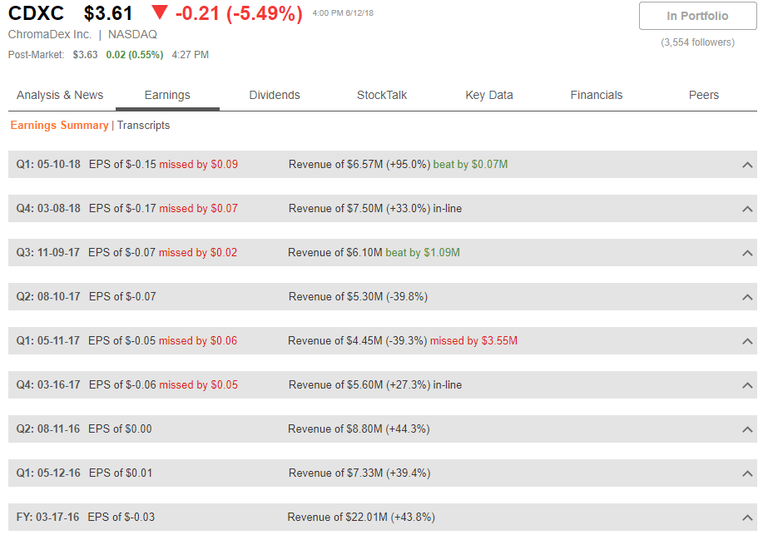

ChromaDex (CDXC) - $3.61

ChromaDex appears to have discovered a pill that fights against aging. They have studied Nicotinamide adenine dinucleotide (NAD+) for years and discovered it is very likely a key to keeping our bodies young. NAD is crucial for cellular health and it declines as we age. When we lack NAD, our cells do not function properly and this may be the reason why we have more health problems as we age to include hypertension, obesity, diabetes, Alzheimer’s, and more.

NAD is created in our bodies by nicotinamide riboside (NR). ChromaDex has 14 global patents or patents pending for:

- Synthetic manufacture of NR

- Manufacture of NR via recombinant microorganisms

- NR for increasing NAD+ biosynthesis

- Compositions comprising NR

- NR for treatment of diseased or injured neurons.

You can check out the reviews of the company’s product, Tru Niagen on Amazon.

Current annual revenues for 2018 are estimated to be around $26 million. If they could sell 2.5 million bottles per month at $40 (1 month supply) that would be a $1.2 billion annual revenue - mere fractions of a percent of the health supplements market. ChromaDex previously licensed out their product, but they have recently revoked those licenses to cultivate the Tru Niagen brand.

With the increase in health consciousness and aging population of baby boomers, I think the potential is there.

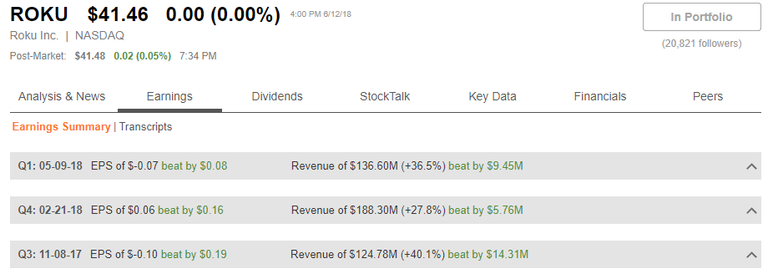

ROKU Inc. (ROKU) - $41.46

You may not have heard of the other companies I list here, but you probably have heard or use what Roku makes. I know I am a happy Roku user.

Instead of spending piles of money competing for the best original programming, Roku is behind the scenes making the best hardware and software to stream that content.

Think of Roku being to streaming video as Windows is to the PC. It’s the engine behind what people use, the operating system.

Since Roku wants to capture the market, they sell their boxes for very little and strive to be the operating system included inside new TV’s. They aren’t looking for money from selling hardware, they are looking to be the go-to advertiser for the rapidly increasing streaming content market.

Think about traditional TV advertising, they “try” to put the most appropriate ads in the TV shows that hit a certain demographic but they don’t really know how effective they are. But a recent study by IPG and MAGNA concluded that ads on the Roku platform are 67% more effective per exposure at driving purchase intent compared to traditional linear TV ads.

This is because Roku personalizes their ads as they have the data to do so. You know two other companies that personalize ads based on their data? Facebook and Google. The average user spends 35 minutes per day on Facebook and for YouTube that is 40 minutes. The average Roku user spends 2.8 hours watching streaming content.

Roku is also building up their own channel where they control everything.

Roku went public at the end of September, but they have been growing revenues at 35% Q/Q since then. I expect the growth to continue.

Amyris (AMRS) - $5.39

Amyris is a biotechnology company that engineers customizes yeast strains. They are able to change the end result of fermentation to hundreds of thousands of molecules found in nature.

Say a company needs a molecule found only in shark livers. Instead of having to buy large quantities of shark livers and then process it down to the molecule they need, they can enter into an agreement with Amyris to develop a strain of yeast that will create that exact molecule in large quantities, for much cheaper, and without harm to animals.

As part of that contract, Amyris will manufacture the molecule from the yeast and deliver it for payment. Additionally, they will receive a royalty once the product containing the molecule is sold.

Do you see the amazing potential here? They will develop exactly what the customer needs for a cheaper price than they are currently paying, in addition to giving them a steady supply of it instead of worrying about being able to obtain enough. Not only will Amyris make a profit from the manufacturing, they will earn a percentage of all the sales going forward - at no cost or effort on their part! Imagine when there are 100-500-1,000 companies sourcing through Amyris. What a huge cash cow potential they have on their hands!

Once in-house project that Amyris is seeing large growth is in cosmetics. They own a brand of skin moisturizers called Biossance that utilizes hemisqualane and squalene, both of which are made by Amyris’ yeast. It seems to be an excellent seller at Sephora, you can browse the reviews here.

Additionally, the EU recently banned a molecule called D5 from being used within their borders and this ingredient was used in many products such as antiperspirants and hair products. Amyris is currently in talks with two companies interested in buying up to $50 million in hemisqualane annually.

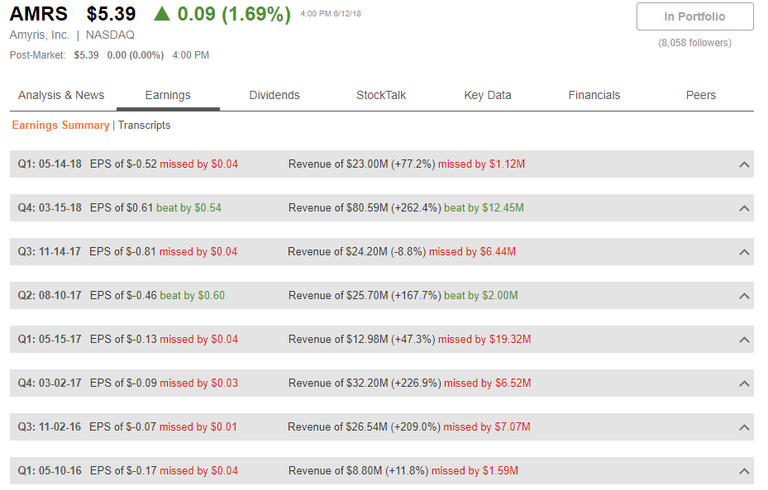

Amyris has been public since 2010 and any look at its chart shows that it hasn’t done well. But I think they finally found their stride and revenues are ramping up. They project 2018 revenues to be between $185-195M and rising to $490-500M in 2020.

Conclusion

I feel that these 5 new additions to the Russell 2000 have outstanding potential for growth.

Of course don't just take my word for it, do your own research. This article is just a starting off point, written to bring these investments into your radar.

As for me, I own shares in all five I wrote about here.

(I normally get paid $50 + paid per view for an article like this but want to give it to Steemians instead!)

Upvoted ($0.14) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Roku and ShotSpotters are decent. Well I am American so ShotSpotters has potential due to the circumstances we face every day.

Yeah, and it was up 6% today

If you're investing in ShotSpotter. Aren't you basically relying that guns are fired? If guns stop firing, they loose profits. Kind of an ethical dilemma for an investor I'd say.

Personally, I see potential in making money investing in it, but at the same time I would hope for the company to start making less money. That would signal that less guns are fired in places where they shouldn't.

The cities pay for an annual subscription, not per gunshot. So as long as they see a need/benefit then they are in business.

I don't see it as an ethical dilemma. ShotSpotter isn't out there creating gun violence, in fact they are doing their part to reduce it by reporting it to the police quickly.

The way they make their money doesn't really matter, because they would be out of business if there never was a gunshot. So if shooting stops, they run out of business regardless of the way they bill.

And I don't know about you, but when I invest in a business I expect it to increase its sales for the next 10 years. So if I were to invest in ShotSpotters, I would be betting that gun control won't get better at least for the next 10 years. Unless of course there is a preventative effect involved. So that the service acts as a deterrent.

Anyway, seeing as in Finland we have like 5 incidents per year where someone shoots a gun where they aren't supposed to, my perspective might be different. Not that either perspective is wrong.

Great profiles of these. I'll be diving deeper into them, thanks!

Let me know what you find!

Solid analysis my friend! Definitely did not know of a few of these. Thanks for putting them on my radar.

Hey, this is what I do :D

Thanks buddy for the heads up about these Companies. I might even be a User of that ChromaDex since it helps with Aging. Sounds very intriguing

Me too! After reading all the science and research behind it, I really want to try it. I just might buy a bottle or two to give it a shot.

Check out this review I pulled from Amazon:

I like Roku, I think they have real potential. Thanks.

Roku certainly has potential. Enough so that I am invested with a decent amount.

Good stuff.