U.S. stock market closed lower in a volatile session on Wednesday, the stock market closed up as the rising data was seen by wall-to-wall actors reflecting strong economic health, although equally strong economic strength did not stop the Federal Reserve from raising interest rates.

February's main index closed lower, with the S & P 500 and Dow indexing their worst monthly performance since January 2016 and the Nasdaq posted its weakest month since October 2016.

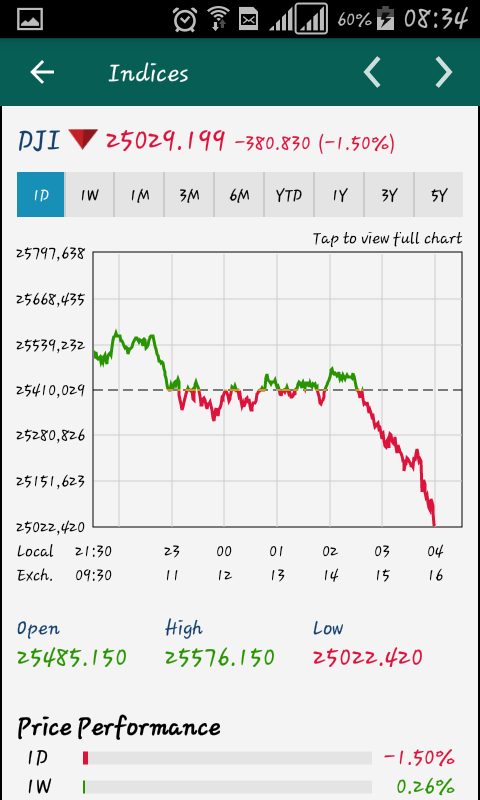

The DJ Jones Industrial Average, -1.50%, fell 380.83 points, or 1.5%, to 25,029.20, sliding 4.3% in February. The S & P 500 SPX, -1.11% index fell 30.45 points, or 1.1%, to 2,731.83, for a monthly decline of 3.9%. The Nasdaq Composite COMP, -0.78% decline by 57.35 points, or 0.8%, to 7,273.01, fell 1.9% on the month.

In recent economic data, the economic growth rate of U.S. trimmed to 2.5% from 2.6% in the fourth quarter, largely due to a slower pace of inventory inventory. The declining data reading of the GDP matches estimates of economists surveyed by MarketWatch.

The Chicago PMI was at 61.9 in February, a data below expectations and representing the lowest level in six months. Home sales fell 4.7% in January, the lowest since October 2014, and the biggest monthly decline since 2010.

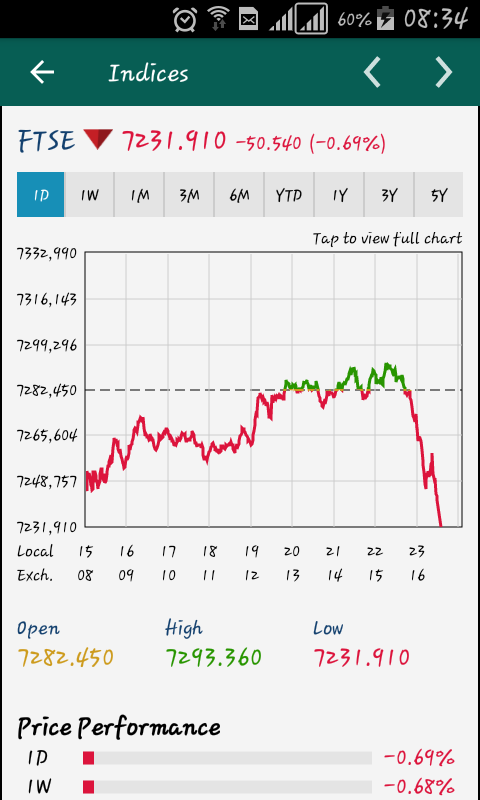

The UK stock market closed lower on Wednesday, ending in February with a fall in monthly yields, as investors focused on prospects of rising interest rates in the U.S. after comments from Federal Reserve Chairman Jerome Powell.

The slowdown in factory activity in China, a key market for London-listed metal producers, also weighed on the London stock market. The UKX FTSE 100 index, -0.69%, fell 0.7% to end at 7,231.91. On Tuesday, London stock markets fell 0.1%.

British blue-chip stocks fell under pressure, SXXP Europe down -0.71% and Asian-NIK market, -1.44% HSI, -1.36%, after a selloff on Wall Street on Tuesday.

The stock market decline came after the Fed's Powell told congressional lawmakers that the economic outlook for the USS. has strengthened since December. It was interpreted as a sign the Fed could raise interest rates four times this year, not three times as previously implied. Powell will testify before the Senate Banking Committee on Thursday.

Kapanlah harga naik lagi