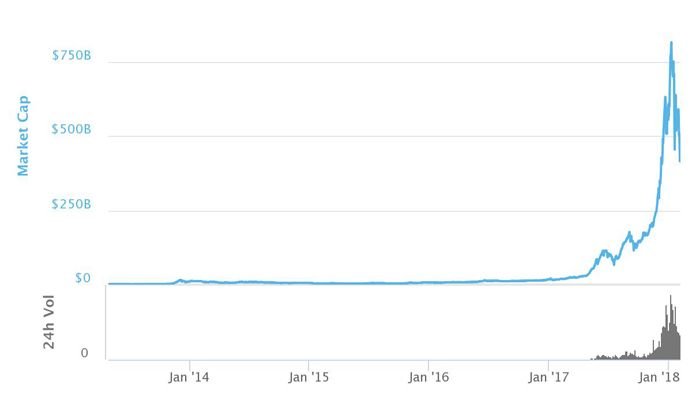

A couple days ago, the overall market cap for cryptocurrency was more than $500 billion. In the last 24 hours, it has dipped below $400 billion. From a guy who's been paying attention to this for only about two weeks, this looks like a crazy loss.

(Though, in looking at the very short history of the crypto market, the overall market cap had never topped $400 billion before this last December. So it may not be that crazy after all...)

Source

My main question, however, regards what market cap really means. The mechanics of it. I've seen it defined as "all the money invested in a market." When I think of it like that, I think that if the market cap decreases, it means people are actively pulling money out of the market, i.e., kind of like a savings account: I put in $100. And a year later I pull out the $100 (or $102 with interest). And the bank no longer has access to my cash.

But as I sit here and think about it, I don't think it works that way. Tell me what you think of the following:

Really really simple model - the whole market has ONE bitcoin, and it is currently worth $10. So the market has a market cap of $10. Through sheer grit and will, I happen to own that bitcoin, and thus the whole of the crypto market. Now, I want to sell it, and I'm hot to trot. And Mr. X offers me $9 for the bitcoin. I sell it to him. Now the market cap is $9, correct?

So where did that dollar go? I did not, as the original investor in bitcoin, pull out any money from the market. Not really. I instead allowed someone to pay me less money than I originally paid. Does my logic hold on this?

The reason I bring this up is that I'm looking at this drop in the market cap, and my instinctual thought is, oh, shit. There must be a lot of major players pulling money out of cryptocurrency. I am thinking of it as a bunch of rational actors choosing to pull out money from a kind of high-interest savings account.

Source

But looking at it in this other way, that's not really the case. Instead you've got a bunch of people making guesses about the future - what they hold is either going to rise in price, or it's going to fall. If they believe it's going to fall, they sell; if they believe it's going to rise, they hold or buy more.

So rising and falling market cap is really more of an indicator of confidence, and that confidence has an effect on value. But that effect is not really the same thing as the thing-in-itself. So does this literally mean that "money has left the market"?

Let me know what you think!

Market cap is an indicator of value and value is an indicator of confidence.

The value of any currency, whether crypto or fiat, is entirely dictated by the sentiment of the market and the fundamentals of the currency. It has been this way since Nixon took the US off the gold standard and the world followed.

So to answer your question a drop in market cap can mean both a pull out of investors or a drop in value. If the value of bitcoin is $1.00 and there are 1000 coins then the cap is $1000 but drop the price to 50cents and the cap is $500. But in a market this low I doubt people are cashing out huge amounts and taking a loss, it is likely though that this correction was caused by a combination of a whale sale of bitcoin and the fear that followed turned into a loss of confidence.

Nice post.I respect you very much because you contribute to steemit.I will do activities like you.I would like to extend the steemit.

Vaya no lo había visto de esa manera amigo, tiene mucha lógica lo que explicas, de verdad hay algunas incongruencias en e volumen de capitalización del mercado

The market cap is indeed based on the current price of the coin which indeed indicates the level of confidence the market places in a project.

But what I think you miss is the very reason why the price is going down is because people are selling.

The missing dollar is the seller's lost.

This post has received a 100.00 % upvote from @siditech thanks to: @jpgaltmiller. Here's a banana!