Here's another reminder both to myself and to my readers to view cryptocurrency ownership as a long-term investment in the financial system of the future instead of a short-term speculation.

I wrote this post on May 25th: The Big Question: Should You Sell or Hold During a Market Correction, and it applies today as well.

Here's the total market capitalization at that time along with the market cap today:

As you can see, even with this massive correction, we're still trending upward over the long-term. My portfolio is down 50% since 2017-06-13, but up 390% since 2017-03-27. As I've mentioned before, I purchased my first bitcoin in 2013 at $20 each. I watched bitcoin go all the way to $1,200 and then crash down to around $250. I didn't sell. Because I didn't sell, I was later able to pay off my house.

This, I think, is the difference between those who accumulate wealth and those who are living paycheck to paycheck. If you have no "extra" to invest, then you may be forced to liquidate when you need funds instead of when you'll get the best returns. Getting out of debt is key along with increasing your income to build savings. The Dave Ramsey baby steps are a good place to start.

It's easy to get frustrated with cryptocurrency investing if you start your investing at the end of a bull market and only experience losses. Keep in mind, those losses are only "on paper" and not realized until you actually sell. If you can hold, it's usually a good plan (unless you're way better than me at timing the markets to get in and out perfectly to increase your holdings).

Many are promised great riches and "lambos" (Lamborghinis) falling from the sky to their own private island in a matter of days or weeks. That's not how reality works. Yes, some people get incredibly lucky, but they are the outliers. The crypto space has a lot of whales who will gladly squeeze margin positions and "weak hands" out so they can pick up cheap coins to further increase their wealth. This is how the game is played.

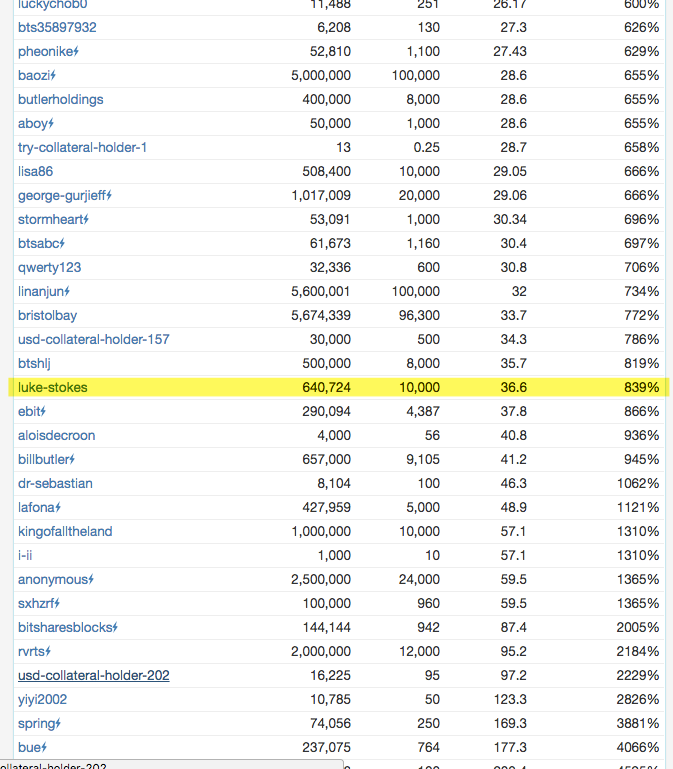

I posted recently about how my HERO margin was called. I also have an open margin with bitUSD, but this time, I hope, I can hold it until the market recovers. I'm watching the cryptofresh BitShares block explorer closely, specifically the "USD Debt Positions (Call Orders)" section. My Collateral Ratio is currently over 800% as you can see here:

Many others, I think, will be squeezed out and their holdings will be liquidated in the waiting hands of whales increasing their stacks. Others will sell for a loss due to fear of losing their principle. Those who win long-term will buy the dips.

Long story short:

- Get out of debt and build savings so you have extra to invest.

- Only invest what you're willing to lose.

- Think long-term.

- Lambos for everyone is not reality. Live in reality.

- HODL.

Don't take investment advice from random blog posts on the Internet, but continue to grow and learn from multiple sources to figure out what works best for you.

Luke Stokes is a father, husband, business owner, programmer, and voluntaryist who wants to help create a world we all want to live in. Visit UnderstandingBlockchainFreedom.com

Life changing wealth is created by holding investments over a period of years, not weeks or months. For those creating substantial wealth in crypto right now the current correction is a flash sale to be bought aggressively.

Like any other investment there is no loss until you sell. Assuming the investor has done their due diligence and has invested based on fundamentals there is nothing about these types of market movements (coordinated dumping by whales) that alters the fundamentals behind the original investment. Ie. you don't sell because some rich jerks are pushing price around for their benefit.

At this point my advice is to look at crypto as a 2-3 year hold and the only reason for selling is re-balancing (ie. BTS spikes 1000% and suddenly is 90% of your portfolio) or new tech replacing old (EOS replaces ETH). Otherwise just ignore the ups and downs as noise/entertainment. There are a few very wealthy individuals who are manipulating the shit out of the crypto market. Every time you panic sell you make them wealthier and give them more power.

Hodl and prosper.

Very well said. A 1337 comment, if you will. ;-)

Why 7h4nk y0u

It's important to find what investment is going to be relevant and worthy in 2-3 years. Maybe you will reevaluate your decision once in a while. But it will come to your analysis, and understanding of what to pick in the beginning how to adjust in time.

Well said.

Lol..this is extremely hilarious! "Where is the fucking lambos my brother?!" Lolz . That pic got me cracking!

True Flip [ICO] - Already running a transparent blockchain lottery! Bomb! Bonus 20%! Hurry! :)

The platform is already working and making a profit :)

https://steemit.com/ico/@happycoin/true-flip-ico-already-running-a-transparent-blockchain-lottery-bomb-bonus-20-hurry

long story short, I read this phrase alot!

Yes agreed that part is fantastic.

Congratulations @lukestokes! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPWow! Nice

This right here is key

"Get out of debt and build savings so you have extra to invest."

Thank you!

Resteeming.

You've got some nice voting power... How about doing @steemerite a favor by giving him a 100% upvote and a follow for his "Lotus Flower" posting... Thanks...

I would love to upvote 100% and I do good content and good profiles that contribute in a meaningful way to the STEEMIT platform.

@steemerite does not follow anyone nor is being followed by anyone. Also this profile only has only 3 posts and no comments on any post.

I may have missed something so can you please justify to me why I should follow or upvote?

@steemerite is very new to Steemit... I was hoping someone could open his eyes to the possiblilities... My 2 cents won't do it, so I've been searching for someone to give him a little bump to get him going... Thanks...

Thats cool and I appreciate your thoughts. I will take another look at his profile and engage with @steemerite.

Thanks.

Update: I commented and upvoted his post and suggested he engage more with community.

Thank you for the suggestion.

Thanks for taking a second look... I hope this is what it takes... I don't think he noticed anything yet... Time will tell... Thanks again...

@pocketechange

@lukestokes " Lambo isn't for anyone" is truly a spot on. I mean come on! wake up people, reality don't work that way. I like the way you convey your views along with some proofs on it. So the thing about investing is that, it's about how to see it in a long term and investing is never ever a quick buck scheme.I mean if it was, everyone would have been rich by now. Upvoted :)

👍👍

Thank you! :)

When we automize most of the work (mining, smithing the metal, building houses), maybe there will be a day for "lambo for everyone".

Excellent crypto investment advice here, friend. I am envious of how early you got into bitcoin and bought. Smart move. Much love.

Thanks Sterlin!

There's a new guy on Steemit calling himself @steemerite ... Could you pay his site a visit and give him a very needed 100% upvote and a follow...??? Thanks...And please don't mention I messaged you...

In my brief forays into the stock market, definitely one of the things I learned was trading on margin is tough. It's nice in that you get a solid multiplier for your efforts, but it's far more dangerous, in that you can get completely blown out of the market, and driven to zero, if you're not careful.

In my opinion, trading on margin is Beast Mode, and you should not do it unless you're prepared to lose everything.

If you want to be in the market and can stomach 'mere' 2x-4x-8x gains? Then simply buying your currency of choice makes the most sense. There's no margin calls to deal with. You own your currency, and its value may fluctuate - but you will still have it.

I think with Steem, if you're actually putting real money into it, it could make sense to hedge your own bet by buying SBD's as well. If the market goes down and your STEEM loses a ton of value, at least your SBD's will end up maintaining their dollar-amount. And if you're going long term, you can sell your SBD's on a downswing to keep driving your position upward - if you're long-term long on cryptocurrency.

I haven't figure out if I am yet :)

Thanks for commenting, Brady. Have you read my posts on BitShares? I link to them in the margin call HERO one. It's interesting because your own collateral via many multiples is used, so it's somewhat different than traditional margin setups where it's true debt. Also, the historical long-term trend of fiat verses cryptocurrency has been very, very good. So, on a long enough timescale, if you're betting against fiat, it's (so far) been a pretty safe bet (though a very volatile one).

If you can get a margin call, I'm pretty sure you are, in some way, dealing in debt. You borrow something and promise to pay it back later. That borrowing is done against a certain amount of collateral. That's debt. If the thing you're going to pay back later loses value in the interim, you buy the thing back off the market at the new lower price, and hand it over - at a profit! If the thing you're going to pay back later rises in value, at a certain point your liability will exceed the amount of collateral you have on hand, and you get automatically liquidated.

I won't pretend to understand any of that variable multiplier and collateral ratios and other such madness; I don't really know what it means. But I'm pretty sure about the first thing.

And, sure, on a long enough timescale, maybe Crypto beats fiat. I mean, hell, I'm here, right?! :)

But margin-trading isn't long-term. One tiny bump one way or another and you can get wiped out. Or make a mint. It's collateralized debt, no matter how you mark it.

On the stock side, the people who work in derivatives markets like that tend to be very short-term day-trader types. Or, they're people who have set up side-hedges to cover themselves if something goes very, very wrong.

(There's actually some really interesting stuff you can do, where you buy something you believe in, and hold it. And then you get some kind of derivative-style bet against it, and hold that too (up to a point). If your main bet pays off, you get margin called on your secondary bet, but if your main bet was good enough, you're still in profit. If your main bet tanks - horrifically - then you at least get a consolation prize on your secondary bet - and it's fine, you still hold your main bet (for now, unless you panic and sell it)).

So for you - and what I can figure that your positions are - I would dump a big chunk of money into good ole' BTC (or STEEM, or whatever currency floats your boat. Or a nice 'basket' of them). And then I would dump a smaller chunk of money - your hedge - into a short against it (SBD maybe? Or some other BitShares thing I don't know about yet?). You just have to work out a spreadsheet of your potential gains to potential losses, or whatever. And you'd have to remember; if your main 'position' goes well, you will lose your hedge. And that's fine, that means you've done well! I think the other thing to note is that you want those accounts to be separate; so that your main asset doesn't get lumped in with the collateral you have on your short. You want the short to liquidate itself (going to zero) when its collateral is spent, not have it keep going and run against your main bet!!!

DISCLAIMER - not financial advice. I don't know what I'm doing. I have never done the thing I just talked about.

I think I read something on Wikipedia once about 'bracketing options' - that might have more details if that's something you're worried about.

Yes, I'll concede it is indeed debt, but so are the pieces of paper with dead people on them in everyone's wallet. Fiat is a certificate of debt with no collateral other than taxes and economic productivity of a nation state (which, you know, I love to consider theft or, at the least, a version of extortion).

In this case, the collateral system really matters. Whereas derivatives traders are often trading with only a fraction of real value backing their positions, BitShares takes the opposite approach with over collateralization. It does so knowing that BitShares itself is a risky, volatile asset. The key being even if the margin is called, no one is hurt accept the person who took out the debt position. Everyone else gets exactly the value they are owed.

I like the idea of betting against yourself to some degree, but isn't that also just like doing the same thing at a smaller scale?

So if create 10k bitUSD out of nothing, buy BitShares with it and hope for the best, betting against myself would be to also buy up some bitUSD. How much? 2k? 5k? If I was to do that, I might as well just create 8k or 5k bitUSD to begin with. The key, I think, comes down to how much collateral you have and how much you are willing to lose.

But yes, selling the bitUSD for just BitShares may not be as good of a move as selling it for multiple cryptocurrencies (which I've also done in the past). With what we saw this past week or so, it wouldn't have mattered much though as everything went down.

I'm glad you're here, Brady. I hope you enjoy playing around with this economic sandbox which runs on smart contracts with no violence. :)

Wow, this is amazing advice and very motivational. I'm a huge Dave Ramsey fan (I disagree on minor details but overall he's awesome) and really agree with what you outline here. Thanks and I'll be following.

Thank you! I worked for Dave for almost 4 years. He helps a lot of people.

I like this. Exactly my thinking. I treat cryptos the same way I treat stocks. But to hold, so pick wisely.

Please visit @steemerite and give him a 100% upvote and a follow... For doing so, you can visit my postings and I'll give you my Theory on Pocket Change... Thanks...

"A little bit of perspective" posts are such a bearish signal. :-P

Hah! Yes, they are indeed. What's also a bearish symbol is the red candle bloodbaths we see all around us. Hahah.

I wonder if you will end up being right here...I think there's more downside to come yet.

this is a really great blog, really great effort posting this article, I must follow you from now, resteemed your article hope everyone could read this wonderful thing I found

The long term trend is that crypto's will be the new currency.

The other long term trend is that paper currencies are going in the trash.

These trends we know are going to happen.

Unless something completely, hands down, better comes along (and it probably will, but incrementally, and bitcoin will adapt it.)

The problem is between here and there.

We know the people with the power behind the money system will do EVERYTHING they can to maintain power. And so, its going to be a bumpy ride.

Well said! Bumpy ride indeed.

Thanks for this analysis and advice. You are right - crypto is not going to give Lambos in a matter of weeks. Like any stock or currency markets, there will be those with big pockets who will try to push the price down and pick up cheap coins.

I am going to hold just as you advise. Thanks for sharing your views. Your opinion lends confidence to newbies like me. Upvoted@lukestokes -

Since markets are red, I am not watching them. Instead, I have focused on improving my blogs. I have posted an interesting blog about Human vs animal eye capabilities, based on my original photos of wildlife. I request you to take a look when you have time and give your comments. It will help me improve my blogs and enrich my Steemit experience.

😃

Great post and good job promoting your content in a non-spammy way. Upvoted.

Thank you very much for your support and words of appreciation. It is a great pat on my back - coming from a Senior Steemian like you.

If it is not too much to ask, may I connect with you on Steemit Chat if possible?

I don't use steemit chat much as I have many different things which take up my time (including my three kids, my wife, and my business). If you have something specifically important you want to discuss, sure, go for it. My patience with random "hi" and "hello" DMs which inevitably lead to "Please follow me and up vote my posts" requests is running thin.

😊 I get what you mean. There must be many minnows like me who must be seeking your attention. I will not disturb you unless I have some important doubt that I need advice on. I know very well that follow for follow and upvote etc are worthless and irritating for Senior Steemians. I will never resort to such mindless tactics.

I will say hi and attract your attention in a non-spammy way here till then. 😄. Thanks for your continued support and guidance in advance.

Well reasoned, thank you. Building a following and finding success here takes time and effort. Patience and proper expectations are key.

Awesome post, Luke. So much truth here, but it all comes down to thinking long term and keeping your expectations in check. Wouldn't mind one of those lambos though :)

Thanks Jason. :)

Yeah, I'd like the money needed for a lambo, but I'd probably use it on other things.

You know, that's what I keep telling people who trade cryptos, FX and stocks, whenever they blame me for suggesting something to buy. First of all, it's all paper losses. No one's forcing them to sell if they don't want to. If they needed the money now, then they shouldn't have invested it short-term in the first place. Second of all, they ask me what I think is a good buy. I'm not an oracle, and I never claimed to be. I just do my research and hope for the best. They could've done their own research as well.

All the red I see in the charts just make me so excited. It's like open season on which investments would retrace strongest.

I generally try to avoid giving specific advice to individuals on which coins to buy. I did so in 2014 and some bought at the very top, only to sell for a loss. If people aren't willing to put in the time to do the research, they are often the first to complain about every single correction.

Your posts are a university to new joiners of crypto trading. Whatever you said 100% correct and I have the same kind of experience as well. When market drops most of newbies are selling their holding coins, but well experienced traders are preparing for that market drops to collect those coins in cheaper price.

As you said in the article most of top 10 marketcap holding crypto coins are bounce back to the previous and probably they will pass the previous peak as well.

Really appreciate your effort!@lukestokes, Finally I would like to say, don't forget to follow @lukestokes, and don't forget to read @lukestokes's articles. Those articles are adding true value to the Steem community and if you follow his guidance you can minimized the loss and definitely you will be at profit in the end of the day!

Cheers~

Thanks :)

You are welcome friend!

It was a rough day yesterday. Nothing going to shake me though. I took out enough a few weeks back to support us for two years. ; ) Going to ride this wave for as long as possible.

Nice, Randy! A two year runway is quite impressive. Well done!

Tomorrow I am starting a comic series titled

"Lamboland Adventures"

DOEET!

Woww so good i'm playing steem for the long term

This comment has received a 0.07 % upvote from @booster thanks to: @hamzaoui.

The markets are an enigma. They always have been and always will be. My grandfather told me long ago, that any financial decision backed by emotion, is a foolish one. Yet markets ride the waves of emotion up and down. In short, doing the opposite of what the mob is doing is almost always the best solution. Patience is always the best approach. It can be quite difficult at times, but this is not a sprint, it's a marathon.

A quote from Warren Buffet comes to mind, “If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.” I think most of us are in it for the long haul, so the bi-polar actions of the market today should not sway us, for we know where we'll be in the future. Steem as well as all the cryptos are simply on sale today.

nice post

resteem and followed

Thank you! Always appreciated.

hodl!!!hodl!!!hodl!!!

All of these!

great post...upvoted

yes long term is profit, when you start daytrading and panicselling you end up losing money. Some great tips here for everyone in your post. Good reminder but also good for people who just starting to know this.

Today's day it is hard to not live paycheck to paycheck. I am currently only invested a tiny bit because I want to be apart of this Crypto space because I feel that this is the future.

I am working on getting better positioned so I can move more into this space. I do like this platform though. I fell this could really replace FB and Twitter as the ultimate Social Media platform and expand the Crypto space.

People need to focus on "cash flow" or "coin flow". Leave the gambling to the whales with money to burn.

First Rule of Trading - Buy when everyone is selling ,Sell when everyone is buying

and for beginners it should be the only rule

This is the Hodl trading perspective I want to read...thank you!! Resteemed, upvoted and followed.

Thanks so much, I greatly appreciate it.

Spot on! I keep trying to convey this concept to friends afraid of crytpos and yet the fear seems to be too much -- it' funny how much press the down turns get, which should not be of concern to those with long sight as an investment strategy.

*Resteemed this excellent article.

Thank you.

any idea in when this correction will end? i'm getting a little impatient :(

In 2 hours, 32 minutes, and 12 seconds.

Haha! No one knows! If you're feeling too impatient, crypto trading may not be for you right now. :)

Lol xp

Nice! :)

How can you analysis that kind of content

Great post. And truthfully, this is the one thing that makes Steemit stand out....NO ONE pushes people to invest. in fact, I read everywhere people saying only invest what you can afford to lose or something on those lines. It is the truth and solid advice.

Great post Luke!

Thank you. I think many Steemit users recognize the value we have here and are in no hurry to see things explode too quickly. Anyone one trying to push someone to buy something they shouldn't isn't helping them.

I need a lambo!

great analysis!!

It's buying time! I don't have a ton of extra disposable income to invest, but if I can buy $50-$100 worth of Steem at $0.96 like I did yesterday I will jump at the opportunity. Just a few weeks ago Steem was well over $2.00 and its been as high as $4. It will come back up eventually. Those are nice returns if you can hodl.

I remember it at $0.15 this past year so keep it mind it can fall even further.

Very true! That would be an even better time to buy :)

that's a pretty interesting post I like it thanks a lot for sharing and keep on posting ;)

I think.. you are too good😲

time to buy cryptocurrency

In 100 years from now you will find the truth under the dust of lost time

you might want to know and upvote

https://steemit.com/travel/@arbindjain/psychedelic-honey-from-nepal

Great analysis @lukestokes . Honestly i have not login into Bittrex account, not want to have heart attack, so , i will stay put till the market correct itself or when fresh funds is available for me to buy more coins. thanks and I resteemed.

That's probably a good plan. I've seen many people post about ignoring their blockfolio during this time and just going out for some time in nature. It's a good idea.

Market is indeed in downtrend but it is not gonna stay in there forever. Market will rise as soon as the Segwit hype gets clear. Market has reached it's lowest downtrend and I don't think it's gonna fall further. GOD helps all. We can HODL our currencies right now. Within a week or two, we can see positive uptrend. @lukestokes

I hope so, but it's hard to know for sure. We're also at the end of a pretty massive bull run as well. How much of the Segwit drama is priced in? How much of the volatility will continue in order for whale to get the positions they want? It's going to be an interesting summer for sure.

hodl is the best strategy

nice post

follow me& upvote

Hi @lukestokes i totally agree with and keep saying it around me. Do not sell keep all of your asset and even get this great opportunity to grab some coins at a good price. Many newcomers are now selling, afraid to get nothing by the end but i always tell them this is a long term market like everything. Nothing come in a day. Thank you ^ and follow you + Resteem it

Thanks so much. Keep spreading the good word.

awesome post and advice too. thanks for this. see you soon.

UPVOTED you.Hi @lukestokes !!

Amazing post with an amazing message! Thanks for sharing! Followed!

Thanks for the follow! Much appreciated.