Last year, Tilman Fertitta, owner of restaurant company Landry's Inc. and the NBA's Houston Rockets, offered $13 a share in cash and stock for the company.

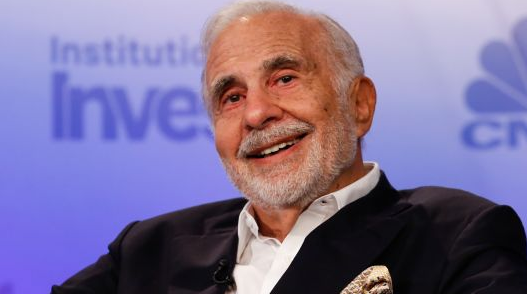

In January, activist / investor Carl Icahn built a 10% stake in Caesars Entertainment Corp. Now Icahn's is pushing for a sale of the company after Caesars rejected a merger approach by Tilman Fertitta.

The activist investor said in a filing with the Securities and Exchange Commission that he wants representation on Caesars' board and for the company to refrain from immediately appointing a new CEO.

Caesars' stock is undervalued and the best way to boost it would be to sell the company, Icahn's filing states. Shares of the Las Vegas-based company jumped more than 5 percent Tuesday.

"We believe that our brand of activism is well suited to the situation at Caesars, which requires new thought, new leadership and new strategies," the filing adds.

Maybe, just maybe this is why I noticed unusual options activity on Friday. The Smart Money is piling into the March $9 and $9.50 call options. And based on the open interest, they have been buying these call options for quite some time. The Smart Money must know something we don't because these are short dated options expiring in less than 30 days.

And according to the daily chart, there is no reason why the stock price can't surpass $10 within the next several weeks as the closes level that would stop price is the daily supply at $12.15.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Yes it is not a personal advice and your information with your shared is very useful for us

Agree, not personal advice, just sharing how I view the Markets.

Hey bud, you been working any of the unusual option signals? How's it been going?

I have taking several, still trying to establish a system. Some UOA I haven't posted and haven't taken, have worked out great like Snap(4X return) and Facebook (3X return) a couple of weeks ago. The ones I'm in now are Zayo and Uxin. I might take an L on Zayo, but Uxin is working out thus far.

The one that didn't work out was Pitney Bowes from a couple of weeks ago. I also got out of the Coca Cola put options and JNJ call options because price for a small lost because price wasn't moving fast enough for me despite these options expiring in January.

I'm not going to take Caesars because I don't really know this sector, like I do tech. However, this one seems like a low risk high probability trade and if I was going to get into this one. I also like all the open interests, meaning open trades.

Thus, overall down a little bit, but I see the potential, what will be key for me is my criteria, with one critical parameter being implied volatility.

Yep, makes sense. Implied volatility important with options. Couple that with a good risk-reward ratio should be in good shape.

This is a tough one as Companies typically wil take time to onboard an activist to their board and even more time to act to their ideas. However, it may be a pay towards expectation of a buy out and the valuations based on the market right now.

Posted using Partiko iOS

No agree, with potential buy outs, one has to buy time, as I'm learning on my UOA Zayo call options.