Good Morning, the following brief is crafted to get readers up to speed in the alternative investment space.

Feedback always welcomed, have a great weekend!

Airbnb plans five more complexes after its first Florida apartments

A new report today confirms that Airbnb will launch a new apartment complex in Florida in partnership with a real estate firm. The rental company plans to pitch the location as prime opportunity for seasonal tenants who will be able to rent their units out for up to 180 days a year. The company also plans to build five more such Airbnb-partnered apartment complexes amounting to 2,000 total units in the next two years, its chief executive told Financial Times.

It'll be interesting to see if Airbnb exports this model to other real estate partners in the future as it continues to try prying more business away from hotels.

https://www.engadget.com/2017/10/12/airbnb-plans-five-more-complexes-after-its-first-florida-apartme/

Flipkart commits $500 million investment in PhonePe|

Flipkart has committed $500M for its group company PhonePe, a payments platform that was acquired in 2015. This is one of the largest single investment commitments in the Indian financial technology payments space, and comes at a time when the top ecommerce players in the country are investing towards building a strong payments system. This newly committed amount brings it to a grand total of $75M worth of infusion by Flipkart since the acquisition. PhonePe recently received approximately $38M from its Singapore-based group entity, Flipkart Payments, according to filings. The company is confident about achieving its target of 25bn digital payment transactions by next year. Fintech in India, especially payments, is undergoing a paradigm shift - and market research shows India’s digital payments sector is projected to grow to $500bn by 2020, representing around 15% of GDP, up from around $50bn last year.

http://economictimes.indiatimes.com/small-biz/money/flipkart-commits-500-million-investment-in-phonepe/articleshow/61050062.cms

Magic Leap looking to raise as much as $1B in new round

Magic Leap may be raising as much as $1bn to fund their vision of a future filled with augmented reality glasses. A Delaware filing dated Wednesday confirms that the secretive startup has authorized about $1bn in new funding. The filing authorizes over 37M shares of Series D preferred stock at $27 per share. No details on investors yet. A spokesperson for Magic Leap confirmed the startup was raising but would not detail whether the round had been completed. A report last month in Bloomberg suggested that the AR startup may be readying itself to begin shipment the device to a “small group of users” in the next six months at a price that could be as much as $2,000. In the past few weeks, the company has begun a new marketing push that has included a branding revamp with a new logo, new website and a new promo video which promises that “the whole story is coming soon.”

https://techcrunch.com/2017/10/12/ar-mystery-startup-magic-leap-looking-to-raise-as-much-as-1b-in-new-round/

Waymo allegedly demanded $1bn in settlement talks with Uber

Waymo sought at least $1bn in damages and a public apology from Uber as conditions for settling its high-profile trade secret lawsuit against the ride-services company, and also asked that an independent monitor be appointed to ensure Uber does not use Waymo technology in the future, sources said. Uber rejected those terms as non-starters, though Waymo’s tough negotiating stance, which has not been previously reported, reflects the company's confidence in its legal position after months of pretrial victories in a case which may help to determine who emerges in the forefront of the fast-growing field of self-driving cars. The aggressive settlement demands also could suggest that Waymo is not in a hurry to resolve the lawsuit, in part because of its value as a distraction for Uber leadership.

https://www.cnbc.com/2017/10/12/alphabets-waymo-uber-settlement-included-1-billion.html

Branson's Virgin Group invests in super-fast Hyperloop One transport system

Richard Branson's Virgin Group is investing in Hyperloop One, a company developing the super-fast transport system originally dreamed up by Elon Musk. Hypleroop One will rebrand itself as Virgin Hyperloop One, and Branson will join the board, the billionaire British investor announced yesterday. The investment amount was not immediately disclosed. Hyperloop One already had deep pockets. Just last month, the company raised $85M in new funding. The company has been in talks with several governments, including the United Arab Emirates and Finland, to study the feasibility of building such a system. No deal has been signed. The company told media outlets in September that the Middle East would be a preferable market to begin with.

https://www.cnbc.com/2017/10/12/richard-bransons-virgin-group-invests-in-hyperloop-one.html

Morgan Stanley sees SpaceX value growing to more than $50 billion

SpaceX could become a $50bn company through its launch of a satellite broadband network, a team of Morgan Stanley analysts wrote in a report yesterday. The private space company on Wednesday launched its 15th rocket this year, and the second this week. More importantly, the Falcon 9 rocket launch was the third time SpaceX reused the first stage booster, and with each of these so-called "flight-proven" launches, it should be easier to attract new customers. Morgan Stanley says SpaceX developing reusable rockets is "an elevator to low Earth orbit." Reducing the cost to launch a satellite to about $60M, from the $200M that United Launch Alliance charged through most of the last decade, was a monumental breakthrough. SpaceX is trying to reduce its cost to $5M per mission, and Morgan Stanley says the launch business "generates limited operating income." The cash cow, according to analysts, is the SpaceX plan to launch a satellite broadband network in two years and send humans to Mars in seven.

https://www.cnbc.com/2017/10/12/morgan-stanley-sees-spacex-value-growing-to-more-than-50-billion.html

Snap's stock rises further the day after its biggest jump since IPO

Snap’s stock rose again yesterday after shares enjoyed their best daily gain since its IPO in March. The stock was up 51 cents, or 3%, to $16.49 a share in midday trading after surging 11.4% on Wednesday following a positive report from analysts. Snap has a total market value of $19.8bn. Snap reported 173M daily active users worldwide in the second quarter. Despite the popularity of Snapchat, the company remains unprofitable. It lost $443M in the second quarter, although part of that loss included costs related to employee stock-compensation awards. Snap’s biggest single-day gain was the date of its IPO. The day after, its stock traded as high as $27.09 a share. The stock then gradually moved lower in the following months, bottoming at $11.83 a share on Aug. 11, before starting to rebound.

http://www.latimes.com/business/technology/la-fi-tn-snap-stock-gain-20171012-story.html

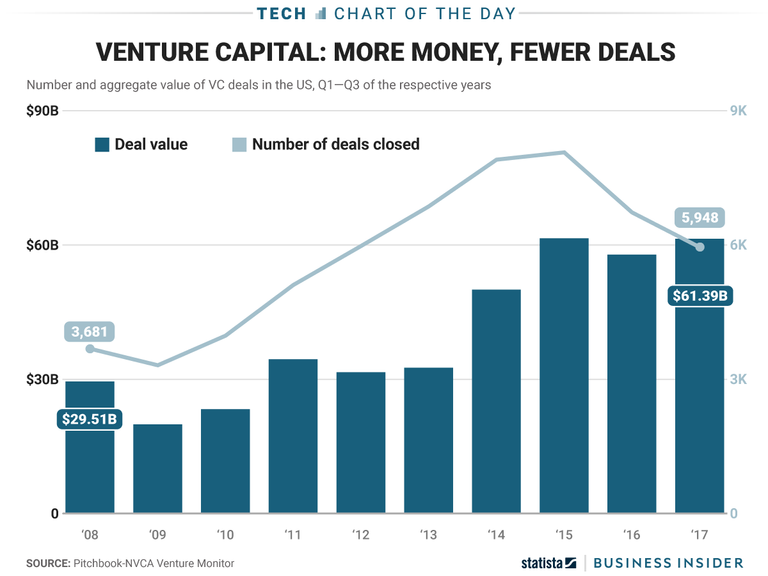

Venture Capital spending is on track to be higher than it has been in years, but fewer companies are getting funded

Venture capitalists have been on a spending spree so far in 2017, but have been funding significantly fewer companies than in the past. According to data from PitchBook-NVCA Venture Monitor, the number of deals that closed in the first nine months of 2017 is lower than it has been since 2011. Companies lucky enough to be part of these deals are being valued a lot higher than their predecessors, and are getting a lot more capital as a result. One of the biggest trends in venture capital so far this year has been the uptick in initial coin offerings, or ICOs. Some critics are wary of the trend however, pointing out that much of the currency is being funneled into young startups that lack the mettle to become successful.

http://www.businessinsider.com/venture-capital-more-money-on-fewer-companies-chart-2017-10

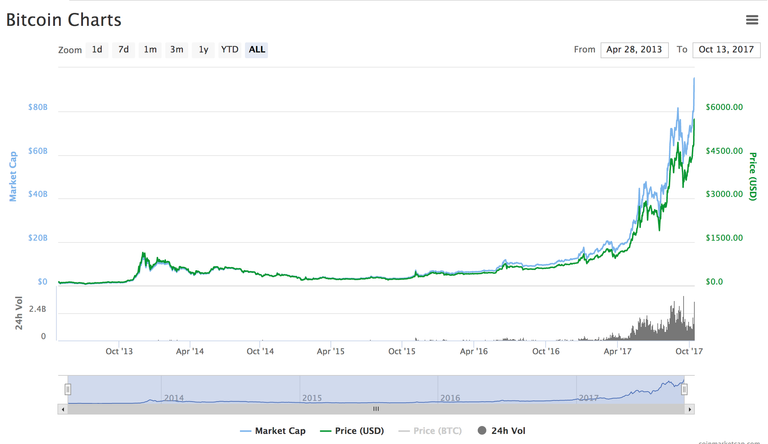

Bitcoin price hits another record high above $5,800, now up 480% this year

Bitcoin hit another record high on Friday, continuing the rally seen in the previous day amid renewed bullish sentiment from investors. The price of the cryptocurrency hit an all-time high of $5,856.10 in the early hours of Friday morning, but profit-taking from investors saw the bitcoin price fall as low as $5,396 in the following hours. Its market capitalization — the total value of all bitcoin in circulation — hit $97bn, and is up over 480% year-to-date. The catalyst for the rally, which began on Thursday, was speculation that China could reverse a recent ban it put on exchanges. Last month, regulators banned cryptocurrency exchanges with some of the largest in the country shutting down operations. Reversing this would bring the world's second-largest economy back online. Another major upcoming change could also be getting investors excited: Another hard fork is on the way, which will create "bitcoin gold". Holders of bitcoin will automatically receive bitcoin gold: essentially "free money." Longer term trends have also helped bitcoin's price. Favorable regulation from the likes of Japan, which has allowed retailers to accept bitcoin for payment if they want, has supported bitcoin.

https://www.cnbc.com/2017/10/13/bitcoin-price-hits-another-record-high-above-5800.html

Coinbase Enables 'Instant' Purchases for US Buyers

Cryptocurrency exchange startup Coinbase has announced that some users will now be able to access "instant" purchases of Bitcoin, Ethereum and Litecoin. The new service is currently only available for users making payments from a U.S. bank account and in amounts of under $25,000. However, Coinbase said it plans to expand the instant purchasing service to other countries "over the coming months." Whereas previously such transactions would have taken several days, the firm said, customers will now have immediate access to their cryptocurrency holdings after the payment is made. The move is likely to be popular with users of the startup's service, which been the target of criticism over poor customer service. Coinbase has previously stated that rapid user growth in recent months led to the issues, committing at the time to devote more funds to boost its customer services resources.

https://www.coindesk.com/bitcoin-ether-litecoin-coinbase-enables-instant-purchases-for-us-buyers/

Congratulations @rowboatmoney! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!