And get into Commodities!

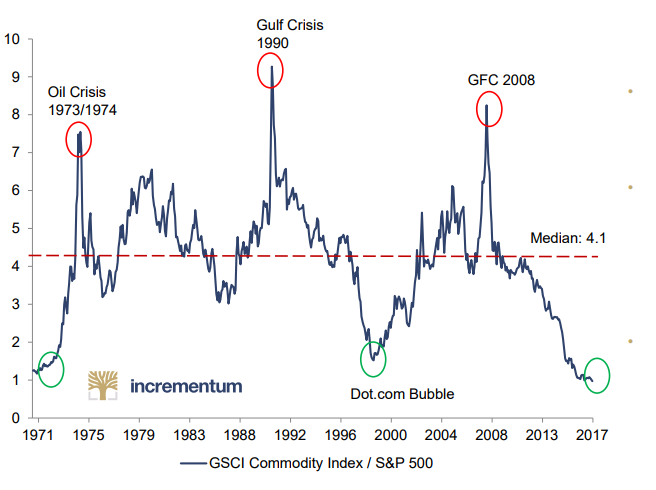

This chart says it all. Everything in life is cyclical. This chart shows that the stock market is EXTREMELY overvalued compared to commodities.

Said differently, commodities are the cheapest asset class out there and when this cycle turns, those invested in the resource sector will reap MASSIVE gains.

Last year marked the lowest volatility in the stock market EVER!

Meanwhile, resource equities were sluggish at best, while unbeknownst to most, the underlying commodities were staging an under the radar stealth rally.

- Gold

- Copper

- Lithium

- Cobalt

- Zinc

All had double digit gains last year.

The S&P 500 has rallied for 9 years straight, now is the time to take profit in this sector while rotating into the unloved and uber cheap commodity sector.

Billionaire Ray Dalio, head of the largest hedge fund in the world last year became the 6th largest holder of GLD, an etf that holds Gold bullion.

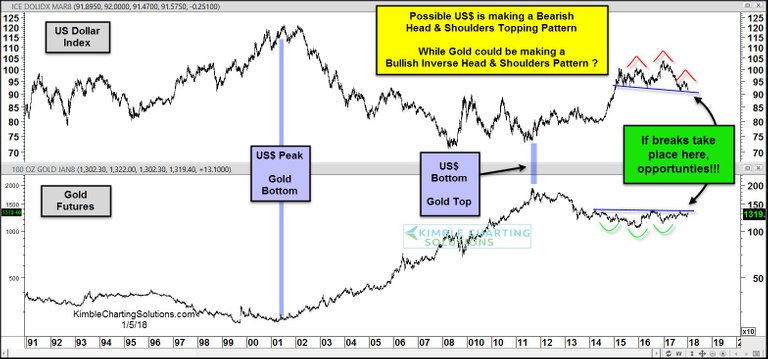

The Dollar is in free fall right now

This is extremely bullish for Gold and gold equities.

Happy Investing!

Until Next Time

It's your move.

JESS

Thanks for reading, if you enjoyed this rant, you might also enjoy some of my

Recent Articles:

The Best Performing Commodity of the Next Decade..

How to Invest Like a Two Year Old...

Death of the Petrodollar Imminent as China Moves to Undercut U.S. Hegemony

This is true, all things go from one end to the other - like a pendulum.

Right now that pendulum is fully towards cryptos but history always shows what is hot at one time is not at another.

Yeah it is! It makes me nervous not having any history to draw upon though. I've made money on the general stock market, and I've made money on crypto craze.

The tough part is having the discipline to buy the out of favor sectors.

But I literally cannot wait until the next market crash!

Who doesn't like a good sale?

I'm the guest on @scaredycatguide 's streaming radio show today. If you are interested.

oh really? cool, I follow him, but I've never listened to the show.

I'll check it out!