Brazil – which accounts for about 45% of global Arabica coffee output – has just completed its 2017/18 harvest. While output was always expected to be lower than last year due to the biennial cycles present in the country, production fell significantly short due to poor weather. Output is likely to be more than 20% below 2016/17 for Brazil (-9 million 60kg bags). Hopes for a rebound in the 2018/19 coffee crop in Brazil have become dimmer as a lack of rain has hampered the flowering of coffee bushes. Although rain has now commenced, it is late and development of new nodes on coffee bushes are likely to remain inadequate.

Mexico and Central America (20% of global production) have commenced their 2017/18 harvest. So far the output from the region looks strong and we could see a 1 million bag increase in production (6%). Production in Mexico Honduras and Nicaragua seems to have improved after years of coffee leaf rust problems, although El Salvador, Guatemala, and Costa Rica are still suffering from this fungus which reduces coffee yields.

Colombia (15% of global production) is likely remain close to last year’s levels which was at a decade high. There has been 30% growth in Colombian production over the past 10 years.

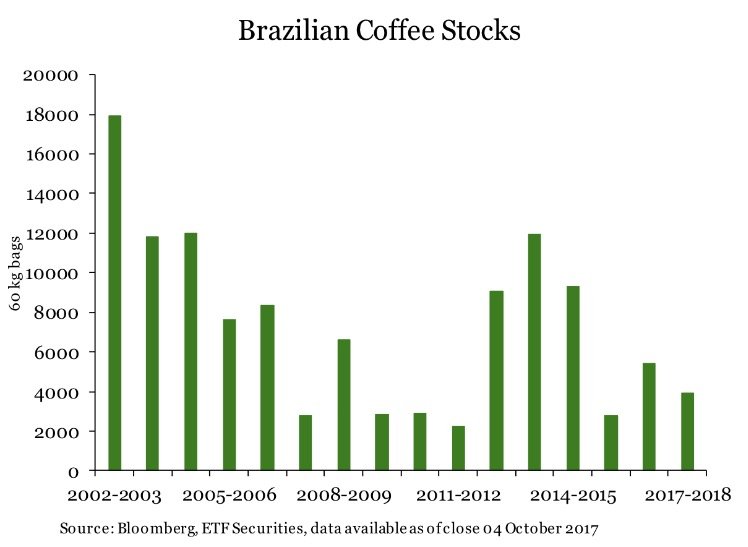

Despite strong production elsewhere, a decline in Brazilian output and weakening prospects for the country this year could act as a catalyst for prices. While in previous years, Brazil has been able to sell abundant stocks from prior years during poor harvests, its stocks have fallen significantly and supply tightness will likely be felt this year.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.etfsecurities.com/Documents/Coffee-offers-upside-potential-in-a-depressed-soft-commodity-market.pdf