Hello Steemians!

This year, 2018 I set my eyes onto reaching greater heights financially. Because of that, I sought after multiple books to learn from and I came across this amazing book, Money: Master The Game by Tony Robbins. The ideas in this book is simply mind-boggling, and I want to share some of the lessons that I've learnt with you today!

If you want to improve your financial status this year (no matter what it is), first you must understand what are the 7 BIGGEST FINANCIAL MYTHS and how to deal with them!

Myth 1: To Make Money, You Need To Beat The Market!

BULLSHIT !!!

If you're interested in investing and you asked around for advice, you might have heard this a lot. Like, seriously A HELL LOT. Most professionals (financial advisors or however they wish to address themselves as) will persuade naïve clients into buying their products/services by convincing them that they can beat the market.

Honestly, there are only a handful of people who has ever beat the market. George Soros? Yup, famous for breaking the Bank of England. Guess what? There's likely less than 10 people in this world who is LIKE George when it comes to beating the market.

In fact, the world's 3rd wealthiest man Warren Buffet (right now) himself is an investor who joins the market rather than beating the market. His reasoning is simple: Beating the market is equivalent to building a unicorn startup today. It's possible, but extremely unlikely. Good news is that if you want to grow your wealth, you don't need to be a unicorn. Just build a great business, and you can profit too!

Source: Giphy

Lesson: If someone approaches you by saying that their products/services can beat the market, RUN!!!

Myth 2: Don't Mind The Small (Service) Fees.

If you've been investing for some time now, there might have been occasions where you wonder: Why did my money increase by so little after so long?

Despite the great results that you're shown, you still cannot wrap your head around why didn't you earn as much money as the results showed? My friend, that is because most of your money has been sucked away under the cover of additional fees and charges!!

Urban legend has it that, compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it.

(No, I'm not quoting Albert Einstein because contrary to popular belief, there is no scientific evidence proving that he actually said this.)

Anyway, this is more than a legend itself - Compound interest is A FACT. If you think that the small additional fees that you're paying for whenever you make a transaction don't matter (because the salesperson told you that it doesn't matter), that's when compound interest works against you!!!

In his book, Tony Robbins told a great story to explain this:

Three childhood friends, Jason, Matthew, and Taylor, at age 35, all have $100,000 to invest. Each selects a different mutual fund, and all three are lucky enough to have equal performance in the market of 7% annually. At age 65, they get together to compare account balances. On deeper inspection, they realize that the fees they have been paying are drastically different from one another. They are paying annual fees of 1%, 2% and 3% respectively.

Below is the impact of fees on their ending account balance:

Jason: USD 100,000 growing at 7% (minus 3% annual fees) = USD 324,340

Matthew: USD 100,000 growing at 7% (minus 2% annual fees) = USD 432,194

Taylor: USD 100,000 growing at 7% (minus 1% annual fees) = USD 573,349

Same investment amount, same returns, and Taylor has nearly twice as much money as her friend Jason.

Source: Giphy

Lesson: Be wary of ALL the additional fees and charges that are included in your investment schemes. Read the TERMS and CONDITIONS, and opt to pay as less charges as possible.

Myth 3: Your Returns? What You See Is What You Get!

Most investments scheme in the market put on a display of average returns. What most people don't know is that the average returns are not your actual returns!

Average returns in investment schemes, are like profile pictures in online dating. They always paint a better picture than the reality!

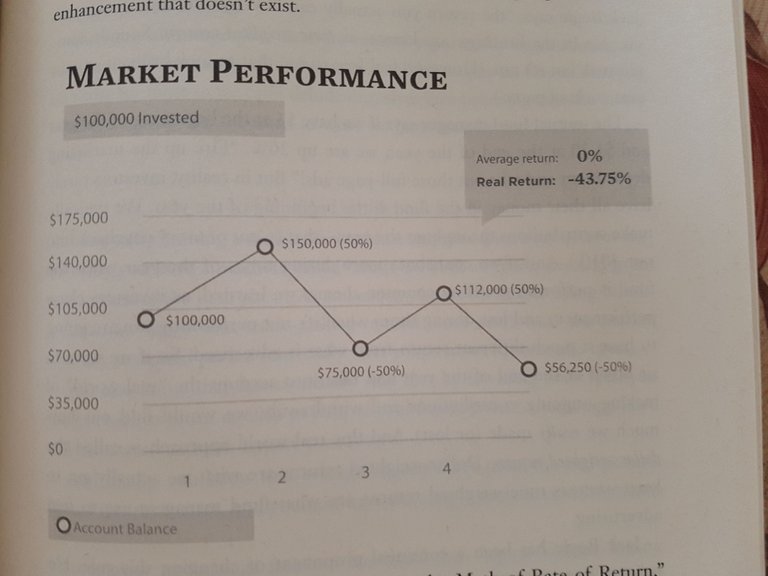

Imagine that in today's market, it is up and down like a roller coaster. Your investment of USD 100,000 goes up 50% in the 1st year, down 50% in the 2nd year, up 50% in the 3rd year, and down 50% in the 4th year.

Theoretically, this results in an average return of 0% (0+50-50+50-50=0). Exactly as advertised to you by the investment scheme. But in reality, you actually lost USD 43,750 or 43.75% of your investment!!

Below is a chart from Tony Robbins which proves why you lose money even though the returns is 0%???

Lesson: Instead of average annual returns, find out what are their monthly returns

Myth 4: Your Broker's Job Is To Help You

Attention: This is not because your broker is an asshole and wants to rip you off (there are many out there who are like that, actually. But probably not yours. Probably.)

Despite the fact that your broker genuinely wants to help you succeed financially, the system is built such that he/she can do nothing but to put the company profits before you!!! You see? The problem here is not your broker, but the role of a broker itself - it's BROKEN.

Isn't the title itself really literal about this? Broker = Someone who 'brokes' other people (or making them broke, basically).

Source: Giphy

Jokes aside, I believe in this saying super much: If you want to go broke, then get a broker.

Myth 5: Your Pension Is Enough For Retirement

Most people cannot retire today because they don't have enough savings to last them for the rest of their lives without working.

Younger generations don't think of retiring because they believe that they will continue working by doing what they enjoy and continue earning as much.

Seems like everyone has forgotten about inflation eh?

No matter how much you make today, if you don't have the right strategy in place to sustain yourself for your later days, you're in deep shit.

Source: Giphy

Saving is important, yet not enough. This is where investment comes in. Investing alone, again is not enough. The key to a successful retirement is investing early and wisely.

How can you do that? By learning from books, investors who are more successful financially than you, and most importantly by actually putting in your money to invest!!

Lesson: If you don't know how to, learn how to. If you haven't done it yet, do it now. Sure, nothing is ever too late - but why continue struggling to earn money at the age of 80 when you can (and should) retire and enjoy life?

Myth 6: Huge Risks = Huge Rewards!!!

I'd say it's Well-Managed Risks = Huge Rewards!

I've only started my financial journey several years ago, and I'm still miles away from where I envisioned myself to be. However, based on what I've learnt from the books I read and mentors that I work with, there is an appalling truth to financial success: huge risks DO NOT guarantee huge rewards, but well-managed risks do!

When it comes to managing risks, I realized that more components lie within our individual selves - dependent on our skills, our network, our capital etc.

Before you can begin managing your financial risks, first you need to identify the potential/existing financial risks that you're facing. Usually, these risks can be spotted based on experiences and data, so this is where your mentors come in. With mentors who are more experienced and successful in dealing with the market, they can help navigate your financial roadmap so that you have a clearer picture on how to reach your 'destination' (financial goal).

Now that you've successfully identified the risks, you must manage them. For this, I've got a handy rule-of-thumb: If you can do it, do it. If you can't, hire someone who can.

Source: Giphy

Lesson: In the end, it's all possible only if you actually start. By learning and experiencing the ups and downs yourself, then you are able to grow and become better in building your wealth.

Myth 7: Lying To Ourselves The Entire Time

This is about the story that you've been telling yourself in your entire lifetime. If you're not where you want to be, it's probably because you believe that:

I can never be rich, because I'm not as good as them.

I can never earn that much money, because the economy is bad.

I can never afford a better lifestyle for my family, because I did not come from a wealthy family myself.

In fact, you might say this too when you read/listen about wealthy individuals:

They came from a wealthy family. Of course they're rich.

That is because their company is so successful. I'm not like them.

They cheated to make so much money.

Etc. Etc. Etc.

Truth is, you know that these are all lies. You know exactly what the truth really is: That you can do it too! But something is holding you back. Is it fear? What kind of fear? The fear of success, or the fear of failure?

Are you afraid that you're going to be too successful, and you can't handle the responsibilities then?

Or that you're going to fail when you try, and you'll be ashamed for the rest of your life?

My friend.. don't give in to your fears. Turn them into your strength, and fuel yourself to strive for success!

Source: Giphy

Lesson: Screw your fears. Be honest with yourself, and face your fears head on.

Reflection

Just like you, I'm also on my way to realizing my financial goals for 2018. I assure you, the journey will be difficult - plenty of downs, not so many of ups... But it'll be worth it. The day that you've become successful, you'll look back and you'll be glad that you did what you've done.

See you at the top, my friends.

Sincerely,

M

What other financial myths do you know? Share with me below!

For your daily dose of entrepreneurship:

DTube:

For my secondary ventures (food, gaming):

Steemit: https://steemit.com/@aaronmcheongg

Steepshot: https://alpha.steepshot.io/@aaronmcheongg

DLive: https://www.dlive.io/#/user/aaronmcheongg

M is the co-founder of Commodum - in which we aim to advance Malaysia's economic ecosystem by centralizing resources to aid student entrepreneurs.

References:

Money: Master The Game by Tony Robbins

Shoutout to @alexe for helping me to proof read this article. Admittedly, I wrote this in a very bad state and I missed out on a lot of obvious mistakes. Thank you to everyone who put up with this quality, next one will be better :)

It was a pleasure ;) Although there were mistakes, I do find this post to be well-written and very interesting to read! So, great job @aaronmcheong on this myth-busting post!

Indeed,the first thing is to believe in yourself that you can create wealth using your own hand too, ppl will never success if they have deny any possibilities even before trying it! I like your second point very much, compounding transaction fees/extra charges do make a difference on wealth in a long run. The example is very clear. In fact, I only learn about the power of compounding interest one year back. Late but I hope not too late. Good sharing!

Yes, compounding interest can really make or break our banks. Glad that you've learnt the importance of it last year, now it's your time to leverage on it to build your wealth!