Warren Buffett is the most successful investor of the world, with a high score of 19.2% annual gain in the last 50 years and a net value of 60.8 Billion Dollar. At the moment he is 85 years old.

If you want to get famous as an investor you need time. First you need time to accumulate and grow your fortune and second you need time to prove that your perfomance is not mere luck. A trader with a perfomance of say 200% in one year who looses the money the next year is not successful. For this reason an intelligent audience should take one hit wonders for what they are: one hit wonders.

There is a difference between investing and speculating, which brings me to Warren Buffett's strategies for getting rich. Warren Buffett knows the difference between these two forms when acting in the stock market maybe better than everyone else.

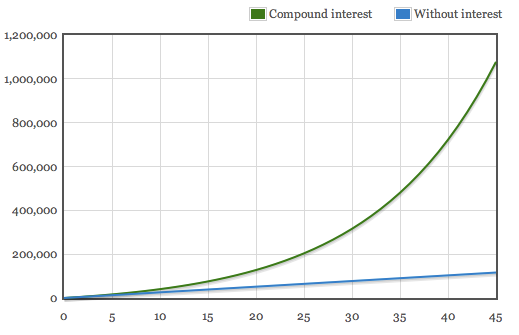

In my opinion investing means buying shares of healthy companies for a low price, preferrable during a stock market crash, and enjoying the dividends. With these dividends one can again buy more shares of healthy undervalued companies. We get a compounding effect and this is, on the long term, what makes you really wealthy.

On the other hand speculating means forseeing trends and knowing how the market will react. For example, buying Facebook put options because everyone is already on Facebook and they will soon all move to Steemit, well this is a speculation.

There is no compounding effect for speculation. Therefor you won't get wealthy. But it is fun and Warren Buffett did it with great success with the extra money he earned for managing Berkshire Hathaway.

That's the point: Keep your money for speculating and investing separated. This shouldn't be mixed up!

In my next article I will dive deeper into Warren's strategies. Until then I wish you good luck for your investments and speculations.

My name is cryp71x. I am a software developer and hobby investor for about 16 years now.

Awesome share!

Thank you, I too am an absolute Buffett fan. You may want to read my post: https://steemit.com/stocks/@lucky.digger/how-i-have-beat-the-stockmarket-consistently-for-years