I am a 21 year old who has recently graduated and has a keen interest in Economics and Investment. The purpose of these posts is to create discussion/insight into the world of the average investor. I have been investing for three years and whilst I have lots to learn, I am confident that I can add something to the community by making these posts.

The following is a breakdown of my Investment Portfolio in terms of performance, allocations and potential buy/sell decisions I will be making in the near future. All performance figures are before tax.

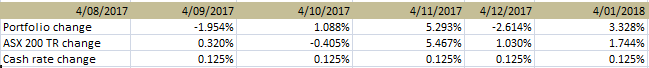

Monthly performance

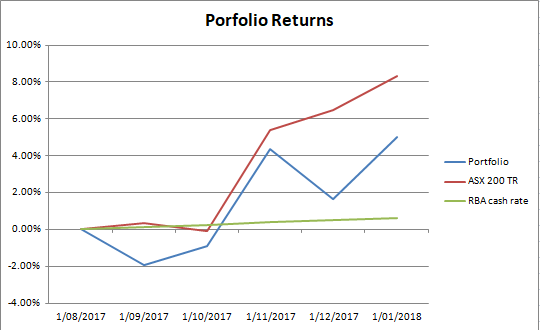

Cumulative performance

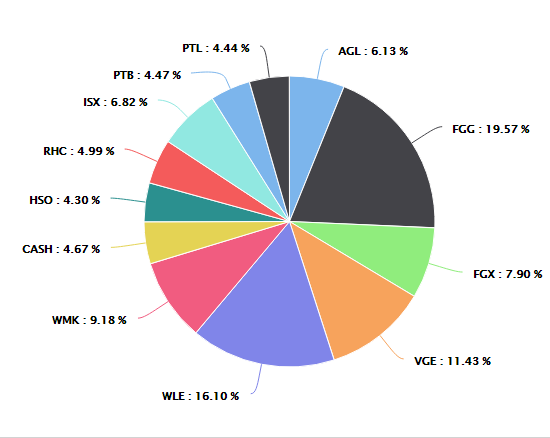

Allocations (as of 16/1/2018)

Considering Buying:

Windlab (WND)- Looking cheap and love the business. The stock lacks liquidity and I think this might be why it is a bit cheap.

More international exposure- LIC or ETF.

Selling Watchlist

WLE- Looking for it to trade at a 5% premium to pre tax NTA.

PTL- Recent profit downgrade surprised me. Valuation looking a bit stretched unless the performance improves dramatically for the second half of FY2018

In addition to my investment portfolio I also like to use acorns to invest and save money for big items like housing and holidays. I believe that it is very effective for both of investing and saving. I may explain why I think this is in a later post. I also have a small portion of my capital in a trading account for speculating/hedging.

Overall Investment allocations:

Investment portfolio: 85%

Acorns Portfolio: 13%

Allocation: Conservative

Trading account : 2%

Positions (as of 16/1/18): Long gold.