ONASANDER INVESTMENT GUIDE

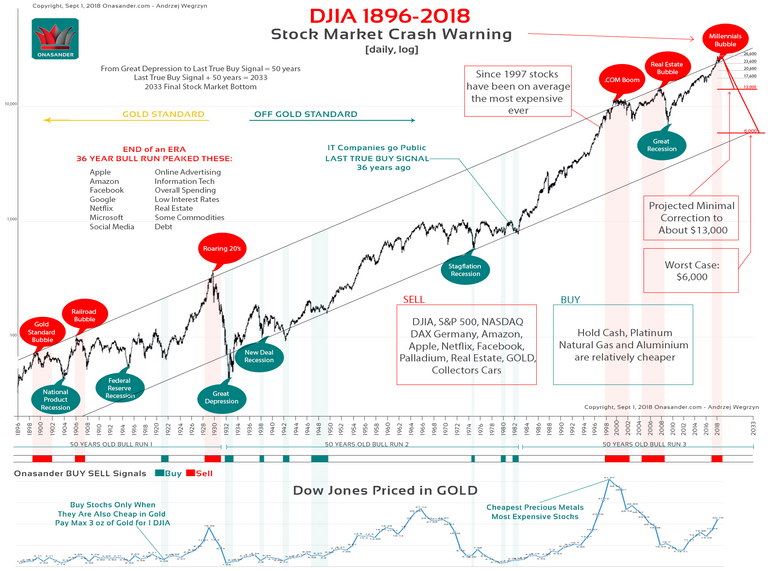

The US Stock market and most other stock markets around the world are topping and will crash within the next 2 years. The US Dow Jones Industrial Average is overpriced just like it was right before the Railroad Bubble Crash, Great Depression, .COM Crash, and the Real Estate Bubble Crash.

The stock market on the broader picture, has been topping since about year 2000, with multiple bubbles and busts in between. Since 1997 stocks have been on average the most expensive ever priced in the US dollar, and in Gold. Stocks priced in Gold are also in the SELL category with the DJIA price hovering around the same 22oz of Gold for 1oz of Dow Jones, as they were before the Great Depression. Looking at Onasander market charts, smart investors should never pay more than 8oz of Gold for 1 share of Dow Jones.

The current 50-year Bull Run started in 1983 and will last until 2033. It had and will have multiple recessions in it. In 2033 major social and economic changes will take place. In this article we will show you what will happen to each asset class until 2033, how to survive the upcoming recession, and how to benefit from it.

WHAT TO SELL, SELL SHORT, BUY OR HOLD

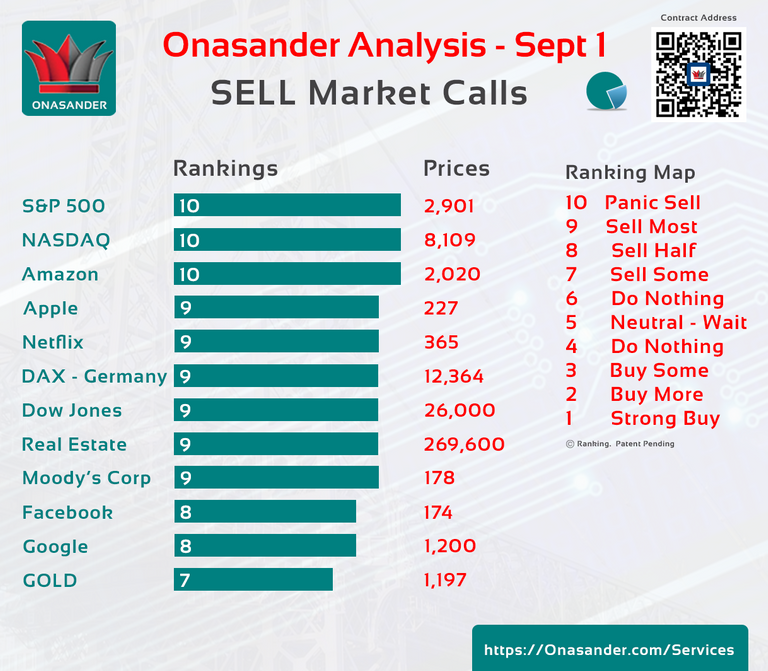

SELL

In this category we will review each notable asset class on the SELL side of things, and help you decide how to position your portfolio for the upcoming changes. This section is very important as some asset classes are the most overpriced ever and will suffer the biggest correction resulting in many bank and fund failures.

Stocks

Stocks are leading the SELL category as they are super expensive now. Buying any single stock at this point is a mistake. There is almost 0 potential on the upside, but at least 50% risk on the downside. This prediction is very generalized, as there are few selective stocks that have corrected already. Excluding those, the Darlings of the Wall Street will correct the most and lead the markets down. Selling them is the easy trade at these levels. Stocks overall have a SELL and SELL SHORT Rating at Onasander.

Gold

Gold is also expensive priced in the US Dollar. We do not advise to short it, but we would not recommend to buy it at these levels, as there are and will be better deals out there. One notable trade around Gold we would recommend is to exchange all your stocks into Gold and start rebuying them once the price of DJIA drops to below 8 oz of Gold. See the main chart for the exact pricing. Overall Gold is a SELL at our Onasander rating agency.

Real Estate

Real Estate is known and preached as a local investment. There is some truth to that and it's a fact some markets are hotter than others, but overall Real Estate prices in U.S are in a bubble again. For July 2018, the US Existing Home Median Sale price was $269,600. Do not buy any residential Real Estate until that number goes to or below $175,000. Chances are higher interest rates and the recession will be the cause of lower Real Estate prices. Cash buyers will benefit the most in that scenario as Cash Will Be King. Onasander has a SELL rating on residential Real Estate.

Collectors Cars

Nothing is more overpriced than classic cars at this point. Any car that is known to be "rare" is priced at least 5x it's practical value. Since collector's cars are a luxury item, they will correct first. SELL all but the rarest classic automobiles. Rating: SELL

SELL SHORT

This is a perfect timing for selling short assets at the very top. Traders can easily sell short all 3 market indices: NASDAQ, S&P 500 and Dow Jones. Individual overpriced stocks like Apple, Amazon, and Netflix can be shorted for lucrative gains as well.

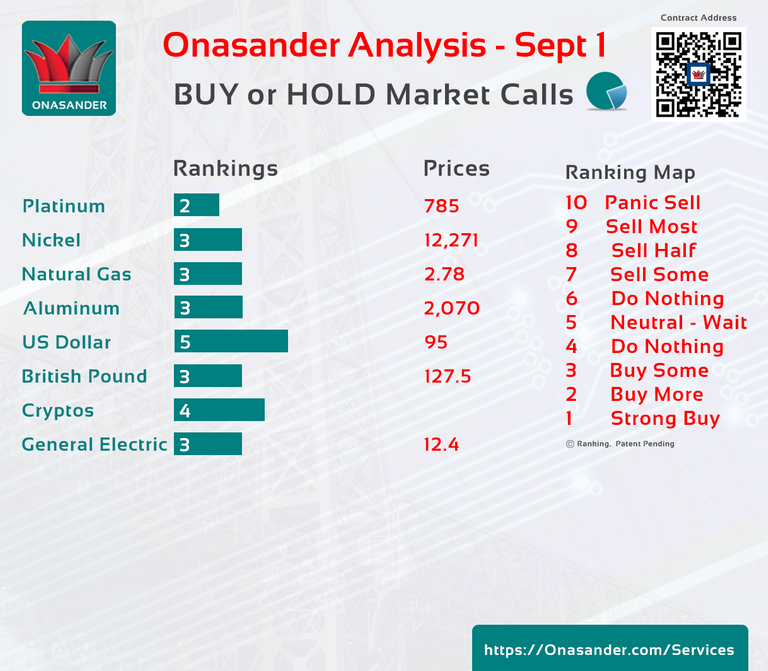

BUY OR HOLD

In this category we will list what can be purchased now, what can be purchased in the future, what to hold, talk about cash, and lay out the general strategy on the LONG side of things.

Platinum

Platinum is one of the commodities that is relatively cheap. Besides Platinum, most assets are overpriced and should not be purchased. If Platinum retraces more, buy all you can afford. It should bottom at around $500 per oz. Platinum is a Strong BUY.

Commodities and Other Deals

There are selective commodities that are already cheaper. These include items like Natural Gas, Aluminum, Nickel, and selected stocks (General Electric, GE) that pulled back already. These assets retraced, but we expect them to correct more during the recession. Investors can buy those assets with no more than 20% to 30% of the intended full purchase. The rest of cash has to be kept for deals with more upside potential. These items are rated as BUY at Onasander.

The US Dollar

The US Dollar is about average (HOLD) as an investment. It's off its lows, but it has not peaked. In case interest rates go up, the US Dollar could move all the way up to 150 points on the index chart. It has a HOLD rating at Onasander.

British Pound

British Pound is relatively cheap comparing to other currencies and it remains a BUY at Onasander. This is one of the currencies that looks attractive right now, before the recession.

Crypto Currencies

The answer to this asset class is very simple. It's a nice invention that irrationally boomed and peaked during the overall economy bubble with the help of disposable income. Let me repeat: Cryptocurrencies were in a bubble and they topped. They are in the correcting phase ever since. Some of them corrected very close to HOLD levels, but it's still too early to buy them.

In case of a recession, there will be very little disposable income and the crypto currencies could correct more. Buy them only and only when nobody wants them, and they retrace to levels they were at least in 2016.

However, there is one event that could trigger another crypto currency run. During the recession, there is a small chance of a state, or FIAT currency failure. That could create another crypto currency spike. Refer to Onasander's Crypto Currency Weekly Ratings for more information.

THE PLAN FOR THE RECESSION

During the recession execute the following plan: In case Dow Jones Industrial Average corrects to about $13,000-$14,000, buy stocks up to 30% of your intended purchase, and purchase more and more as the DJIA price goes down (roughly about $6,000). In case DJIA priced in Gold reaches below 3 oz, buy US stocks with all your cash and do not purchase any other investments. Read about our Correction Projections to prepare for future investments.

STOCK MARKET CORRECTION PROJECTIONS

The stock market will correct within the next 2 years. We are facing 2 different possibilities. The first possibility is for a standard correction of about 50%, the second for a major correction of 80%.

50% CORRECTION SCENARIO

This projection is more likely to happen, and we should be able to see DJIA at around $13,000. This coming recession should not be the end of this major 50-year Bull Run, and the DJIA should bottom about 50% lower. This is where you should buy stocks with 20% to 30% of your entire account as there will be deals not seen since 2009.

80% CORRECTION SCENARIO

The other possibility is a full-blown correction to the bottom channel support line. In that situation DJIA would bottom around $6,000. That would give us the best buying opportunity of the last 36 years. This scenario is very likely to happen in 2033, at the end of the 50-year Bull Run. In 2033 the bottom price would be obviously much higher than $6,000, but the 80% correction effect would be felt as if it hit $6,000 right now.

In case you are a money manager, or a major financial institution trying to manage funds for the next let's say 100 years, you must understand the difference between both 50% and 80% scenarios. Buying stocks using your entire account during the 50% correction could become deadly for your institution, as you could be stuck at a nominal loss for up to 2 decades. This is the same risk as seen in 2009. Committing too soon with too much equity could simply bankrupt your company.

COMMON QUESTIONS

ARE WE ALL DOOMED?

Absolutely not. Major corrections in the stock markets and real estate will benefit all of us, and investors will be able to finally find deals. Almost every asset class is overpriced at this point and the prices are unsustainable. Some kind of adjustment is required. All bubbles and recessions bring social changes that benefit everyone. They start new economic activities, inventions, and promote healthier overall investments. This time it will be no different.

HOW BAD WILL IT GET?

The correction to roughly $13,000 on the Dow Jones will not bring the world to its knees. It will probably start another boom. The correction to $6,000 would be a world changing event, but it's not likely to happen until the year of 2033. Stock Market and Real Estate investors will suffer the most.

WHEN TO REBUY STOCKS?

Rebuy 20%-30% of stocks at the $13,000 Dow Jones correction level, and rebuy all of them at the $6,000 level. The most important part is to sell them right now, and rebuying anything lower than the current price is already a winning trade.

WHAT WILL CORRECT THE MOST?

Asset classes that were leading the current boom will correct the most. NASDAQ, S&P 500, DJIA, DAX Germany, Amazon, Google, IT Stocks, Netflix, Apple, Facebook, and similar will correct the most. Residential Real Estate in hot markets will lead the correction as well. Locations like Tampa Florida, San Francisco California, New York City New York, are some of the markets that are overpriced.

WHAT ASSETS WILL CORRECT THE LEAST?

Platinum, Aluminum, Natural Gas, Nickle, British Pound, and Stocks that corrected already (like GE) will correct the least and remain some of the safest to keep.

WHAT WOULD HAPPEN IF I PURCHASED STOCKS NOW?

Investors who purchase stocks right now and can manage to keep them forever could wait for up to 40 years in order to make money with those investments. For example: Buyers who purchased stocks at the peak of the Roaring 20's (1929), were not able to see Real gains until 1966. 37 years wait period to be up 12%, and 69 year waiting period to double that investment.

PLANNING FOR THE FUTURE

The economic future is pretty straight forward. The upcoming recession will happen within the next 2 years. Depending on the correction level, there will be social and economical changes. "Regular" (50%) recession will correct most asset prices and create grounds for another boom. That boom would most likely be the last boom within this 50-year Bull Market (1983-2033).

Full blown correction now or at 2033 would produce more drastic changes. Debt reset, end of: social media, cell phone era, information technology, and consumer-based economy will most likely be the final outcome, before we move to new economic activities and ventures for humanity.

Throughout history every Bull Run had its few major areas of interest. Some of the notable industries in other Bull Markets included: banking, railroads, industrial companies, farming, and etc. The current run evolves around: information technology, debt spending, credit cards, social media, cell phones, and the internet. That will eventually come to an end and new industries will pick up. Therefor the next 14 years is the end of the current investment era.

SUMMARY

The upcoming recession is around the corner. Selling all overpriced assets and staying liquid is the ultimate trade at the moment. CASH WILL BE KING. Investors must be prepared for a 50% market correction before they can start buying stocks again.

We present all this information as we are in the midst of building an investment fund. Right now, we are running an ICO for our Onasander investment fund project, and we decided to give out trade calls and market analysis for free in order to attract future clients. The above charts and market calls will prove to our clients that Onasander's investment decisions are spot on. It will show we can manage money, out trade anyone in the business, and build a successful financial conglomerate.

Stay tuned on our website for more market information. We will publish trades before anyone realizes they exist, and promote our Onasander ICO project that way. Good luck in your ventures.

Please note some of the charts, information, and analysis above were simplified for the purpose of this article. There is more sophisticated data and analysis behind the scenes, and this writing is a general guidance to a broader audience.

good

nice

wonderful project good luck

GREAT AND NICE IDEA

This project provides great opportunities.

Good information

Good project

Hi

PERFECT

great project

nice concept with best team