Chance of US interest rate cuts in July rises to 100%

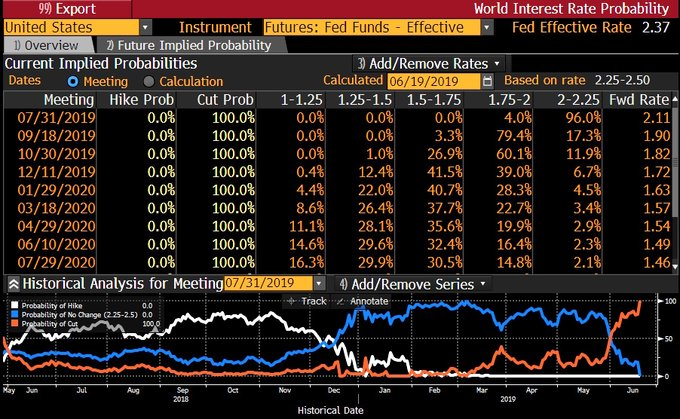

The US central bank decided yesterday to leave the interest rate unchanged, in line with expectations. Jerome Powell did, however, clearly state during the subsequent press conference that the Fed will intervene if necessary. And with that the chance of an interest rate cut in July increased to 100%.

Quite a lot has changed in the space of six months when it comes to monetary policy. For example, Fed Chairman Jerome Powell introduced the ninth interest rate hike since 2015. He also announced in December that the US central bank would continue to raise interest rates in 2019. At the time, that caused him a lot of criticism, because Wall Street had its worst December month in years. Partly as a result, Donald Trump opened the monetary fire on Powell.

Investors count on an interest rate cut

And it is starting to look strongly that Trump's anger is starting to affect Powell. For example, Powell announced last night that the US central bank will take an active stance when it comes to stimulating the US economy. Powell announced that uncertainty has increased sharply in recent months, and the Fed will therefore keep a close eye on economic data.

And those words make it clear, according to experts, that the Fed is ready to lower interest rates. And according to the financial markets, the interest rate cut will start in July (100% chance). In addition, there is currently even an 80% chance of a second interest rate cut in September.