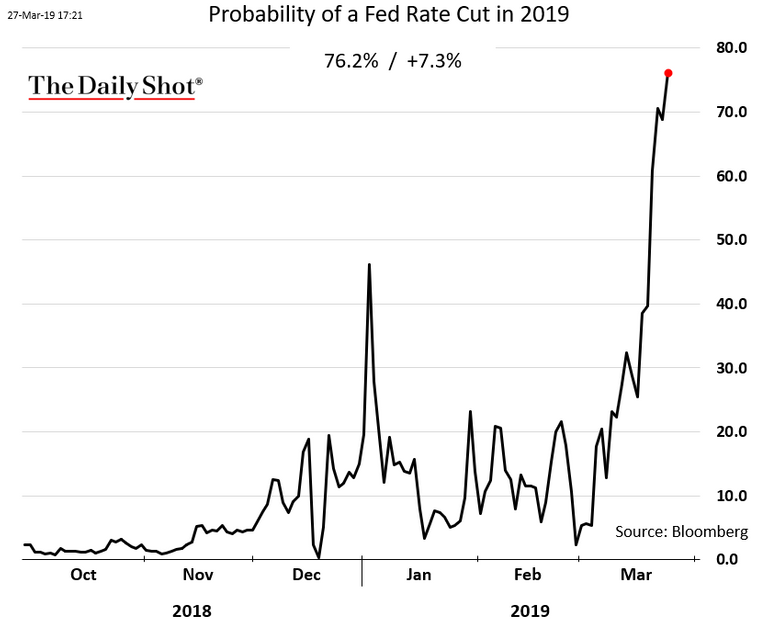

The chance of an interest rate cut this year rises towards 80%

Quite a few things have changed in a few months. This is not only reflected in the financial markets, but also in the monetary landscape. While the ECB announced that European banks will soon be able to raise money again from the central bank at extremely low interest rates, Powell said that investors would not expect an interest rate rise this year. In the meantime, investors are counting on an interest rate cut rather than an interest rate rise.

- Jerome Powell, president of the US central bank, is under attack. Donald Trump has repeatedly criticized the Fed president in recent months. According to Trump, Powell can even be seen as a threat to the American economy. And the open criticism Trump expresses is remarkable, because the US president has appointed Powell himself as the successor to former Fed chairman Janet Yellen.

Trump demands interest rate reduction from the Fed

The criticism that Trump has voiced about the president of the US central bank seems to be bearing fruit on monetary policy. After all, during the most recent press conference, Powell announced that investors do not have to expect an interest rate rise this year. The graph above, taken from The Daily Shot, shows that investors now estimate the chance of an interest rate cut at more than 76% this year. And that is not surprising, because Trump announced last week that he wants the Fed to implement an interest rate cut and will stop reducing the balance sheet position.

Despite the fact that the US central bank must act independently, there is a good chance that Trump's words will have an effect on Fed policies. Yet Trump's criticism must be put in perspective. After all, the president seems to be particularly busy with the American elections that will take place next year. He wants to prevent the American economy from falling into decline before that time. And even the monetary policy of the US central bank must yield to that.

Risk Disclosure

TRADING IS NOT SUITABLE FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND CAN CAUSE YOU A COMPLETE LOSS OF YOUR FUNDS!

Trading foreign exchange on margin carries a HIGH LEVEL OF RISK, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose!

The high degree of leverage associated with trading currencies means that the degree of risk compared to other financial products is higher. Leverage (or margin trading) may work against you resulting in substantial loss. And feeling a sensation similar to getting sucker punched in the stomach.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Excellent post, things are getting interesting for sure.