#Investors-Group News: The Housing Market is in "Serious Trouble" and The Economy has not been this bad since Napoleon was around..!!

Garbage and vomiting diarrhoea coming from the Mainstream Media

Despite the ongoing garbage and vomiting diarrhoea coming from the Mainstream Media that The Economy and the Housing Market is going strong. They aren't..!!

I am sorry to be the bearer of bad news for those who still believe that they are.

Both the Housing Market and The Economy are in serious trouble and I mean SERIOUS TROUBLE.

The Economy has not been this bad since Napoleon was around..!!

For over +4 years I have been banging on that The Economy has not been this bad for over +100 years and that you had to go as far back as the Victorian times of the late 1800's to get even close to a time when it was this bad.

Over the last few days, sadly I had to apologise to people and admit that I had got it wrong.

I have now changed this and my latest stance may shock quite a few of you.

Basically in light of the latest Economic Indicators that have just been released I have pushed this period back to the late 1700's or at a time when Napoleon was around..!!

This is no Joke..!!

Just to make sure that your eyes are not deceiving you, or that you think that this is some kind of joke, I will repeat what I have just said.

You would have to go far back as the late 1700's, or at a time when Napoleon was around, to come anywhere close to a period that The Economy was this bad.

...ohh and just to make sure this is loud and clear, this is NO JOKE..!!

A few tweets from the last few days

I just wanted to share with you a few tweets from the last two days which will hopefully give you a flavour of what I am saying...

As for the Housing Market

As for the Housing Market, what most people do not realise is that it is built on a foundation of Toxic Financial Derivatives that are no different to a festering pile of "Horse Dung"..!!

Financial Derivatives

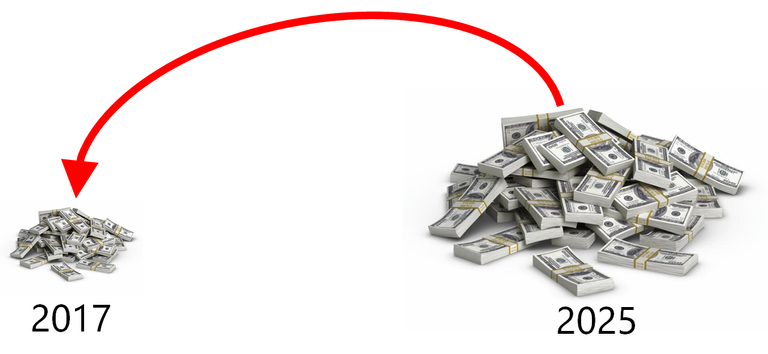

For the ones still unfamiliar with Financial Derivatives, they are simply a mechanism to push risk out into the future by essentially robbing prosperity from the future to bank profits today.

In very simply terms, they look like this.....

In reality what is really going on behind scenes is that banks are in essence raping the future prosperity for short term gains today.

This WILL, without any shadow of doubt, have MAJOR CONSEQUENCES down the line.

So just to recap, you would have to go as far back as the late 1700's, or at a time when Napoleon was around, to come anywhere close to a period that The Economy was this bad and that the Housing Market is built on a festering pile of "Horse Dung"..!!

Thanks for reading.

Stephen

Please feel free to use the #Investors-Group tag for: Stocks, Cryptocurrencies, Commodities and Investment related Blogs.

In place of JUST the housing bubble.. we have the student loan debt, the credit card has returned (as the people in 2008, were re-issued credit again) and let's not forget about the automobile loans. Sub-prime loans galore people! they are EVERYWHERE

We are a nation of borrowers and we are slave to the lenders... that will never change

I could not agree more. What is the Fed going to do: lock up all the students with debt arrears as collateral, fill their parking lots with second-hand cars people cannot afford, pile high all the TV's on credit, worse still what about all the debt that has been taken out for paying for "coffee and cakes". I'd like to see what banks take as collateral for this stuff. Unsecured credit defaults will make the 2008 Crisis look like a kiddies tea party..!! Stephen

Good perspective, all those people buying $10 lattes on credit? really? And obviously the credit card companies and financial institutions issuing credit lines could care less.

NOTE: I have nothing against the coffee stores and franchises that sell these "pricey" drinks or the people that frequent the businesses... but when you are crying that you can't pay your electric bill, buy your medications or have fallen behind on a mortgage/car payment or minimum credit card monthly payment... all the while you are holding a styrofoam cup filled with Pumpkin Spice Double Up cream (or whatever) please don't complain to me.

Nothing like buying stuff you can't afford, but what is worse is people get away with it from bailouts no thank you! not being a part of that anymore

Sad but true....

Now we must have to open our eyes and see what's going on before it's too late...

Thank you for this inspiring post.

let's not forget about the automobile loans.fill their parking lots with second-hand cars people cannot afford.

This slow-motion train wreck feels like it might be picking up a little steam, your thoughts on the economy are right in line with mine, keep spreading the word!

awesome post!

lets connect!!