After a promising start to the month, the market did not followthrough with new highs. I believe that most expected a continued increasing trend after the Consensus conference given all the hype behind it. Despite having over 7,000 participants which was a record, the market was not impressed and a sell-off ensued. However, should we be surprised? I don’t think so.

Source: https://coinmarketcap.com/charts/

Time has demonstrated that markets behave very similar. When something is hyped or pumped, it leads to an increase in valuation. However, when the expectation becomes a reality, prices come down. This is seen most notably when Apple launches a new iPhone. The announcement or leak of the keynote speech typically leads to an increase in the stock price but prices come back down around the time of the actual announcement.

Therefore, given the expectation of Consensus, many were disappointed to not see much more come out of it. Despite the amount of projects at Consensus and the announcements, none seemed to impress to take the market to a new level so markets started to decline. Not even the EOS hype was able to move past the the market sentiment. It too has fell victim to FUD and uncertainty. However, the market continue to be well above the lows seen this year and multiples of where they were in previous years so the trend is still higher in the long-term.

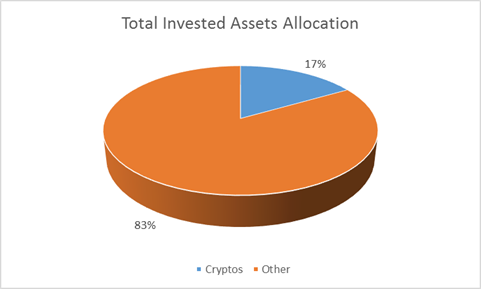

As with most portfolios, mine took a hit because of these moves. However, I am seeing less volatility which is great because it becomes an important factor in potential future investors. Here is a snapshot of what Bitcoin and Cryptocurrencies represent as a percentage of my total portfolio:

As I learn more about the technology and the potential it has to disrupt financial markets, I get more comfort with the amount allocated to these assets. In fact, I am considering moving that percentage up to 25% over the coming months. As you know, I typically deploy a Dollar Cost Average approach in these investments.

However, I will most likely not add any significant amounts to existing positions as I would like to explore into new assets to add to the portfolio in this time frame as I believe there are a number of altcoins that have gotten to interesting valuations. In order to execute this strategy, one important decision will be the need to open new exchange accounts. I have been very hesitant to do this as I am still concerned about the security issues still present at most centralized exchanges. That is why I am also looking at decentralized exchanges.

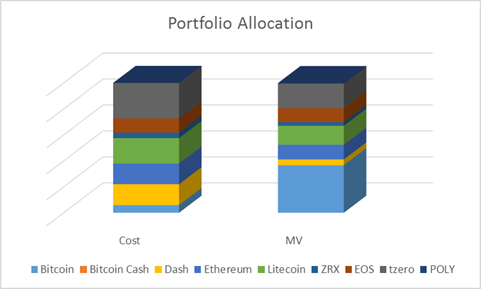

Despite all the moves in the market, it was another boring month for my crypto portfolio. I did not add to any of the positions in my portfolio so the changes in allocation are only due to changes in market value:

As in the past, this does not include my positions in #STEEM which I did continue to add to as part of my long term strategy regarding the #Steemit ecosystem. I remain committed and excited to the potential of the blockchain and its social integration with the #Steemit community. I truly believe that the value of this ecosystem will grow exponentially in the future.

What do you think about the market and where we go from here? What are you thoughts about my portfolio? Do you think any adjustments should be made? How about potential exchanges I should consider? Any assets you like that I can do my homework on? I look forward to your thoughts and engagements in the comments below!

Follow me on Twitter: @NAICrypto

Don’t forget to vote, comment, follow, resteem and browse my channel for more information!

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources they provide by using my referral link:

https://www.minnowbooster.com/referral/530636

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

I have been liking the references on the Binance exchange as they have grown enormously and provided support to many tokens, including one I am watching call the Enjin Coin which is based on the gaming industry.

Binance is at the top of my list but really would like to go to a decentralized exchange to support that movement. I have heard about the Enjin coin but I hesitate to get involved with small cap names. Thanks for the feedback!

Awesome post. A couple of points:

PS - how did you invest in tZero, I want in.

Thanks for your engagement! Regarding tZero, it has been a long process but went I through their accreditation process fairly easily but it seems that they have had difficulty completing the ICO given the requirements so they have delayed the ICO another month. I have had 2 opportunities to opt out but I think this is a great project and am willing to hold on to it for the long term. The way the have communicated along the way proves to me that they want to get this right for those involved and the regulators.

Great article my dude. Big fan of ZRX as well 👍🏼 Keep up the great content 😁💪🏽

Thanks! ZRX definitely is up there when you think about decentralized exchanges so I hope it will be an exciting future there. I’m still learning the business model before committing more capital there but its on my list.

Definitely agree with that! Decentralized exchanges are the future in this space. Let's just say that Coinbase acquiring Paradex (a decentralized exchange built on top of the 0x protocol) last month is incredible news and almost guarantees a promising future for ZRX. Meet you at the top ma dude 💪🏽 🔝

Upvoted ($0.20) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.