The Internal Rate of Return (IRR) might sound complicated, but don’t worry—I'm here to break it down with some fun examples! We’ll see what it means, how to calculate it, and how it helps you make better investment decisions.

What is IRR?

Imagine your friend Mark offers you this deal: "Give me $1,000 today, and I’ll give you $1,200 next year." Now your financial brain wonders: “How much am I really earning here?” That’s exactly the question the IRR answers! It tells you how much your investment is growing, expressed as a percentage return.

The higher, the better!

How is IRR Calculated?

Now, let’s get into how you actually calculate the IRR—but don’t worry, we’ll keep it simple!

The IRR is the rate that makes the present value of your future cash flows (the money you'll receive) equal to the initial investment you made. In other words, it’s the return percentage that makes everything balance out to zero.

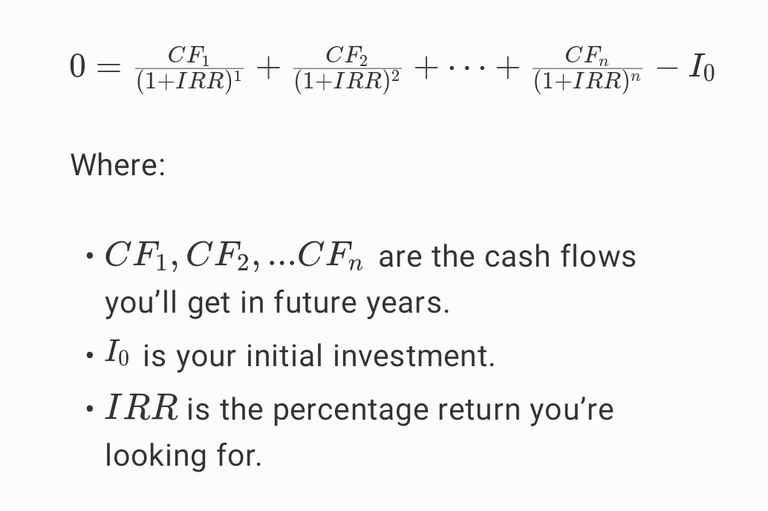

Here’s a simplified version of the formula:

But don’t panic—no one expects you to solve this by hand! This equation is tricky, so we usually use tools like Excel or financial calculators to do the heavy lifting.

Example: Lemonade Stand IRR Calculation

Let’s go back to your lemonade stand example:

You invest $500 upfront to set it up.

In the next three years, you earn $200, $250, and $300 from sales.

To calculate the IRR, you could plug those numbers into Excel (or a similar tool) like this:

In Excel, list your cash flows: -500 (your initial investment), 200, 250, and 300.

Use the formula =IRR(A1:A4) (assuming your cash flows are in cells A1 to A4).

Excel will calculate the IRR for you. In this case, the IRR is approximately 18.6%. That means your lemonade stand is growing your money by 18.6% each year on average. Pretty sweet!

Why Is IRR Useful?

IRR helps you compare different investment opportunities. Imagine two friends offer you deals:

Mark says, “Give me $1,000 and I’ll give you a 10% IRR with my lemonade stand.”

John says, “I’ll give you a 15% IRR if you invest in my ice cream truck.”

It looks like John’s deal is better because of the higher IRR—but wait! Maybe his truck requires more maintenance or is riskier. IRR is helpful, but you should always consider the bigger picture.

But is IRR Perfect?

Not quite. It has a few quirks, just like a lemonade that can be too sour or too sweet:

Bumpy cash flows: If you have irregular cash flows (earning a lot one year, little the next), the IRR might give weird results.

Comparing apples to oranges: Two investments with the same IRR might be very different in size and risk. It’s like comparing a small lemonade stand with a chain of lemonade franchises: same return, but very different investments.

Conclusion

The Internal Rate of Return (IRR) is a great tool for understanding how much an investment will pay off over time. It helps you compare opportunities and make informed decisions. Just remember, while IRR gives you a good idea of your returns, it’s important to also consider things like risk and effort. I have learned to use it to better evaluate the return I expect from my investments!

So, next time someone offers you an investment, ask, “What’s the IRR?” But don’t forget to look at the whole picture before making a decision! 😁

Do you have experience on Hive?

Feel free to leave your suggestions, I'm here to grow and improve.

New to Hive? Here is what I learned to have a good stay here: Thank you!

🔸Do not copy/paste & Do not spam & Do not flood

🔸Take your own photos or, if necessary, use the copyright-free ones

🔸Do not upvote your own posts and comments

🔸Interact with others & Do it in a meaningful way