What is IX Swap ?

A decentralized exchange (DEX) is a common (P2P) business focus that partners advanced cash buyers and vendors. Rather than concentrated exchanges (CEXs), decentralized stages are non-custodial, which implies a customer stays accountable for their private keys while executing on a DEX stage.

IX Swap is the liquidity solution for all STO/TSO exchanges globally, bridging the gap between CeFi and DeFi.IX Swap is the last piece of infrastructure needed to breathe life to the STO/TSO industry.

The IXS token multiplatform dispatch will in like manner fuse KuCoin Spotlight, what started on September third and will run until an IEO happening at the same time as the IDO.

Our Mission

Beating any issues among DeFi and CeFi, Bringing liquidity to the STO market The security token industry is ready for it’s restoration anyway the business really faces a primary concern of conflict which is trading liquidity due to the shortfall of licenses and market makers in the business.

IX Swap’s focal objective is to use blockchain development to gather liquidity plans and system for the security token climate, giving trading and overall induction to this unseen asset class.

Features you can get if you join IX Swap

- First Security Token/TSO liquidity pools: STO/TSO token holders will be able to legally mine liquidity for the first time ever

- Platform: First DeFi market making solution purpose built for STO and Tokenized Stocks

- Borrowing & Lending: Take advantage of your idle assets to earn passive income

- Licensed partner: IX Swap has forged partnerships with licensed intermediaries to deal with the nuances of securities

- Unlock the value of your idle STO: Earn through liquidity mining and staking of your STO/TSO.

Why you should chosee IX Swap :

- First Security Token/TSO liquidity pools

- STO/TSO token holders will be able to legally mine liquidity for the first time ever

- Platform

- First DeFi market making solution purpose built for STO and Tokenized Stocks

- Borrowing & Lending

- Take advantage of your idle assets to earn passive income

- Licensed Partners

- IX Swap has forged partnerships with licensed intermediaries to deal with the nuances of securities

- Low Fees

- Significantly reduced fees compared to the 1-2% banks charge for private asset investments

- Unlock the Value of your Idle STOs

- Earn through liquidity mining and staking of your STO/TSO

Token

The IX Swap team is starting on its journey to initiate cross-chain compatibility by integrating with Polygon’s full-stack scaling solution to combat the current gas fee issues our community is experiencing on the Ethereum main network and providing cross-chain access to the Polygon community.

Security tokens and tokenized assurances are the best expansion between the standard and decentralized financial universes, and IX Swap’s new commitments have for a long while been dismissed by various players in the business. Since these commitments tackle huge issues and help the business with beating major issues in offering kinds of help to a promising addressable market, IX Swap and its new commitments have gotten the thought of critical players in the business.

As an exhibition of the assurance and capacity of IX Swap, the endeavor gave close to 2,000,000 in IX Swap tokens before the IDO to a couple of monetary examiners and observable crypto advocates. These join SMO Capital, Token Bay Capital, Baksh Capital, JST Capital, Faculty Capital, COSIMO Ventures, Tokenomik Inc., Soul Capital, and N2H4 Capital.

Allocation Token

- Liquidity Providers 60%

- Rewards Distributed as Staking Rewards

- IXS Reservers 40%

- IXS Moon Vault

- IXS Solar Vault

- IL Insurance Vault

- IXS Reservers 40% IXS Reserve Vault

Partnership

IX Swap has finally revealed a fundamental association with AllianceBlock for the coordination of state of the art DeFi applications into the IXS organic framework. IX Swap limits as a Uniswap for TSOs and STOs, liquidity and deals with tokenized offers, and security tokens. IX Swap is a primary stage for giving AMM limits and liquidity capacities with respect to the STO/TSO industry. The stage works with trading of wellbeing tokens through security works with and approved administrators to offer cases and obligation regarding. AllianceBlock’s Blockchain-cynic stage develops interoperability and sponsoring deals with any consequences regarding decentralized financial business areas. The stage is furthermore esteemed for giving data driven and predictable access from customary financial establishments to liquidity providers.

Through joint exertion, the two phases AllianceBlock and IX Swap will see the improvement of a regulatory pleasing organic framework that will push the destiny of the capital business areas and money related industry. To enhance the IX Swap organic framework, IX Swap will use AllianceBlock’s DeFi applications which consolidate AllianceBlock Data Tunnel, AllianceBlock Bridge, and AllianceBlock Liquidity Mining as a Service. This affiliation will redesign the cross-chain and DeFi limits of IX Swap to grow liquidity, Blockchain gathering and care.

It is AllianceBlock’s middle mission to defeat any issues between standard cash and DeFi finance. For the gathering at AllianceBlock, the inevitable destiny of cash is the compromise of mechanical turn of events and capital work processes. AllianceBlock tries to give standard money related associations induction to new DeFi markets, climate scaling gadgets for interoperability and financing, and DeFi projects. As of now, the stage is based on cultivating a financial structure that will give DeFi contraptions to coordinated money related associations worldwide for steady induction to the DeFi space.

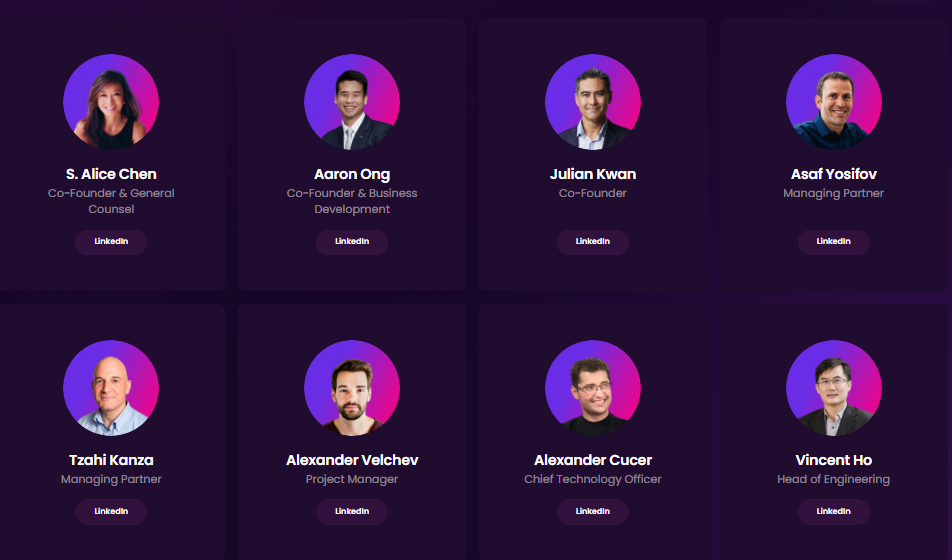

Team

The team behind IX Swap have worked over 15+ associations between the partners and have immense experience across the capital business areas and the blockchain chain space. Through their massive data and experience, the team had gotten together to address a key infrastructural issue which was liquidity in the security token natural framework

Roadmap

ACCURATE INFORMATION

- Website : https://ixswap.io/

- Litepaper : http://ixs.loc/app/uploads/2021/08/IX-Swap-Litepaper.pdf

- Medium : https://ixswap.medium.com/

- Twitter : https://twitter.com/IxSwap

- Facebook : https://www.facebook.com/IXSwap/

- Telegram : https://t.me/ixswapofficial

- Linkedin : https://www.linkedin.com/company/ixswap

- YouTube : https://www.youtube.com/channel/UCaYPNR-eLs9iuB5ZVKRx-fw

AUTHOR

- Bitcointalk Username : Ris88

- Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=742331

- POLYGON Wallet Address: 0xa9826b1d63a550E5fC6A5a6e351224E07195fD95