Today we will talk about where to invest money in 2022. In the last 2 years, the topic of investment has become very relevant. Most of you have most likely heard of how much Tesla or Apple shares have risen. But, probably, not everyone has yet begun to invest. If you are still going and thinking, then you are probably interested in the topic where you can invest in 2022. So let’s talk about that. There are a lot of tools for investment, so we will analyze the main ones: from the most conservative to quite risky.

1. Bank deposit

Let’s start with a bank deposit. This is the most conservative tool, known, probably, to everyone. Now the yield of cash deposits is about 5%. The main problem with this instrument is that its profitability often does not overtake inflation.

You can also open savings accounts in banks. This is an instrument similar to a deposit, but with an even lower yield, because money can be withdrawn from it at any time without losing the accumulated interest. It is suitable if you gradually save money for some purpose. As a result, we have two safe tools that bring almost no income, but rather simply save your money from inflation, at least partially.

2. Real Estate

Real estate is the second most popular investment tool in the world. The apartment is reliable, it is something tangible, and therefore inspires confidence. Real estate in which case you can always sell, rent or live there, which is also not bad. The average level of profitability from renting an apartment is 5-6%. However, this is without taking into account the growth of real estate in price.

But such a staggering return was not always and will most likely not always be either. This must be taken into account when investing. The main problem of this tool is the high entry threshold. After all, not everyone has the opportunity to buy an apartment for several million dollars and rent it out.

3. REITs

Let’s move on to the third point – real estate investment funds, REITs. This is exactly what solves the problem with a high threshold of entry into real estate. Such funds are essentially companies that buy a large amount of real estate and subsequently rent it out. Different rates specialize in different properties. Some buy data centers, others warehouses, others hospitals or dormitories.

How to invest in REITs? It’s very simple: buy their shares. By the way, the rates are famous for their high dividends, because according to US law, they are obliged to spend 90% of their profits on dividends. If you do not have the money to buy a house or apartment for rent or you do not want to do it, then perhaps you should look at such an alternative.

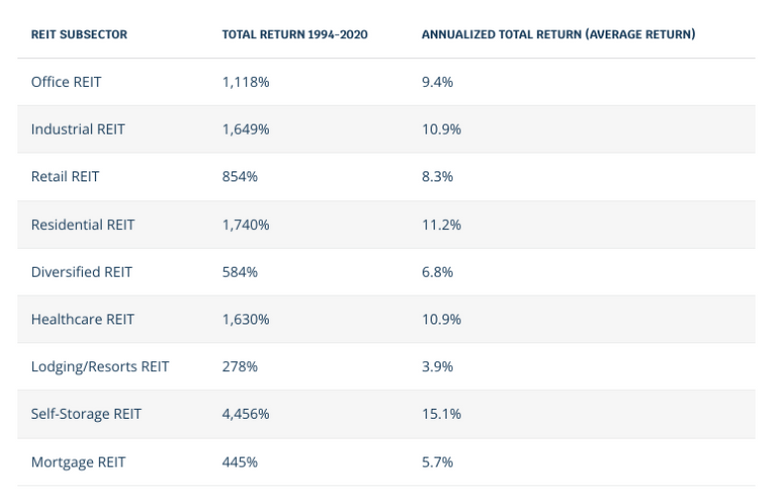

The yield on the rate depends on the type of real estate, but on average brings 9-11% per annum in dollars, taking into account dividends. Let’s look at the following table.

4. Stocks

The following stocks we have, one of the classic tools of the investor. A stock is a company’s share. Therefore, when buying a share of, say, Apple, the investor receives a share of this business, albeit a very small one. From that moment on, he has the right to part of the company’s profits – dividends. As well as on her property in case of bankruptcy. Stocks can generate income for an investor in two ways. The first is the payment of dividends.

This is the portion of the profits that a company sends to its shareholders. True, not all companies pay dividends, and not always. The second is the growth in the value of the paper itself. If the business is developing and the company earns more and more every year, then its share in the market is growing in price. By buying cheaper and selling more expensive, the investor can also earn. Let’s look at the U.S. stock market.

On average, over the past 30 years, it has grown by 10% annually in dollar terms, if dividends are taken into account. Approximately on such profitability and it is worth focusing on when investing in stocks. However, it is always worth remembering that “‘profitability in the past does not mean profitability in the future”.

In addition, it cannot be said that the stock market is growing steadily by 10% every year. It is very volatile, so be prepared for drawdowns of 15-30%.

5. Bonds

The next option for securities bonds. These are actually IOUs. Companies or governments issue bonds to raise money for further development. Investors who buy these bonds, as it were, lend their money to the issuer so that he subsequently returns it with interest. Bonds are distinguished from stocks by a set yield.

Usually, the yield on bonds is known in advance and how long you will have to wait for repayment, that is, the return of the debt. In addition, a bond is a liability, and the issuer cannot fail to pay interest unless it goes bankrupt. With dividends, things are different, the company can stop paying them at any time if it wants. How much can I earn on bonds? The return depends on the level of risk.

The longer you wait, the higher the yield. If the investor wants more and is willing to take risks, he can buy corporate bonds issued by companies. The yield on them is now in the region of 8-11%, depending on the maturity date.

6. ETF-funds and mutual funds

Now we have ETF funds, Exchange Traded Funds, on the line. Exchange-traded mutual funds are funds that include many securities selected according to a certain principle. Let’s say you want to invest in America’s biggest companies like Amazon, Google, Apple, Coca-Cola, Pfizer, and so on. But you don’t have enough money to buy all these stocks in the right proportion, and there’s no time to keep an eye on them all. In this case, you can buy an ETF fund for the index of the 500 largest companies in America (S&P500). In this fund, each company has its own percentage depending on the capitalization. Here’s what the chart for the S&P 500 index looks like on the following graph.

What are the benefits of ETFs? In the event that some company goes badly, this will not greatly affect your entire portfolio, because the company occupies only a small part. However, this still does not insure against crises. Even highly diversified ETFs can adjust by 15%-30%. By the way, ETFs are not necessarily just stocks. They may also include bonds or gold. Each investor, if desired, will be able to find a fund that corresponds to his level of risk appetite. The return of each of the funds depends on which asset class is included in it. InvestFuture analysts believe that ETFs are the best way for a beginner to start investing so as not to make a lot of mistakes.

7. Gold

Number seven on our list is gold. Unlike previous instruments, it does not bring any passive income. However, gold retains the value of money and serves as a defensive asset in an investor’s portfolio because it will never depreciate.

How to invest in gold? Maybe you think buying gold jewelry would do, but it’s not. Most likely, you will not be able to sell the product even at the price at which it was bought. Simply because the new one is always more expensive than the used one. An investor can also buy a gold bar or coin, but this type of investment has a high entry threshold, fairly low liquidity, high commissions for buying/selling. Such products need special storage conditions and protection against theft. In general, there are many problems.

Therefore, the best option for a private investor will be the same ETF fund, but for gold. Bullion is owned by the fund, and when buying an ETF, the investor seems to acquire a small part of the total. He cannot touch the purchased gold, but his share is traded on the market and has high liquidity with low commissions.

8. Cryptocurrency

It is impossible not to say about cryptocurrency. This is the most controversial investment tool, but it is foolish not to notice the multi-trillion dollar market that continues to develop. It should be remembered that cryptocurrency is a very risky investment. But if you believe in the development of blockchain technology and alternative finance in general, then perhaps you should direct a small percentage of the portfolio to such assets.

The industry is still very young and volatile, it shows both stunning growth and huge drops. In addition, this industry is still poorly regulated, and there is a lot of fraud. Therefore, it is worth approaching it carefully.

9. Life Insurance

Consider what investment life insurance is. This is a tool that combines insurance and investments. When buying Life Insurance, you give your money to an insurance company, and it, in turn, invests them in various financial assets: stocks, bonds, derivative financial instruments.

If the investment is successful, then at the end of the contract you will receive the money contributed and additional investment income. However, it often turns out that investments are unsuccessful. Then the yield may be less than 3%, which is lower than the deposit. If during the term of the contract, an insured event occurs, mainly the death of the investor, the company is obliged to make an insurance payment. InvestFuture is skeptical about this type of investment. Very often it is a marketing product on which insurers mainly earn, and not customers.

10. Crowdfunding

And our last tool is crowdfunding. This method allows you to invest in startups. The author, or founder, on a special site, describes his idea – a business project for which he needs money, the amount for implementation, and deadlines. If investors find the idea viable, they can invest money to make future profits from the project. In some ways, this is similar to investing in stocks, but there are huge risks here.

First, most projects do not survive to profit. Secondly, it is very difficult to distinguish an entrepreneur burning with an idea from a scammer. Therefore, you should be extremely careful.

Conclusion

So, friends, we have analyzed the 10 main investment instruments for 2022. They have different levels of risk and different budgets. Therefore, each investor will be able to choose something and his personal investment portfolio. I hope that now it has become a little clearer to you how and where you can invest your money.

Well, as a bonus, another very important investment option is in your own education. After all, no matter how much money you earn, if you do not know how to dispose of them, you will never become wealthy. Therefore, it is very useful to learn how to properly select certain instruments and why they should get to your portfolio.

Subscribe, improve your educational level to invest successfully! I look forward to your comments. Share what tools you’ve invested in and what you’ve been able to achieve.

Source: https://job-online.club

|  |  |

|  |

You've given out a good point on how to invest our money and if all these should be put into consideration, I believe it yield a good fruit.

An estate is a good investment, and bank deposit is considerable as well, because as days go by, it will be accumulating with a good interest and this is best when you're making a long term investment....

Cryptocurrency is a good way to makes investment too , though might be risky but has a lot of advantages , there's more to talk about crypto...

Yeah, this is an interesting article, thanks for posting..

Posted Using LeoFinance Beta

Every business or investment is risky. But risk can always be mitigated to maximize profit.

Posted Using LeoFinance Beta

Thanks for the feedback! I am glad that my post was interesting to you!

Did you follow any of those investments?

Congratulations @jobonlineclub! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 1500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Insightful and eye-opening 👍

For me, investing in cryptocurrency is my favourite and most preferred option right now. However, I have plans of diversifying into real estate and the stock market because these are all profitable investment options. I guess what is holding me back is the funds to kickstart. Sooner than later, the funds will come because I keep working towards that.

Posted Using LeoFinance Beta

Same here. I am trying to diversify my investments too. And I always exploring and trying new investment opportunities. The golden investment rule: Never put all eggs to the same basket.

Yeah, it is expedient that as an investor or businessman you spread your capital across many promising assets. If one fails then the others can come to the rescue

You cannot be frustrated when you have multiple streams of income.

Posted Using LeoFinance Beta