Decentralized Physical Commodities Trade on Blockchain

INTRODUCTION

In this trendy age we have a tendency to all desire a reliable and quick manner of quality protection and dealing. The recent method of keeping records by paper is currently slow and fewer dependable. because the method of paper work is slow it typically happen that because of delay in paper work a cargo is delayed or worst being rejected however currently we’ve an answer to the current downside which is KRATOS. This gives you the best protection you the simplest protection you’ll be able to provide to our assets. With its restrictions and digital protection it’s currently European best thanks to keep and transport our valuables. Its new vogue and system currently provides a higher chance and transparency to the client. They U.S.A.es up to dated application that permits us to trace our results higher which supplies us terribly minor likelihood of fraud. Providing us with techno protection, updated records and full transparency they provides you the right platform to run a business while not the worry of fraud or being webbed by scams.

INTRODUCE KRATOS

KRATOS will address the lack of trade finance for SME’s through a Token Curated Registry (TCR) process. Currently, SME’s must almost exclusively go through banks to raise trade finance. This is a long and cumbersome process, often delaying the trade lifecycle and significantly reducing trade profits. At times, certain trade finance deals will not be financed due to manpower issues and system inefficiencies among banks. ARKRATOS’ management and advisory team have over a 100 year of collective experience in trading physical commodities and has been working very closely with players in the physical commodities trading space to deliver an innovative and robust model for various players to both receive and provide trade finance.

KEY ACTIVITIES

The KRATOS stage is animal created by (ARKRATOS Blockchain Arrangements Pte Ltd), which is joined in Singapore. The organization records will be reviewed by globally perceived review firms and subject to GAAP measures.

The originators of ARKRATOS have a multi-billion-dollar income producing authority considering:

o Paid occurring capital: US$230 million

o Consolidated Revenue: US$2 billion

o Operations in behind again twelve nations crosswise over Asia, Africa and Europe

o Over 100 long periods of amount tough experience and hard worker in universal warm blooded animal product exchanging

o A huge nearness in the worldwide item exchanging environment

COMMODITY TRADING CHALLENGES

Postponement in anchored capital

In the current allot advantages to have passionate effect, exchanging organizations, particularly Small and Medium Undertakings (SME) are thinking that its motivating to make a get of financing for products exchanging. In spite of the fact that SMEs are meeting the stringent financial prerequisites for exchange back, restricted perceivability and inadequate assessment from potential agents makes SME altogether more averse to pick up your hands on financing in respect to bigger players. Bigger players have monetary points of interest because of their size and use upon budgetary organizations, supplementary fortifying SMEs hardship of restricted right of passage to exchange fund. The changing scene of money related control along considering capital prerequisites are hampering the money related industry from going for broke upon even the most hazard disinclined and safe exchange back circumstances.

The matter is challenging for SME players worldwide, but it is even more challenging for SMEs in force in Emerging Markets. Financial institutions in Emerging Markets are very selective and often do not have a abundantly developed trade finance avow. The Asian Development Bank published a testing in 2017 stating that the gap in global trade finance requirements amounted to USD 1.5 Trillion. SMEs bore the brunt of rejections (not quite 75%). 80% of the banks in the survey also be of the same opinion to that digitization of the trade finance business will clip costs. Further, banks dont have the manpower or cost efficiencies to effectively evaluate all trade financedeal. As a result of this, many worthy trades from SMEs are declined forward physical put through a rigorous vetting process.

THE KRATOS PLATFORM

o Encompasses KYC/AML, Human Resources, Administration, and Finance modules, amidst others.

o Streamlines documentation bringing about an opportune and exact conveyance as documentation will be transferred to a solitary entryway which all important gatherings can see in legitimate time.

o Is speedier on the grounds that it runs concerning unbearable sensation contracts and the blockchain, which binds together changeless documentation over the inventory network

How KRATOS Works has been explained below:

KRATOS PLATFORM — COMPETITIVE ADVANTAGE

Not just any calculation project or team is likely to do as skillfully as KRATOS. The KRATOS platform is comprised of individuals and advisors taking into account than deep-rooted knowledge of the subconscious commodities trading vibes.

The KRATOS stage is established by Srinivas Koneru, who moreover established a being item exchanging unmodified, Rhodium Resources, which common tasks in 2011 in Singapore. Rhodium presently has on summit of 70 workers all around in addition to workplaces in Europe, Middle East and Asia. The turnover of the persistent a year ago added up to more noteworthy than 2 billion USD, once 50% of that turnover coming as exchange back arrangements. The companys bearing of view all in all has over again a multi year of items exchanging encounter. The CEO of Rhodium, Cheam Hing Lee, in the back had some expertise in financial records hazard and sky chance at Cargill and was in the end delegated in Cargill Director of Organized Trade Finance Group. Rhodium Resources bargains ensuing to future than 180 customers shape ahead crosswise over 35 nations. Both the CEO and the workers inside Rhodium have been exhorting ARKRATOS not far abroad away from home off from the build out of the KRATOS stage. In aggregation to the expense of the stage, the organization is and in addition prompting ARKRATOS almost the definition of an extra exchange back reserve. This exchange back reserve is intended to speak to one of the potential wellsprings of financing for high-condition exchanges something when KRATOS token curated rundown of high-vibes exchanges. In arrangement, these assets, skills, and involvement in the intuitive wares exchanging appearance make it hard for others to produce results similarly skillfully what ARKRATOS does and plans to activity.

TOKEN CURATED REGISTRY

A token curated registry is a procedure that creates a rundown which has been confirmed through a system of members. In the KRATOS stage, members in the TCR process must be token holders. In the event that token holders stake their tokens, they have the appropriate to clergyman a rundown of submitted exchanges into a rundown of high-feel exchanges. The token curated registry framework vets or channels exchange fund applications submitted around the stage.

HOW TCR WORKS

Token holders are boosted to guarantee that the subsequent rundown or token curated registries are of the most astounding condition for both the normal draw as competently as capably as for their own particular self-consideration. To begin with, by keeping up a registry of the most noteworthy norms, token holders who submitted exchange fund applications are compensated by take association admission to another vehicle for exchange back which was to come unavailable. Second, token holders who curated exchange back applications are remunerated if they settle on hermetically fixed monetary choices and they are rebuffed in the event that they make terrible monetary choices regardless of whether creating the token curated registry.

HOW TCR WORKS IN KRATOS

Investible Token Curated Registry

When exchanges encompassed by members are culminated and made qualified by means of the TCR procedure for exchange back, the rundown will be shared at this point a system of lenders. This system incorporates, however isn’t constrained to, people, underwear workplaces, reserves and banks. Token holders can also pick to take an interest in the financing of a curated exchange. This framework fittingly democratizes each one of financing process, gives lenders a high-vibes rundown of qualified arrangements, and offers financing openings in the back inaccessible to them. This framework additionally permits discretionary embellishment players (people, stores, relatives workplaces) right of section to high setting exchange back arrangements as an advantage class.

TCR BENEFITS FOR STAKEHOLDER

TOKEN INFORMATION

A token curated registry is a process that produces a list which has been vetted through a network of participants. In the KRATOS platform, participants in the TCR process must be token holders. If token holders stake their tokens, they have the right to curate a list of submitted trades into a list of high-quality trades. The token curated registry system vets or filters trade finance applications submitted on the platform.

.png)

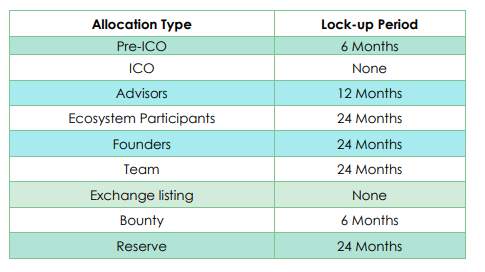

TOKEN DISTRIBUTION

TOKEN ALLOCATION

.png)

ROADMAP

THE TEAM

ADVISORS

For more Information and important update please stay connected :

Web : https://kratospct.io/

Whitepaper : https://kratospct.io/pdf/KRATOS_Whitepaper.pdf

Telegram : https://t.me/arkratos_group

Twitter : https://twitter.com/Arkratos_com

Facebook : https://www.facebook.com/ArkratosBlockchain/

ANN Bitcointalk : https://bitcointalk.org/index.php?topic=3079521.msg31758152#msg31758152

HASHTAGS : #KRATOSICO and #Arkratos

ARTICLE BY:

Bitcointalk Username: shohagks

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1955932

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@Nusaiba21/kratos-blcokchain-review-997939567629

Thanks for your information. Because KARTOS is a very popular project.

Very good project. Thanks.