Kucoin is a cryptocurrency exchange that launched in October of 2017, and in the two months that they've been operational, their volume has grown exponentially and continues to grow.

Disclaimer: I have invested quite a large amount of money into KCS (110% profit in 5 days), but I will continue to hold it indefinitely.

TL;DR

Kucoin Shares is a more incentivizing investment than BNB, as BNB has already increased so much + BNB doesn't give out dividends. I see the price of KCS increasing to ~10 USD by the end of this week and ~25-50 USD by the end of this month (depending on how their servers hold up). If they list Raiblocks before Binance, I also suspect a spike in volume and thus spike in KCS price.

Introduction to the Kucoin Exchange

The Kucoin Exchange offers many trading pairs which include big coins like NEO, LTC, ETH and more, but what most people use Kucoin for is to trade obscure new coins, like DBC and BNTY, both of which came onto the market within a week ago. Kucoin has the highest volume for those 2 coins.

Introduction to Kucoin Shares

Kucoin shares are my favourite part about Kucoin, and why I moved 90% of my BNB (which gave me over 250% profits) into Kucoin Shares about 2 days ago (already over 60% profit). Many of you would have heard of the rise of BNB, from less than a dollar to over 10 dollars in 3 months. I believe Kucoin Shares can do better that than, and I'll explain why.

BNB vs KCS

BNB is used to halve fees, so many users buy BNB to hold and eventually it runs out, then they buy more thus driving up the prices. Hoever, if they use BNB to pay fees, the person who referred them gets BNB as commission, which mostly gets sold, thus lowering the prices. I myself receive about 85% of my commission from Binance as BNB, although I used to hold, I know sell it to buy Kucoin Shares.

KCS can also be used to reduce fees, so many large traders hold KCS to reduce fees. The difference with KCS is the more you hold, the more your fees are reduced, thus incentivizing users to hold more. Another incentive to hold more is the daily dividends that KCS pays. 50% (for 6 months, then reducing to 15% over 2 years) of the fees are given back to KCS holders, distributed proportionally to how much KCS a user holds. This means when someone receives commission, they are less likely to sell their KCS as KCS is a coin that keeps on giving, in fact, I sell all my other dividends and commissions from Kucoin to buy KCS.

Analysis of the Price of Kucoin Shares

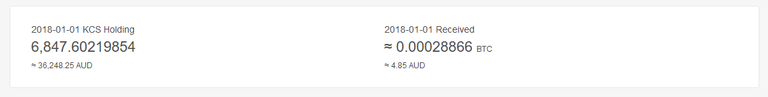

Typical return on investments (ROI) for low risk investments fall between 3% - 5% per year, whereas more risky investments can be anywhere between 5% to 20%, with most people being satisfied at a ROI of around 10%. Below is my dividend payout from yesterday.

The price of KCS was 0.00031499BTC ($4.08USD) at the time of that photo, and offers a ROI of 4.88%.

This may not sound amazing, but here are some factors to consider:

- KCS holders are also in the running for prizes and giveaways, their latest giveaway offers KCS holders free bitcoin (depending on amount being held)

- ROI is 4.88% assuming the exchange volume stays the same, although it's likely to increase

In fact, the volume rose from around 50 million yesterday to 70 million today, and the price has increased around 16% - Many hold for the reduction in trading fees, thus giving it practical value too, also reducing the circulating supply and increasing demand

- Kucoin is one of the only exchanges ready for many of the new NEO ICOs coming in Q1 2018, thus the volume will likely blow up, thus increasing the demand and need of KCS

- Listing Raiblocks soon will blow up the volume (if they list it before Binance)

Potential Price of Kucoin Shares

Volume drops to below $40 million daily: price will decrease to around $2.00-$3.00 USD

Volume stays around $40-$60 million: price will decrease to around $3.00 - $4.00 USD

Constant volume will likely lower prices as the price is currently inflated due to speculation

Volume increase to top 20 exchange (volume ~double): price increase to ~$10.00 USD as more speculation happens, large increase to dividends and more people hold to pay fees

Volume increase to top 10 exchange (volume ~x10): price increase to around ~$50.00 USD as more people hold to pay fees and massive increase in dividends

I don't see Kucoin getting much larger than around 10th any time soon due to their servers. The only reason Kucoin can make it anywhere near top 20 is purely due to them being able to provide coins other exchanges cant.

How to Buy

Kucoin Shares are only available on the Kucoin Exchange. Sign up and transfer your coin onto the exchange to start trading. I suggest you transfer eth onto Kucoin as transferring BTC has quite high costs. If you're transferring more than ~10000USD, it won't really matter as the transaction costs will be less than 0.2% and the price to trade to and from will end up being approximately the same.

Price has risen about 20% since this was posted, if you're looking at it now, I suggest waiting for it to fall around 0.00033-0.00035 before buying.

Nice post, but people who wait may end up paying more if it continues to grow at this rate...

That's true. At the time of posting that comment it had just spiked and it did fall to 0.00030 before going up again!

In the Buy zone again today. I think it's lots of weak hands selling out.

Great post and input guys, interesting to see long term i think KCS is a good investment. Provided we continue to see monthly volumes rise on KuCoin.

Yeah! I sold around 0.0013 after making around a x10 profit and bought coss which went to absolute shit. I'm glad I bought back a small amount (around 1btc worth for 0.00084 last night).