Even though American securities regulation is an essential stepstone (given the trust it arises with institutional investors seeking to touch the ground with blockchain industry) on the path to a proper understanding of blockchain businesses intentions, one must give some thought to how private international law interprets both blockchain transactions and ownership rights registered on the blockchain.

One may argue that the essence of the international law itself is antithetical to the philosophy of blockchain as it always centers the governmental control over business relations and the transactions they execute. However, given the ever-increasing number of hacks and malware spread throughout the blockchains networks and the internet itself, more and more people understand that if, much like in conventional private law, if a uniform regulative body (State in case of private international law) existed in blockchain, this would enhance the maximum level of lege security for all parties. Unfortunately, this utopian level of uniformity may only be achieved with the consent of all the states of the world, or at least, the ones that take up the bulk of crypto trading, mining, investment, and daily usage.

Today’s reality renders blockchain world with incomplete understanding as to what rules it should abide by when it does business in different jurisdictions. And it always has to, blockchain isn’t about limiting business in one country. Here, we arrive at the hot question of the industry - what level of involvement of governments is desirable for the blockchain industries to be attractive for institutional investors and help crypto privies organize sort of self-regulation that does not interfere with the philosophical foundations laid down ten years ago.

Given the basic paradigm of blockchain, one may assume that all blockchain transactions are international per se, therefore it is questionable whether all jurisdictions are tasked with introducing their national rules applying to those transactions. Not to say that all decentralized cryptocurrencies reject state’s intervention completely as they offer a potentially disrupting approach to the world economy itself, while the currency itself is sustained by the whole community (of miners). So, does this mean that blockchains do not need help with legal security from the states?

Blockchain relies on the overwhelming trust in the monetary system it offers so that the users of this system are persuaded to place their trust in a digital protocol which operates with no or little human involvement after it is launched, without complete or even partial understanding of the underlying technology. With conventional finances and financial regulation, this trust would have been placed within a financial intermediary with the state acting as guarantor of the legal security.

Presuming that blockchain is self-regulated, it would be reasonable to assume that the rules each community member is expected to abide to should be created by the community itself, mainly miners as they hold the most powers in blockchains, such as the unique ability to roll-back all transactions in the blockchain by executing a 51% attack. The universal consent of all participants of the blockchain (nodes) is essential to its proper functioning. This is what is called ‘consensus protocol algorithm’ which is the most important yardstick for differentiating blockchains. The way the nodes arrive at the consensus is so definitive that the top-2 blockchain in the world - Ethereum is gradually moving to shifting from Proof-of-Work protocol (in order for miners to approve the transactions and create a block the extra-difficult mathematical task must be solved) to a more progressive Proof-of-Stake protocol (mere holding of a large pre-defined number of tokens by masternodes is sufficient for creating a blog).

Basically, the legal rules written down by community members may be called ‘subnational’ as they are comprised of internal customs and widely-used practices of the network’s participants. In other words, a blockchain’s ultimate dream is creating its own, well, state.

However, even in this case, the mere adoption of the generated rules does not suffice for their functioning, blockchains are then faced with the necessity to create a set of tools and mechanisms for monitoring the application and compliance with those rules. This enforcement protocol must be built on the very same basis as the decentralized digital system itself. The proper description of such a protocol from a legal standpoint was introduced before the dawn of the blockchain and it was named ‘Online Dispute Resolution System’.

ODR is a form of online settlement that uses alternative methods for dispute resolution (alternative dispute resolution). The term covers disputes that are partially or fully settled over the Internet, having been initiated in cyberspace but with a source outside it (offline). In the literature on the subject, the terms electronic ADR (eADR), online ADR (oADR) and Internet dispute resolution (iDR) are treated as synonymous.

There is no permanent system for reporting the number of entities that use online dispute resolution. Published research focuses mainly on showing levels of alternative dispute resolution (ADR) use in specific countries. However, there is no similar record on entities offering its online form.

With the case of ODR, the final word in the resolution of disputes arising within the community is to be assigned to the majority of participants (example of Proof-of-Stake protocol), or the participants elected by the community by means of voting (example of the Delegated-Proof-of-Stake protocol). The sad reality of the world’s largest protocol - Bitcoin is that the role of the universal judge is usually shared among the participants that have the largest computing power.

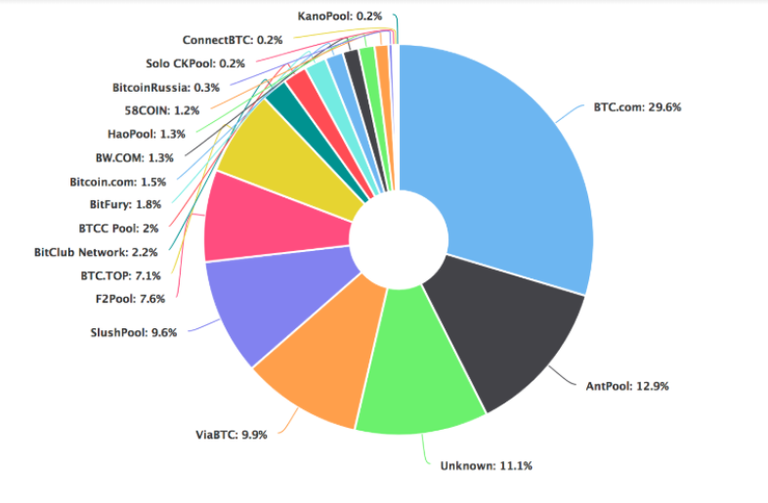

Now, you should understand that Bitcoin is not that decentralized, as some uninitiated people tend to believe, or, to say more precisely, 11.1% decentralized. As we can see from the pie-chart displaying the distribution of aggregated computing power of the world’s largest mining pools, if the 4 largest mining pools converged together to decide that they don’t want an undesired transaction to take place, they can just direct their cumulative computing power to mine the blocks backwards to the state right before this transaction. It is especially concerning that all of those mining pools are Chinese.

trend towards centralization will only gain momentum in the future, guys

people understood that crypto anarchism is bad

huh, crypto is not that decentralized after all

I remember the term Lex Cryptographia first emerged in Karl Marten's works. It's canny