Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

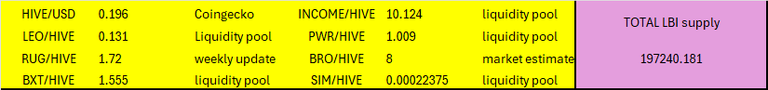

Here are the token values used at the time of this report:

And for comparison, here is a link to last weeks report:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-9-week-ending-29-sep-2024-4wb

Now, on to the numbers:

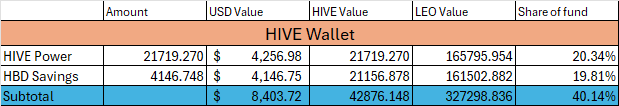

HIVE Wallet

No big post payouts this week, and no major changes of note. Around 100 HP increase for the week, and 7 HBD. Pretty stable week really. I have added a small amount to our PWR delegation, with a goal to build it up over time to 10K. Currently, our delegations are:

- 10,000 @leo.voter

- 8,000 @empo.voter

- 3,000 @brofi

Plan is to build the empo delegation to 10K and then work on brofi.

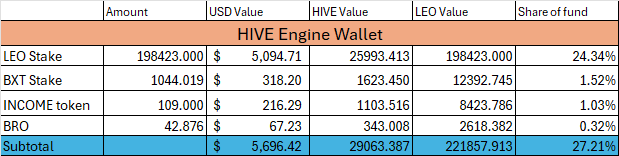

HIVE Engine

A full 7 days of LEO bounty being paid, which has been nice to see. Hopefully the unreliability of this is fixed - time will tell I guess but this is the first week we have received all seven payouts in the week since I took over running LBI. It will be nice to see leo.voter payouts become reliable. This week, it was BXT's turn to have issues. When we get to the income report, you will see it missed 4 days this week. The issue seems to be fixed, and it has been historically much more reliable so we will mark it up as a temporary glitch. Looks to be all back on track now. BRO was also patchy, but they usually backpay and yesterday we did get 6 payments in a row of BRO, so all is good for the week. Not a lot added to the token amounts from post payouts this week, just a few INCOME and BRO thanks to a quieter week.

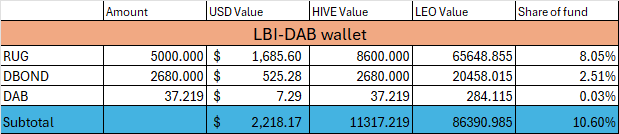

@lbi-dab Wallet

Solid week for this wallet - good and bad really. The HIVE value of RUG has dropped over time since we bought it. However, DBOND minting was solid again this week. We minted 9 DAB across the week, so our daily drip is steadily growing. The price of DBOND is up over peg at the moment, so our income (I sell a couple of DBOND each day) is decent.

This week, I cheated as you will see in the income section, to bring in a good number for income for the week. Part of that cheating was selling extra DBOND (minted from RUG holding) to boost the income from this wallet at the end of the week to give the income number a bit of a kick.

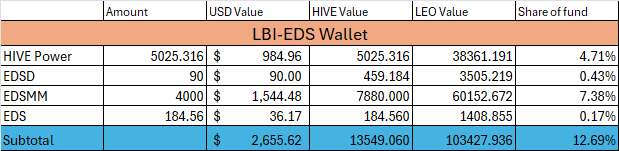

@lbi-eds Wallet

Very reliable as always from the EDS project. We minted 32.11 EDS from all sources, which was a bit more than last weeks 25. There isn't much news here, just chug away and let it do its thing. The income from here will grow each week, nice and steady. This is our lowest maintenance wallet, and we get to just sit back and watch it grow. My favorite type of investment.

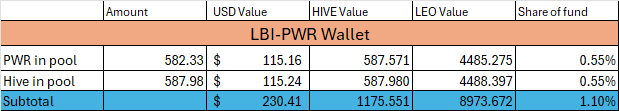

@lbi-pwr Wallet.

The PWR pool APR increased during this week, which is nice, and adds a few LEO to our income wallet at the end of the week. Between the pool and the delegation from the main wallet we are earning just over 2 PWR each day. This gets compounded into the pool, and we should see slow and steady growth over time.

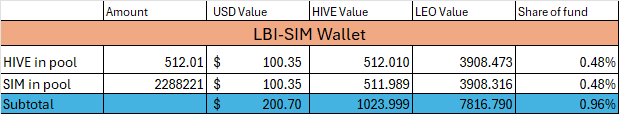

@lbi-sim Wallet.

A couple of missed payouts this week from the SIM power. This is not a big issue for us at this stage, as our power is still ramping up from buying in. Once we clock over a month for this position, we will get a good picture of what income this wallet will produce. The pool generates a couple thousand SIM per day, which is a bit under half a HIVE value to compound. I'd like to boost this position, but for now we shall just let the SIM power build and then go from there.

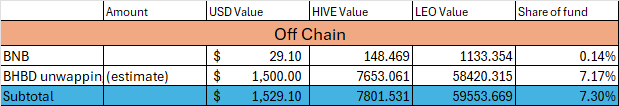

Off Chain.

No change here - for now. I am hopeful of bringing good news on this front soon. Our support ticket for the BHBD recovery has received some contact this week, so I'm hopeful for a resolution soon. We need to remain patient, but things are progressing which is good to see.

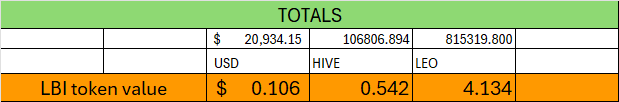

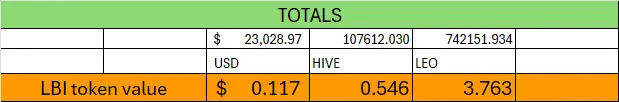

Totals

A fairly big sell-off for LEO in the last 24 hours has had an interesting effect on our overall wallet values. The LEO price per LBI token is well up, over 4 for the first time that I have seen. The wallet held over $20,000 in value which is nice. Steady week overall, despite the fluctuations for LEO. HIVE price was also down for the week, from $0.214 to $0.196 at the time of this report, so to hold on to 20K is a win I think.

Here is last weeks result for comparison:

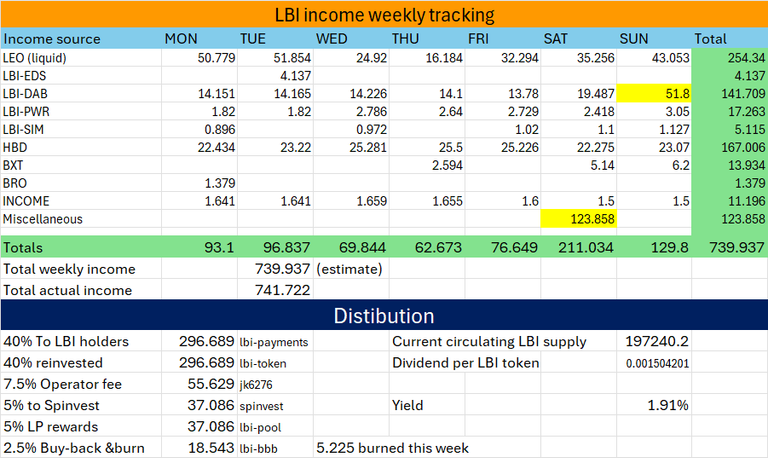

INCOME Statement

Before I post this, let me just say, I cheated this week. The two spots I cheated are highlighted yellow in the spreadsheet below.

Income was tracking quite poorly with only a couple days left in the week. I'm keen for the income distribution to grow steadily over time, and this week was looking like it would be way down on previous weeks. A few reasons for the bring smaller LEO post payouts and curation, BXT missing payments and having had a really good week last week. So, on Saturday you can see a "Miscellaneous" income. This came from the HBD from a post payout. Instead of reinvesting all of this payout, I traded it through to LEO and added it to the income distribution. Also on Sunday, I sold a bit more DBOND than usual to boost the income from the DAB wallet.

So, after pulling these tricks, INCOME was up on last week. The Dividend per LBI token increased a bit. The Yield figure was lower than last week, as it compares the LEO dividend to the LEO token value, which jumped quite a bit on Sunday. I hope that "cheating the system" like I did to bring in a decent income is just a one off, but I am really keen to keep income growing and have built in some "wiggle room" so we shall see.

Dividends went out, and some more LEO was added to the Pool reward contract. The nice part is that as the price of LBI is below asset backed value in the pool, we burned 5.225 LBI tokens this week. Every week, our assets grow and our income grows, and our supply of LBI tokens drops.

Overall, a mixed bag this week, with some good and some bad outcomes. Add in a dash of cheating and we have grown income for the week, and held on to a decent value despite asset price drops.

Thanks for checking out this update, have a great week everyone.

Cheers,

JK.

Here are some more recent posts to learn more about LBI.

https://inleo.io/@lbi-token/lbis-september-2024-recap-2zc

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

Posted Using InLeo Alpha

A small suggestion h-e wallet - let's get 15 more SOL. It will increase post payouts a bit. You may try creating an order for less than 1 Hive

Hey @jocieprosza - I will add the extra 15 over the week. I know very little about SOL, so I'll take your word for it. I'll just add a few here and there till we get to 25.