Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

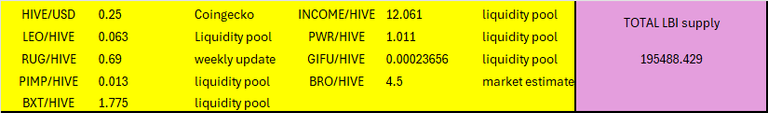

Asset prices are down over the last week, and have dropped a bit more (mainly HIVE) since the cutoff for this report. Anyway, here are the prices used for this weeks snapshot of our wallets:

Here is the link to last weeks report for comparisons.

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-31-week-ending-2-march-2025-apw

On with the update.

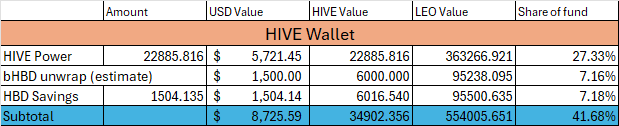

HIVE Wallet

56 HIVE added for the week, which is a decent week for us. Not much else to report as we have not changed things this week. Value of the HIVE has dropped, with HIVE down from $0.30 last week to $0.25 for this report (and further still since).

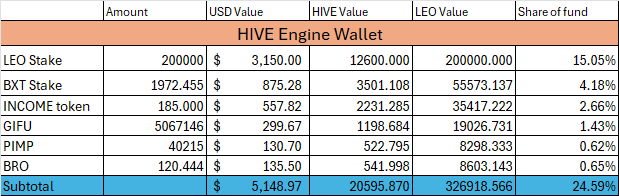

Hive Engine Wallet.

Again, small changes this week, I've been focusing on the other wallets, so there has been little changes made here.

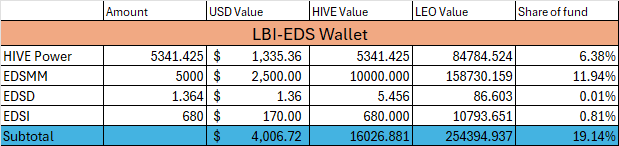

@lbi-eds wallet.

Something changed this week. To add back in some diversity to this wallet, I've decided to get back in to EDSD token. Without any new funds to invest, this will be a slow accumulation. we mint around 25 EDSI each week. I've decided to sell whatever we make above 20 each week, and trade those proceeds through to EDSD. So, we make 25 EDSI, sell 5 so we are still growing by 20 EDSI each week. But we add in a small amount of EDSD also. The good thing with EDSD is that when HIVE price is down, we get more EDSI as rewards. When HIVE is strong, EDSI rewards will be lower, but we will be able to add more EDSD. It's like a very small scale way to DCA out of HIVE into USD. Just a small tweak to build another asset over time.

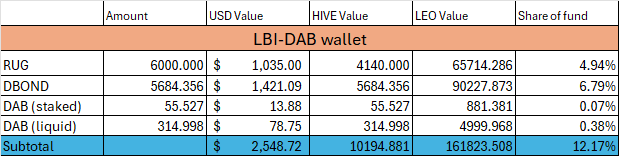

@lbi-dab wallet.

After last weeks major changes, we get to see how that has impacted this wallet this week. So this week we have a combined total of 370.525 DAB compared to last weeks 354.097. We gained 16.428 DAB for the week, which is a good increase from the roughly 10 per week we were tracking. RUG value is not great, but it still yields nicely. All up for the week, we added 28.7 DBONDS plus the 16.4 DAB, not bad.

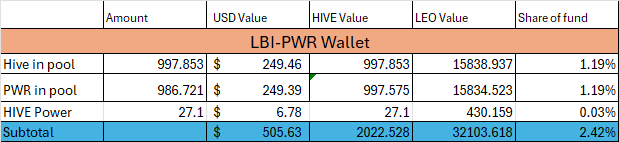

@lbi-pwr wallet.

I put out a post a couple days ago with all the details and plans for this wallet, so I won't say too much more really. Added 27 HP to this wallet this week, plus a little to the pool also. If you have not read the linked post, basically, I'm using some of our daily PWR earnings to build a Hive Power balance into this wallet.

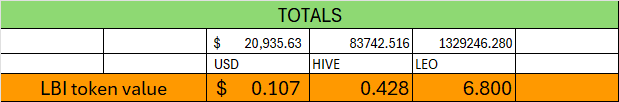

Totals

USD Value of the fund is down $3315 over the week. That's a 13% drop for the week - ouch. HIVE valuation is up a bit, and LEO value is pretty flat.

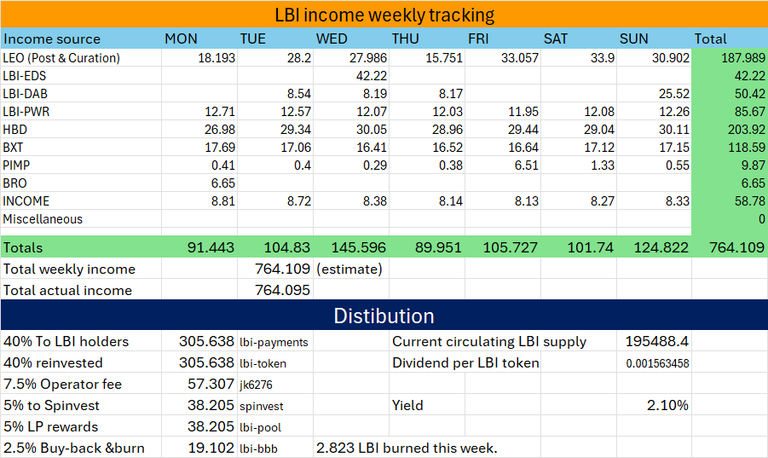

Income statement

Won't go into too much detail here. Income is down a bit more from last week. Changes made over the last couple of weeks have prioritized growth over income. So we drop some income in the short run, but position ourselves better for the long run.

Yield for LBI holders is 2.1%, having peaked a few weeks ago close to 3%. For those not familiar, the reason's our yield is so low is that:

- We only pay out 40% of our income,

- Lot's of our assets mint other assets, so while they benefit the fund, they don't add to income.

- Growth is the priority, income will be a benefit of that growth over the long run.

Conclusion.

A bit of a disappointing week really. HIVE is at $0.23 as I write this post. Maybe alt-season is cancelled this cycle? Anyway, work continues to keep building our sub-wallets into stand alone entities with a diverse base of assets all related to their main theme. The EDS wallet is getting back into the HBD stable-coin backed EDSD. The PWR wallet has started building it's own HP balance, and changes made for the DAB wallet will drive faster growth there. The long term plans are all in place, but seeing value declines and the fund worth around what it was months and months ago takes the wind out of my sails a bit.

Another thing I have considered doing lately is to build a new wallet specifically for LEO. We could shift our LEO stake over to it, and tweak our curation methods. That new wallet could add some HP to go back to delegating to leo.voter, possibly even some LEO miners to give it a growth profile. Currently we are sitting put on 200K LEO. Splitting it into a new wallet, and giving it a growth path could be good for the fund in the long run. I'd like to hear everyone's thoughts on that. Might make a post later in the week to flesh out the idea a bit.

That's it for this week, lets hope HIVE recovers and the week ahead is a better one.

Thanks as always for checking in on this weeks update,

Cheers,

JK.

Posted Using INLEO

Might be a good idea to move that LEO to a separate wallet. I have delegated most of mine to my alt. I still have the stuff pooled with my LBI though. Are many people taking advantage of that pool?

I'm going to write a post at some stage about why I am so focused on building each wallet as a stand alone entity. Long story short, it is to position so that we could spin off divisions, raise new funds or even sell off divisions. Everything has a price, and a nice self sufficient wallet with scale in a bull market might be attractive where the whole wallet might be more attractive than the sum of its parts.

Anyway, a dedicated LEO wallet makes sense to me. still thinking on how to structure it so it still spins off decent income each day, but has its own growth path built in.

As for the pool, it is still a small but useful proposition. Yield is better than holding liquid, and I'm trying to keep the price loosely pegged to the asset backed value with my personal stash. I'd love the pool to grow deeper, but I think much of LBI's holder base is very passive/disengaged/even gone from hive.

I delegate HIVE to the LEO fund and get a good chunk of LEO on a daily. The investment looks terrible no due to the cost, but I'm almost at the 20,000LEO mark.

That's kind of what I thought about the pool.

Congratulations @lbi-token! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 23000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPHive onslaught is really brutal.