LendLedger is the first blockchain-based open protocol connecting data providers, lenders and borrowers to help small businesses globally unlock the eight trillion dollars in loans they are unable to access today.

In finance, a loan is the lending of money by one or more individuals, organizations, and/or other entities to other individuals, organizations etc. The recipient (i.e. the borrower) incurs a debt, and is usually liable to pay interest on that debt until it is repaid, and also to repay the principal amount borrowed.

For business owners or those aiming to set up a large scale of business, setting up a large scale of business or maintaining and expanding existing business requires a huge amount of money (capital) which most people can not afford as an individual, and there might be need to borrow more capital either from Formal Lenders or Informal Lender in form of loan. This two present way of Lending methods are not doing too much work good for money borrowers.

The Formal Lender

Banks and other financial institutions are referred to as the Formal Lenders. Business oriented individuals make use of this means to get loan in other to set up there businesses. But the procedure or requirements needed to get this loan is always the problem for the borrowers because the banks and some other financial sectors will have to enough and thorough investigation about the business the person want to set up, if it's profitable or not b4 issuing out the loan. The Bank will require some datas which includes the customer financial data information from timely bill payment to daily transaction amounts and the owner should be able to present the health status of the business which are mostly not accessible for formal verification.

The major problem of this method is that borrowers need a way of accessing their data and also at the same time guarantee the certainty of the accessed data and also digital service providers need an easy way to provide data security to lender.

Informal Lender

In as much as the Formal Lender is not that accessible for individuals, they tends to take the Informal part which is loan for Families, Friends and Relatives. Even though there is little or no external control over the lending practices and the methods is mostly suitable for poor households, the method is still not good enough because the interest rates can be very high and above all, the lenders can use unfair means to get the money back and at any time without considering the borower because there is no proper agreement.

The Solution

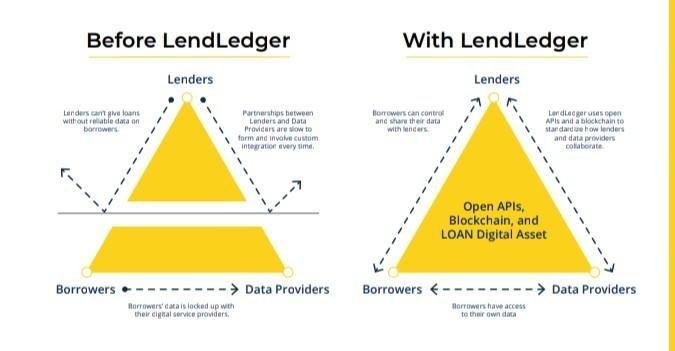

Therefore, the lending market needs an environment of trust and transparency that connects Lenders with borrowers' data and tracks payments over time.

The Lendledger replaces the centralized intermediary with an open and decentralized network. The Lendledger protocol allows anyone to join the network and enables trustworthy exchanges of data directly between parties, participants maintain control of their own data and build a reputation on the network.

This is only possible through the lendledger open APIs and a unique digital assets (LOAN) that interacts with a smart contract on blockchain. The Lendledger will also provide a software solution that will allow users to easily access the ecosystem.

With the open APIs, the decentralized network can replace some of the intermediary functions formerly completed by a centralized system: controlling which participants can access the system, connecting parties directly to one another, and enabling fast and trustworthy loan decision.

Lendledger will use the Blockchain technology to create a trusted, open lending network. A Blockchain particularly well-suited to create trust between participants who don't know each other because anytime a smart contract is executed on the Blockchain, information is recorded to the public Blockchain ledger. There is no central administrator and no gate keeping.

By combining the transparency of a Blockchain with the security of encryption technology, Lendledger will be able to maintain openness while protecting the confidentiality of identifying information. On the other hand, Borrower financial and business data is only transmitted directly between participants in an encrypted format. No confidential data is public on the Blockchain.

Read more about the LENDLEDGER on

website

whitepaper

twitter

telegram

ANN

Thanks for reading..

I am Folajuwon56 on Bitcointalk