About LendLedger

°LendLedger associates Lenders with undiscovered information to connect the multi-trillion-dollar hole between monetary

organizations and casual Borrowers.

It unites Borrowers, Data Providers, and Lenders in an open and secure worldwide environment based on dispersed record innovation.

°Through the LendLedger Protocol, anybody can join loaning markets. The convention's APIs1 permit parties that don't have any acquaintance with one another to trade information and esteem. Also, it utilizes Stellar's blockchain innovation to catch credit payment and reimbursement records progressively. This continuously results in straightforward and obvious notorieties for all members.

By taking a gander at the blockchain, Lenders can see Borrower conduct and value hazard fittingly.

°LendLedger will encourage independent companies and casual Borrowers secure reasonable credit from money related foundations.

Its open guidelines and believed shared record will build information sharing, showcase associations, and loaning volumes.

LendLedger empowers a more proficient, reasonable, and comprehensive loaning market.

PROTOCOL

The LendLedger Protocol is a suite of Open APIs that interfaces members in loaning markets. It is an open option in contrast to focal mediators and loaning stages.

Borrowers, Lenders, Data Providers, and other specialist co-ops utilize the APIs to share information and exchange esteem. The convention records each such communication on the Stellar decentralized record. This implies there is a lasting, straightforward record that gatherings can trust, regardless of whether they don't confide in one another.

- The LendLedger Protocol has four segments that cooperate to make an open, straightforward, and confided in stage.

1.Information APIs

These APIs characterize how information is passed between gatherings. They characterize the organization in which information is put away on the blockchain, how it is asked for, and how it is sent. The information APIs indicate positions for business information (utilized for credit choices), KYC information, and credit assessments. After some time, the network may include Information APIs to deal with more kinds of information.

2.Exchange APIs

These APIs oversee how esteem is transmitted. They are the building obstructs from which shrewd contracts for credit and specialist co-op assentions can be assembled.

3.Credit Smart Contract Templates

These are format savvy contracts for regular private venture credit items. After some time, the network can utilize Transaction APIs to fabricate brilliant contracts for less basic advance sorts.

4.Advance Digital Asset

LOANtokens are LendLedger's advanced resource. At the point when staked by a Credit Node (depicted beneath), they discharge LedgerCredit. LedgerCredit is the convention's interior bookkeeping unit. It is designated in wording of official (fiat) money and goes about as an IOU with respect to the guarantor.

USERS

Here is the means by which each loaning business sector member will utilize LendLedger.

.jpeg)

LENDERS

Originate advances utilizing credit information made accessible by Data Providers. Sign credit contracts with Borrowers and dispense credits to them.

DATA PROVIDERS

Provide credit information they aggregate on family units and organizations to Lenders and

BORROWERS

Borrowers Acquire their own or business credit information from Data Providers. Distinguish advance offers from Moneylenders and apply for and get advances.

CREDIT EVALUATORS

Provide advance choice suggestions dependent on advance applications shared by Lenders.

IDENTITY VERIFIERS

Contract with Lenders to give confirmation of Borrowers' KYC information.

LOAN SERVICERS

Collect advance reimbursements from Borrowers in the interest of Lenders.

DATA EXCHANGE

In the LendLedger Protocol, information is traded utilizing exchanges on the Stellar decentralized record. These exchanges go about as an informing framework. Every exchange has a notice field in which LendLedger members insert information solicitations and reactions.

Yet, the information itself (e.g. credit information shared between a Borrower and Lender) is too substantial to store on the blockchain.

So it is put away on IPFS (InterPlanetary File System)3 and referenced by a Stellar exchange. Utilizing encoded information ON IPFS likewise guarantees that information is just available by gatherings approved to see it.

The LendLedger Token (LOAN)

The LOAN token is the prohibitive course for framework individuals to get to the features of the LendLedger arrange. Advance fills various necessities:

• For Lenders: It enables them to get to the framework, make credits, and pay for organizations related to advancing

• For Data Providers: It gives them the chance to discover ways to deal with adjust and offer data

• For Borrowers: It gives them the authorization to see and apply for advances

• For Credit Nodes: It enables them to stake LOAN with the true objective to issue LedgerCredit (the strategies for trades between all individuals on the framework) LOAN is a Stellar-issued modernized asset that relies upon the Stellar Consensus Protocol. It easily joins into a current decentralized structure, including modernized wallets and the inalienable Stellar trade.

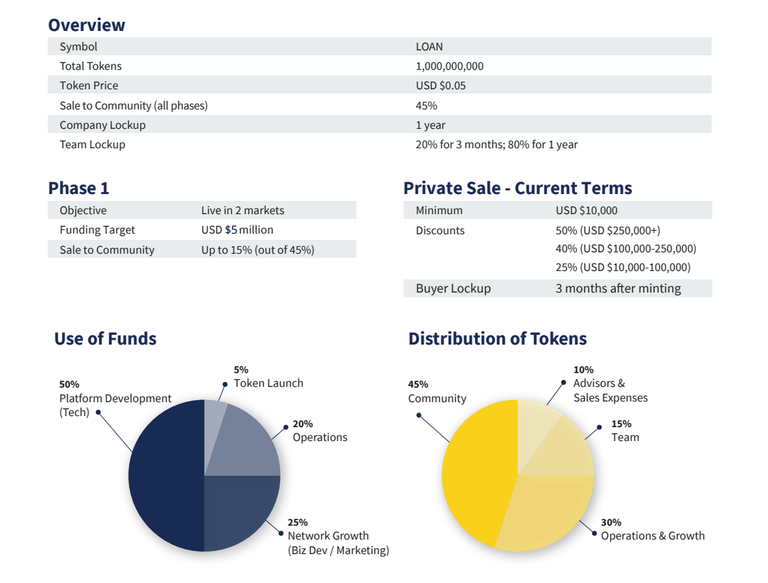

TOKEN INFORMATION

For more info about this platform, and also to join the network, endeavor to visit:

WEBSITE

TELEGRAM

WHITEPAPER

LINKEDIN

TWITTER

BITCOINTALK

MEDIUM

Thanks for reading. I am HIFEMIH

Dear friend, you do not appear to be following @wafrica. Follow @wafrica to get a valuable upvote on your quality post!

Congratulations @hifemih! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!