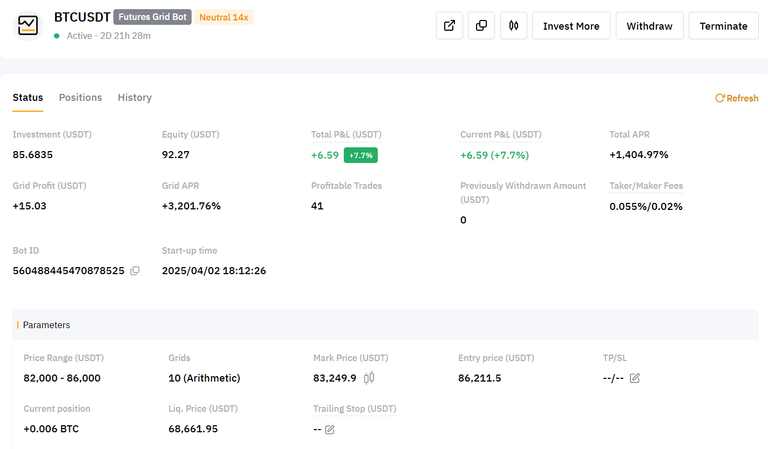

Trading bots are my favourite tool in trading by far! It lets me harvest Bitcoin's volatility without much fuss. Bellow is my current main bot info:

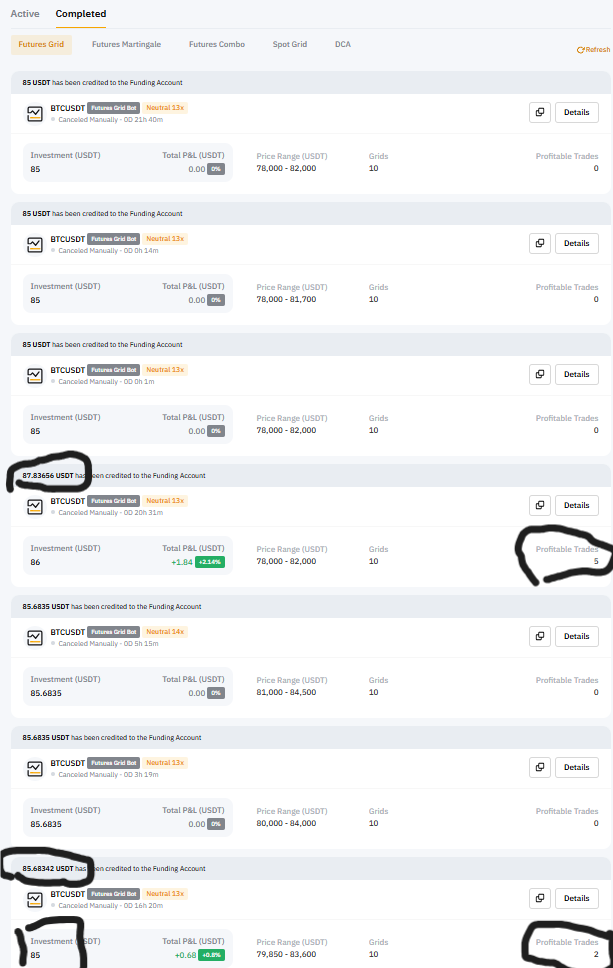

I created and terminated a few other bots until I caught the range in which BTC bounces back and forth at this time.

Only 7 profitable trades out of these 7 bots that ran for awhile until I terminated them and set up new one. And 41 completed profitable trades in my current one.

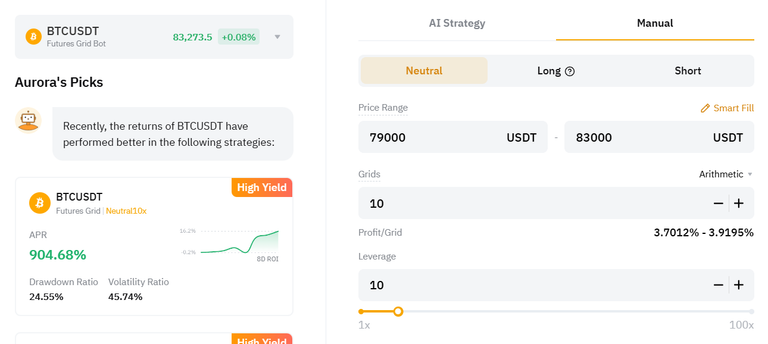

My favourite way to create a bot is just bellow market price. For example at curent price (~83,273 usd) I would use these parameters:

That way I can esaily exit the bot if the price runs away to the upside or I can manage liquidation risk if the price dumps.

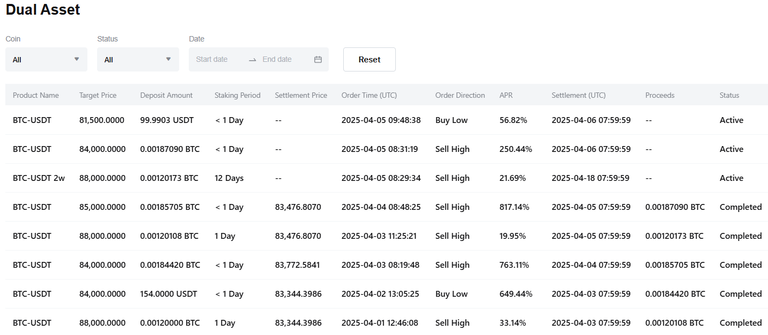

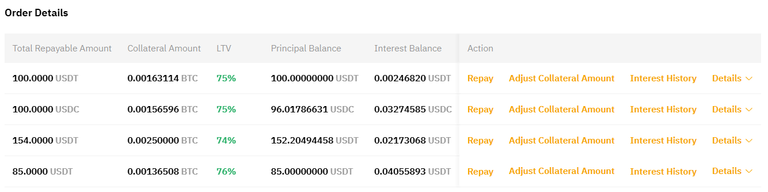

Another tool that I used a bit is structured products. These are the trades so far:

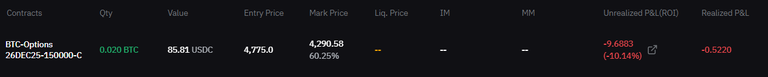

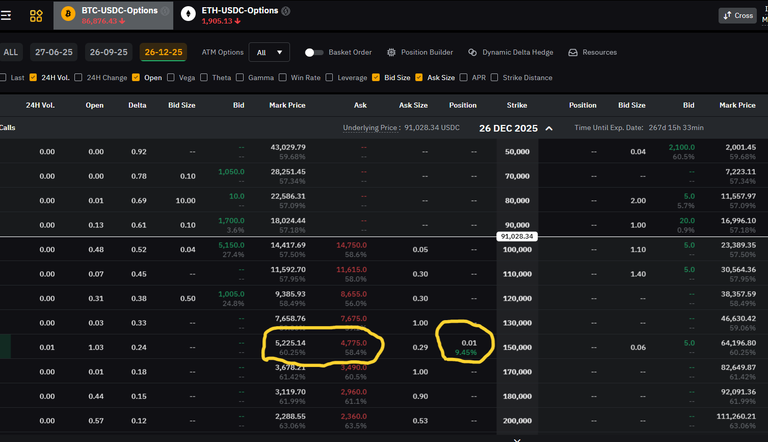

Also I bought a call option which in the red at the moment:

I don't really like options and try to avoid them. But there are quite a lot of ineficiencies in the order books when the price moves hard in one or another direction. I think people set limit orders and don't manage them live. And when BTC price moves hard, options price move on order of magnitude higher.

For example when I bought my call options their fair value was 10% above the price I've paid for them. You just can't leave value like that on the table if you are trying to maximise value.

Of course BTC price action later in the week eviscerated that value but still. You can't control that.

I finansed these trades with loans. Borowing rates right now are ridiculously low (~4,35% APR). lol that's even lower than Saylor pays for his STRK and STRF oferings :)

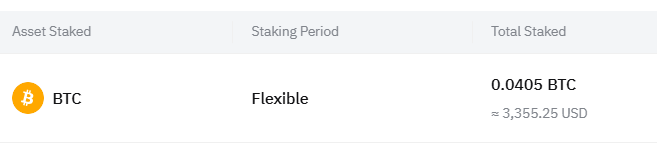

And the rest ~4 mil sats sit in flexible earn deposit generating a bit above 0.3% APR and waiting to be deployed if the market dumps further.

That's it for now. Thank you for reading if you did :) If you have any suggestions or tips I would love to hear them!

Upvoted 👌 (Mana: 0/37) Liquid rewards.