An in-depth review on getting a Chase Total Business Checking account. There are free business checking accounts, but I will join any bank that provides a substantial bonus for signing up. I love getting bank bonuses for credit cards and checking accounts. You can get these bonuses for personal and BUSINESS accounts. If you don't have a business, relax, you're probably still eligible with a little work. You can get a Chase Business Checking account bonus with a sole proprietorship or starting a single person LLC for a reasonable fee.

| Account: | Chase Business Checking Bonus |

| Bonus: | $300 (typically range from $200 to $500) |

| Availability: | Nationwide (Online and In-Branch) |

| Requirements: | No Direct deposit needed Must Deposit $2000 or more within 20 BUSINESS days of account opening Maintain a balance of $2000+ for 60 days Complete 5 qualifying transactions within 60 days |

| Bonus Received: | Day 70 |

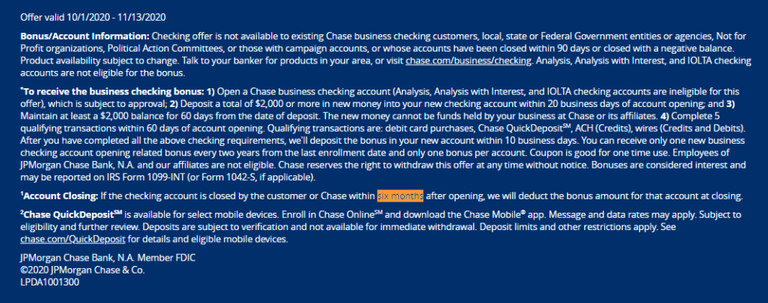

| Restrictions: | Account MUST be open for 6 months otherwise bonus is forfeited |

| Churning: | Previous accountholders with closed accounts for at least 90 days are eligible |

| Deadline: | This $300 Chase Business Checking Promo is available until 11/13/2020 |

| Sign Up: | https://www.chase.com/business |

Chase Business Checking Minimum Balance:

| Monthly Fee | Fee waived with | Bonus | |

| Chase Total Business Checking | $15 | Average daily balance of $1,500 | $300 |

| Chase Performance Business Checking | $30 | Average daily balance of $35,000 | $300 |

| Chase Platinum Business Checking | $95 | Average daily balance of $100,000 | $300 |

Which Chase Business Checking account should I get? I recommend getting the Chase Total Business Checking account. The$300 Chase Checking sign-up bonus is the same for all the available Chase business checking accounts, so might as well get the cheapest one.

How to sign up for a Chase Business Account with the bonus

The process to open a Chase business checking account with the bonus is a little strange. You’ll have to jump through a few hoops but it’s still relatively easy to sign up and get the bonus.:

- Get the Chase business checking coupon by providing your email

- Sign-up for the Chase business total checking account online

- Sole Proprietorship: EIN or Social Security Number

- LLC: EIN and Articles of Organization

- Secure message customer service with your coupon promo code

- Deposit $2000 within the first 20 business days

- AND keep your account open for at least 6 months otherwise Chase will clawback the bonus.

Get the Chase checking coupon: Start at the Chase Business page and click “Continue” in the top left for the “Get $300 for New Chase Business Checking customers”. This will bring you to another page what will provide a box to enter your email address. After submitting your email address, you will be provided the Chase business checking coupon code.

The email from Chase will tell you that you need to use the Chase checking coupon in a physical Chase branch when opening your small business checking account. You don’t have to do that. You can open the account online. I have confirmed this by calling Chase and also after opening the account online.

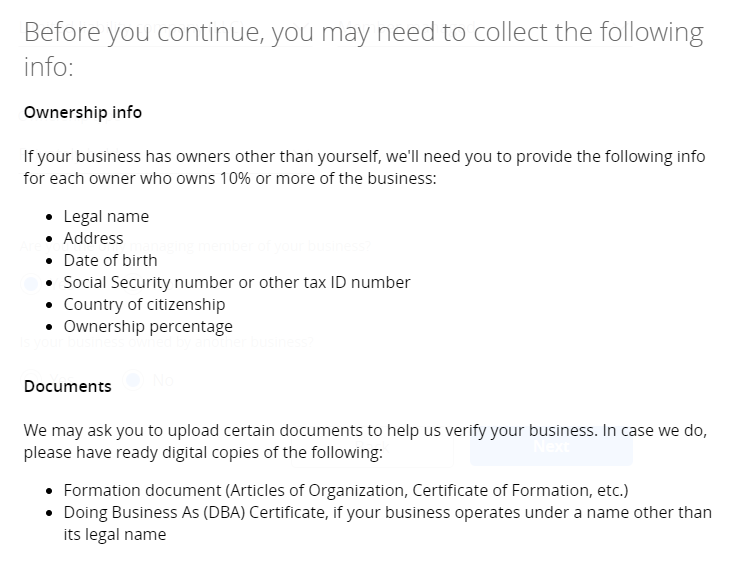

Signing Up Online: The online application only takes a few minutes and you will need your small business information. Even if it’s just a sole proprietorship, you’ll likely be eligible if you still have employment income. I was able to open the account using my LLC that was formed in Wyoming while I physically live in California. For an LLC, you will need to provide your Articles of Organization.

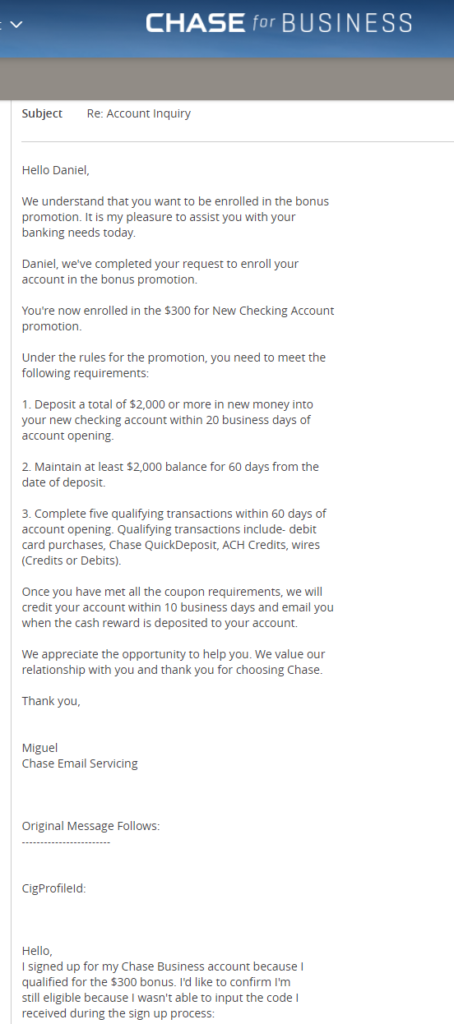

Send a secure message with your Chase Business Checking coupon code to sign-up online.

IMPORTANT send a Secure Message to Chase: If you open your account online, you will still need to provide the Chase business checking coupon through secure message after opening the account to confirm that you will be eligible for the Chase $300 checking bonus for small businesses. To do this, after logging into your Chase Business account, click the 3 horizontal lines at the top left of your account page and select [Secure Messages]. Select [New Message] at the right, [I have a question about one of my accounts] and [Account Inquiry]. This will then show the option, “Still have a question? Send us a message.” Then you will be able to contact customer support to provide your Chase small business checking coupon bonus code.

Accounts must be kept open for 6 months

How long do I have to keep the account open? According to the offer terms, you can’t close the account WITHIN 6 months of opening it. You can close your Chase business checking account after having it open for at least 6 full months.

When do you get the Chase Business Checking Sign-Up bonus? Within 10 business days of completing all the bonus requirements the cash reward will be deposited to your account.

What do you need to open a Chase Checking Business account?

Getting approved for bank business checking accounts is MUCH easier than getting a credit card. The approval rate is very high as long as you have all the correct information regarding your business.

I have opened an LLC (in Wyoming) but was able to get a Chase business account registered to me at my home address in Los Angeles. Since I applied with an LLC, Chase only required my LLC’s Articles of Organization during the application process. Within a few hours of applying, I was approved for my Chase business account.

If you open a business, make sure you have a very wholesome business name. Even if you’re not doing things very wholesome, banks can reject you for anything because they don’t want their services to be associated with something they disapprove of. For some reason having the name “Sly Credit” was bad for financial services so I had to rename my LLC to something more generic. After that, I was instantly approved for all business related banking.

LLC Requirements for opening a Chase business account

How Often Can You Get The Chase Business Checking Bonus?

With perfect timing, you are eligible to get a Chase Business Checking bonus every 9 months. That’s because:

- You need to keep your Chase Business Checking account open for 6 months otherwise you forfeit the bonus

- To be eligible for a new Chase business checking bonus, you’re previous account must be closed for 3 months (90 days).

That means if there’s a Chase Business Checking promo every 9 months, you can get that bonus every 9 months! It’s incredibly generous and I guess people haven’t taken as much advantage of this side of Chase because there’s no 5/24 here. Just free money.

VALUE: How much is the Chase checking bonus worth?

The $300 Chase Checking business account bonus is worth it but it does take time. The 6-month account opening requirement is a long time so remember to set a Google Calendar notification when you are eligible to close your Chase business checking account without losing the bonus.

- $2000 is locked in the account for the first 2 month (60 days)

- Then you get the $300 Business checking bonus 10 business days later

- Then you can choose to [bring the account balance from $2300 to $60 and pay the $15 monthly fee for 4 months] or [maintain a daily balance of $1500]

The $300 Chase business checking bonus for holding $2000 in your account for 2 months is a 15% return on your money. Calculating it as APR, that’s 75%! BUT, keeping it open for 4 more months starts to drop that return. You’ll need to keep at least $1500 in the account to waive that monthly $15 account fee.

It comes down to this: Is it worth $60 to hold $1500 in a Chase account for 4 more months? That’s a 4% return on your money for that 4 months (or 12% annually). If you qualify for more checking bonuses from different banks, then absolutely take that money and go for another checking bonus. You can think of it as a $240 Chase checking bonus for keeping $2000 in your account. That’s a 12% return on your money for 60 days (60% annually).

My Experience With Opening a Chase Business Account.

I’ve banked with Chase for almost 20 years now for mostly personal banking. I’ve also had a business credit cards with Chase but this was my first Business Checking Account. My business credit cards were approved with just a sole-proprietorship while not having much of a real business. Now, I actually do have a small business (this blog and vlog) and was quickly approved for the Chase Total Business checking account with my LLC documents.

It was great that I could sign up for the Chase business checking account online and still provide the promo coupon for the bonus. Unfortunately, I did run into an issue when connecting my other CHASE personal checking account. Since there is only 20 business days to transfer in money and qualify for the sign-up bonus, I want to transfer money in as fast as possible, but ran into these issues:

- Can't Connect External Accounts Instantly: Connecting a Chase Personal Checking account to my Chase Business Checking account was not instant. Even though I tried the instant connection it resulted in an error. I also tried connecting my US Bank checking account but it also failed. This forced me to use the trial deposit method.

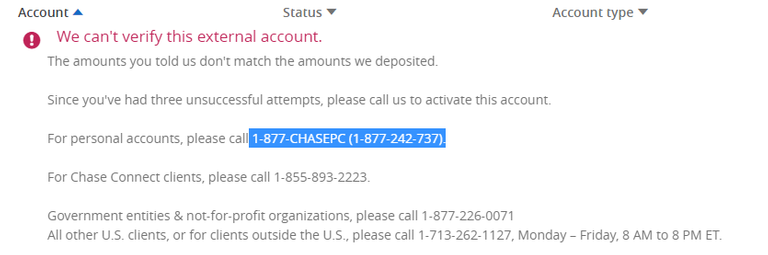

- Customer Support Phone number is incomplete: After getting the "We can't verify this external account" error I was told to call Chase. Since I'm not a Chase Connect client (at least I don't think so) I had to call the number for personal accounts. I HATE dialing words so of course I'll just use the numbers. The phone number listed was 1-877-242-737. That's it. That's one number shy of a value phone number.

- Trial Deposits Take 4 business days: At least in my case, it took 4 business days for the trial deposits to show up. This eats up a lot of time when you only have 20 business days to transfer in money.

- Transferring Money To My Business Chase Checking: It takes 5 business days to complete the transfer.

To fund your Chase Business checking account can take about 9 business days. You have 20 business days to deposit the required amount of money for the sign-up bonus. That means, you have to deposit money as soon as possible because there's not a lot of room for error.

Chase provides a partial phone number but you can figure out the real number.

FAQ

Can I open a Chase Business account online? Yes, you can open your Chase Business Checking account online and STILL get the bonus. You will need to contact Chase via Secure Message and provide them your Chase business checking coupon code.

Can I open a Chase Business account over the phone? You cannot open a Chase Business account over the phone. You will have to go in-branch or apply online.

Is Chase a good bank for small business? Chase is a good bank for a small business but it does have fees which can be avoided if the right requirements are met. For a small business with not many transactions or available cash, I would recommend a fee-free business checking account with Novo.

How much does it cost to open a Chase business account? Opening a Chase business account is free and they also offer a sign-up bonus throughout the year. The Chase Total Business Checking account (cheapest available) has a $15 monthly service fee but is waived with a $1,500 minimum daily balance.

Do I need a TAX ID to open a Business Checking Account? You do not need a EIN for a sole proprietorship and you can use your social security number.

Last Thoughts:

Setting up my Business Chase Checking account ran into several issues and quite a few delays. It takes 9 business days to set up an external account and transfer money in. You have only 20 business days to transfer money in for the bonus which means you have to be ready to transfer money in ASAP. Even though there were some hiccups, this was still worth it for the "fairly" easy sign up bonus.

The Chase business checking account has a very easy approval rate and you can get the bonus every 9 months! That is of course if there is another bonus during that time, but it's still a super-easy way to churn out free money from the bank. Even if you don't have a business, it's worth starting a business just to get these business checking sign-up bonuses!

Posted from my blog with SteemPress : https://slycredit.com/chase-business-checking-review/