Silver Price Analysis

For the past several years, gold prices have staged a historic rally while silver has largely struggled to keep up. For investors, that could mean a buying opportunity. I have been saying for years silver is way undervalued. It has returned 12% a year on average for the past three years, compared with 16% for gold. I think that 2025 is looking to be a good year as we have broken some resistance level in 2024 that I thought would hold, but now they have become support. Industrial demand should be up as manufacturing continues to grow and with geopolitical risks people want to buy some safety which silver can provide some of that.

Silver Chart

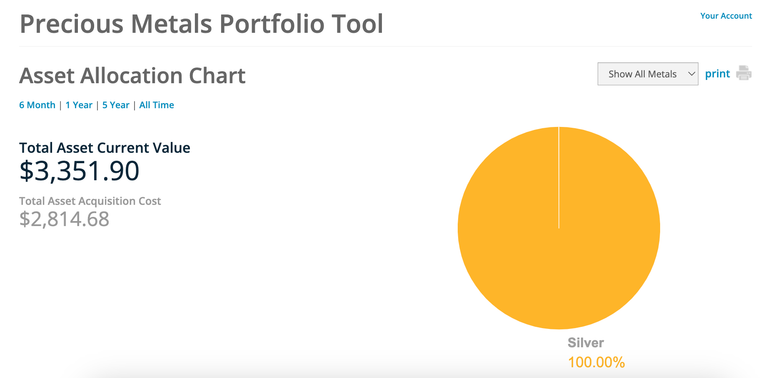

Portfolio Update

Silver took a dip with the rest of the market on Friday so my current assets are valued at $3,351.90 with a total acquisition cost of $2,814.68.

Asset Allocation Chart

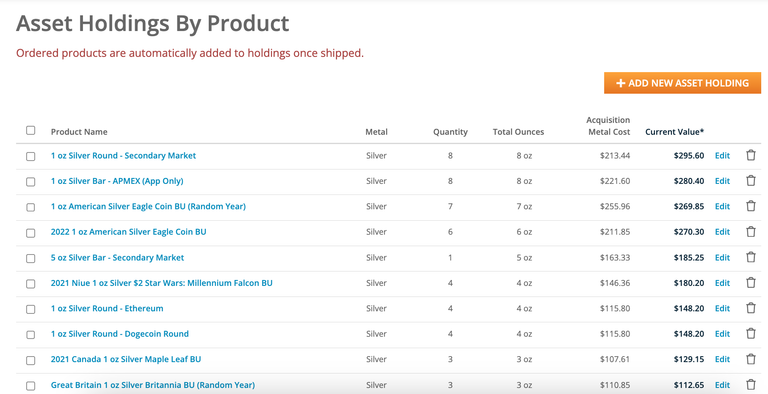

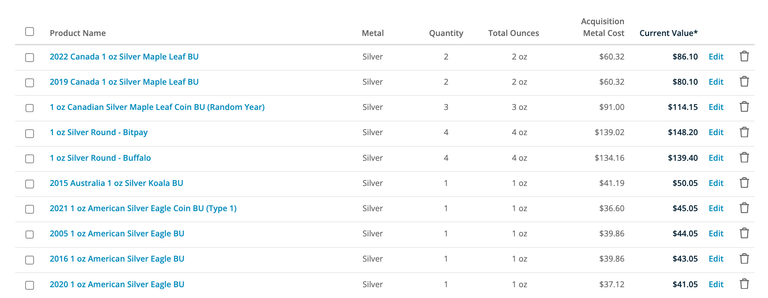

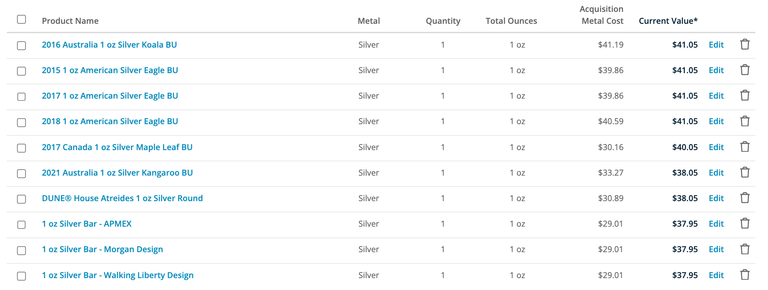

Asset Holding by Product

You received an upvote of 22% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag. You have created a Precious Gem!

A break out will happen this year.

Silver will surely follow gold

Silver is shinning , good time bro

I am so sure that this particular year, the price of silver will definitely go up