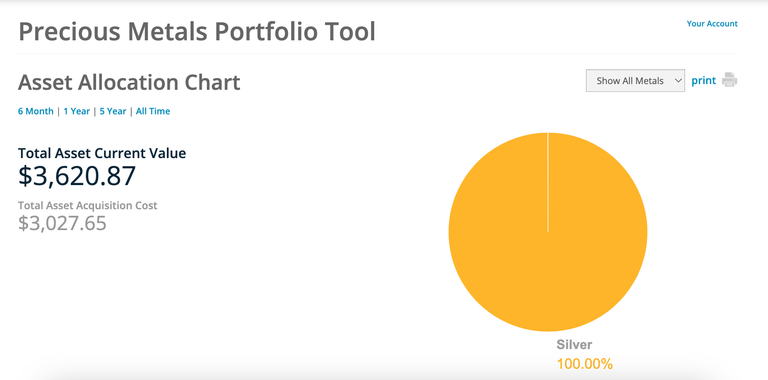

Silver Price Analysis

Wht's up silver bugs it's been a wild week in markets. Silver price strives to hold the key resistance of $32.40 plotted from the December 12 high. The asset trades above the 20-day Exponential Moving Average (EMA), which trades around $32.00, suggesting that the near-term trend is bullish. The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sideways trend. Looking down, the upward-sloping trend line from the August 8 low of $26.45 will act as key support for the Silver price around $30.00. While, the February 14 high of $33.40 will be the key barrier. I looking at any weakness I have started to build a paper trade of SLV to sell covered calls against. I have added about 350 shares of SLV this week.

Silver Chart

Portfolio Update

Not a bad week considering stocks and crypto got crushed. My current assets are valued at $3,620.87 with a total acquisition cost of $3,027.65.

Asset Allocation Chart

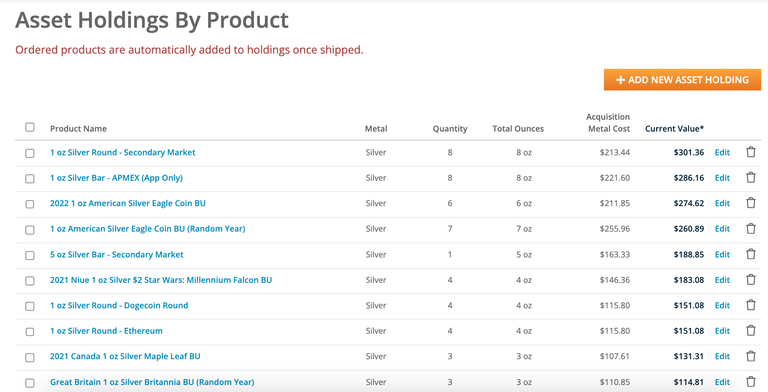

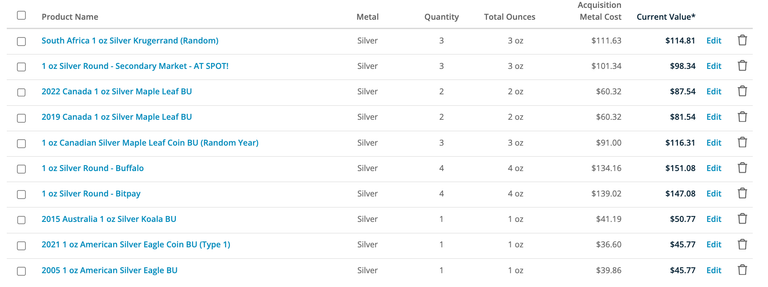

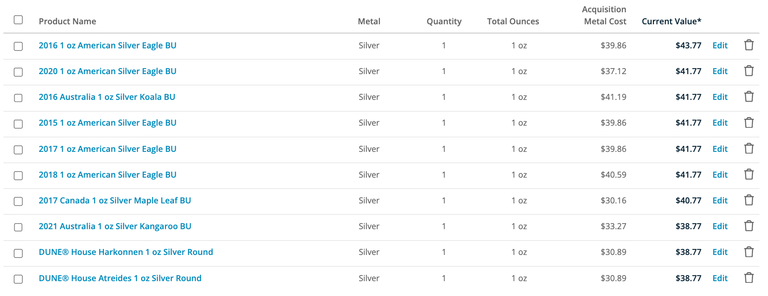

Asset Holding by Product

stable price, not bad considering all the turbolence with tariffs and politics

You received an upvote of 100% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag. You have created a Precious Gem!

It feels good to be in the green doesn't it? Maybe we'll see some testing of $35 again, but the way things have gone this past week I'm not sure what's coming next...

Buy now before Trump pulls more stupid shit and metals explode.

Nice to see silver still doing well given how everything else is in a bit of chaos.