The cryptocurrency market is entering a historic moment, and those who are smart won't want to miss it!

In addition to Bitcoin's new all-time high, new political forces and economic events are favoring the crypto sector in an unprecedented way.

Today, I will explain how the political scenario in the USA and recent market movements can influence your next investments.

The Current Bitcoin Cycle and Political Scenario

Bitcoin is resuming its upward trajectory, reminiscent of previous cycles. Unlike other years, however, the context in 2024 brings some important differences: the recent result of the US presidential elections, the global geopolitical and macroeconomic moment and the mass adoption of the institutional.

With Trump's victory and the increased presence of pro-crypto representatives in Congress, we are entering a highly favorable scenario for the industry.

More than 270 pro-crypto candidates won seats in Congress, creating the chance for more favorable regulation of digital assets in the US. This environment can attract institutional investments and boost the price of Bitcoin and other assets.

The New Posture of the American Government

Here are the main points that could directly affect prices in the short term:

Change at the SEC: Trump promised to replace the current SEC chairman, Gary Gensler, known for his strict stance against cryptoassets. A change in SEC leadership could eliminate critical barriers to the expansion of the crypto economy in the US.

Strategic Bitcoin Reserve in the USA? Senator Cynthia Lummis has suggested creating a strategic Bitcoin reserve for the US, which could boost global demand for Bitcoin. With a pro-crypto Congress, this proposal has a better chance of moving forward, which could increase the value and adoption of BTC on a global scale. Trump also mentioned in his political campaign the possibility of making a "Stock Pile" in BTC.

Institutional Capital Inflow: The day after the election, Binance and Coinbase saw over $9.3 billion in stablecoins inflow, proposing that large investors are preparing to enter the crypto market en masse.

BlackRock Bitcoin ETF Surpasses Gold ETF

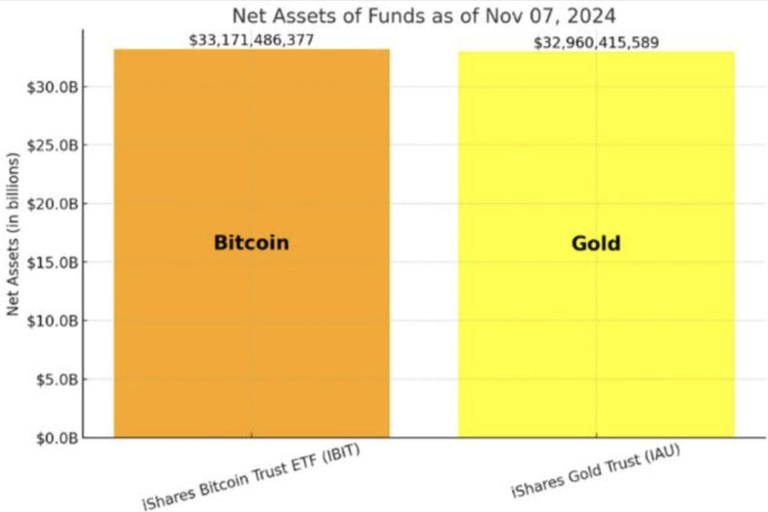

The iShares Bitcoin Trust (IBIT) was launched by BlackRock in January this year as one of the first spot Bitcoin ETFs approved by the SEC.

Now, IBIT has surpassed the iShares Gold ETF (IAU), the manager's own gold ETF.

According to data from BlackRock, last Friday, IBIT accounted for around US$33.17 billion in assets under management. The gold ETF - IAU, launched approximately 20 years ago, had US$ 32.9 billion.

BlackRock has around US$10.5 trillion in assets under management and Larry Fink, the company's CEO, claims that bitcoin is “digital gold”.

Main Market Trends in November

In October, known in the sector as "Uptober", Bitcoin rose around 10%, ending the month close to US$70,000 and increasing its market dominance.

This week we reached US$88 thousand and the increase in Bitcoin's dominance indicates that investors are still preferring BTC as a safe asset amid economic and political uncertainties.

Memecoin Narratives

Memecoin Cycle and Market Sentiment: Speculative tokens such as memecoins have served as a barometer of market sentiment.

The Rise of AI-Powered Memecoins: Tokens like $GOAT, focused on artificial intelligence, have demonstrated explosive growth, showcasing the fusion between AI and Web3. This movement may be indicative of future trends, where emerging technologies combine with cryptoassets.

DOGE and the “Trump Trade”: Social memes related to DOGE have gained traction recently, especially after Elon Musk made a joke about “D.O.G.E. Department of Government Efficacy”.

Opportunities and Protection in Times of Uncertainty

Amid volatility caused by geopolitical conflicts and macroeconomic uncertainties, Bitcoin is increasingly being seen as a store of value.

Recent tensions between Israel and Iran have increased volatility, but Bitcoin has shown resilience, reinforcing its role as a safe-haven asset in times of uncertainty.

Get ready to make the best of the Cycle

With so many opportunities in sight, this is the last chance to strengthen your knowledge and prepare to take advantage of the next waves in the market. The bull run is just beginning!

Posted Using InLeo Alpha

Prepare for the Activation of U.S. Crypto-Coinage... It will be "Stable" and 100% backed (Face Value for Face Value) by U.S. Gold Coins...