A recent report suggests that as many as 46% of Americans expect to retire in debt. This % is alarming for a variety of reasons, one of them being that it will be harder for those who are on a fixed income to try and pay down their debt later on in life.

Social security trusts are expected to run out of money sooner or later.

In 2020 there were over 60 million people in the U.S. who collected Social Security benefits and so if that fund runs out and those people aren't able to be paid any money, it's going to start fueling a bit of chaos.

For those who are thinking that in years to come there will be a social safety net there to save them and help them they might find out too late that it wasn't what they thought it would be. Millions of Americans today struggle on a fixed income in the U.S. and inflation is no friend when the cost of living starts to rise and income isn't rising along with it.

The average payment from social security in the U.S. is around $1,600 for 2022.

Over 55% of people in the U.S. worry about hunger and homelessness.

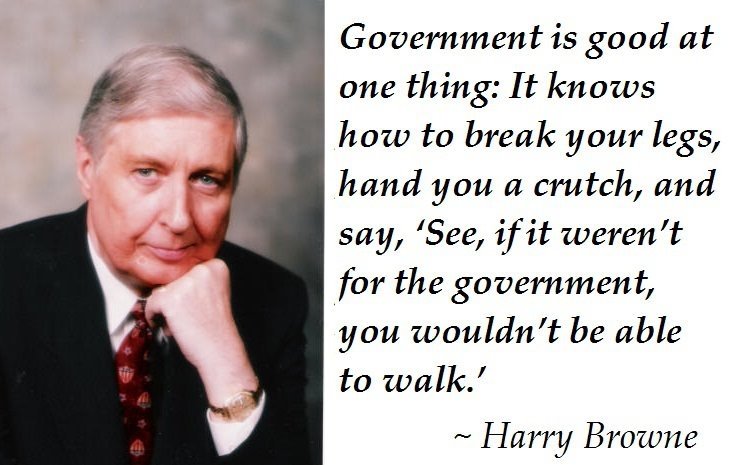

The state in many ways is to blame for the hardship that people face today, from the value of money deteriorating, preventing individuals from starting honest businesses or moving to places with more opportunity etc, dictating who can be hired or what they can be hired for, or taking away billions in resources from individuals all around the country in the name of safety. More people would be able to increase their economic mobility and standard of living if it weren't for that infringement in the market and toward the individual and their freedom.

Sources:

https://money.usnews.com/money/retirement/social-security/articles/how-much-you-will-get-from-social-security

https://nationalinterest.org/blog/buzz/average-social-security-payment-2022-will-be-1657-196971

https://www.marketwatch.com/story/55-of-people-say-they-worry-about-hunger-and-homelessness-in-america-during-pandemic-year-2-11616766694

I cannot imagine how one can retire when still in debt.

So, is the US going towards the soviet route of breaking down?

Soviets invaded Afghanistan. That didn't end up well for their economy and soon, it collapsed. People severely underestimate the role Afghan war played in the breakdown of soviet union. Now, the massive debt US accumulated because of Afghan war is going to cost the average Americans plenty. I won't be surprised if it ended up like the soviet union.

Possible help on the finanacial path (195 pages): https://www.goodreads.com/book/show/69571.Rich_Dad_Poor_Dad