The best way and the cheapest fees are on Vanguard - a nice tracker fund with all the first 200 top companies selected for you if it is long-term. Given that the 4-6% return is safe, low risk and you invest less than 25K for no tax. If you invest more you may be taxed if you get more than £1000 per year in dividends. A nice 3 year bond or cash isa with most of the banks will also give you 4-5% return.

If you like medium to high risk, check this one: https://across.to?ref=0xB018AC399491B9320A456ad0e696D2032b6bADD3

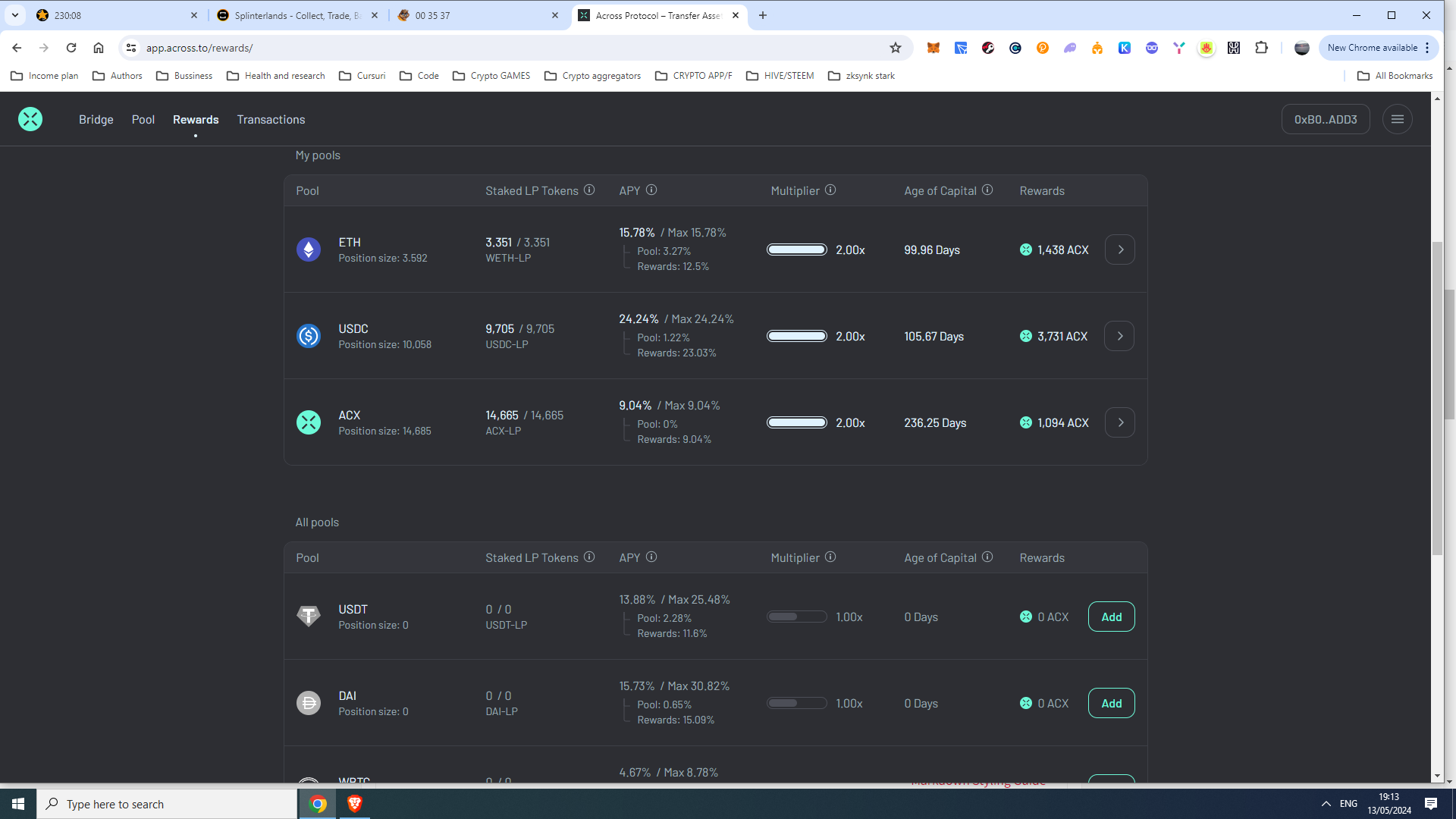

it is a referral to provide liquidity, if you need it, you get around 17% for ETH and 24% for stablecoin like USDC if you keep it for more than 3 months. Across is one of the best bridges and it is made by UMA, so they got a solid team behind. I parked some of my crypto here and I do exchange all the rewards into more stable every 3-4 months.

Cheers, I might have a look at some stocks funds, I'm steering clear of DEFI pools, I had enough of those in 2021. I'll just stick with my 20% on HBDs!

HBD is cool too, at least for now. I am increasing my HBD too lately.

What you want is a tracker fund, low fee, variety for portfolio. Do not pick single shares, they are expensive long-term.

HBD is cool too, at least for now. I am increasing my HBD too lately.

What you want is a tracker fund, low fee, variety for portfolio. Do not pick single shares, they are expensive long-term.

With 200K invested, over 15 years the difference in fees and compounding is like 600K in single shares versus 2.3M for tracker. Roughly! Before COVID, now we do not know yet, but they tend to do well long term.