The bulls are back, the market is ripe for a short squeeze. Conditions are overly bearish and everyone knows it. Big players are looking for the best possible deal they can get on these firesale prices.

Most traders are feeling the exhaustion of three negative quarters. Margin calls have been happening all year long and portfolios are thin. Only an absolute madman would buy in at a time like this? Wrong!

The federal reserve rate pivot is just around the corner my friends. Fear not, there is only so much downside to a market like this. Since March we have seen five rate hikes coming from Washington... +0.25%, +0.50%, +0.75% (x3).

It is expected that the next hike will be a 0.75% basis hike in early November and a final 0.50% hike in December to close out the hawkish fed measures in 2022. If this happens the market will surely respond positively as there is light at the end of the tunnel!

Institutions wanna nail the bottom and it will be coming very soon.

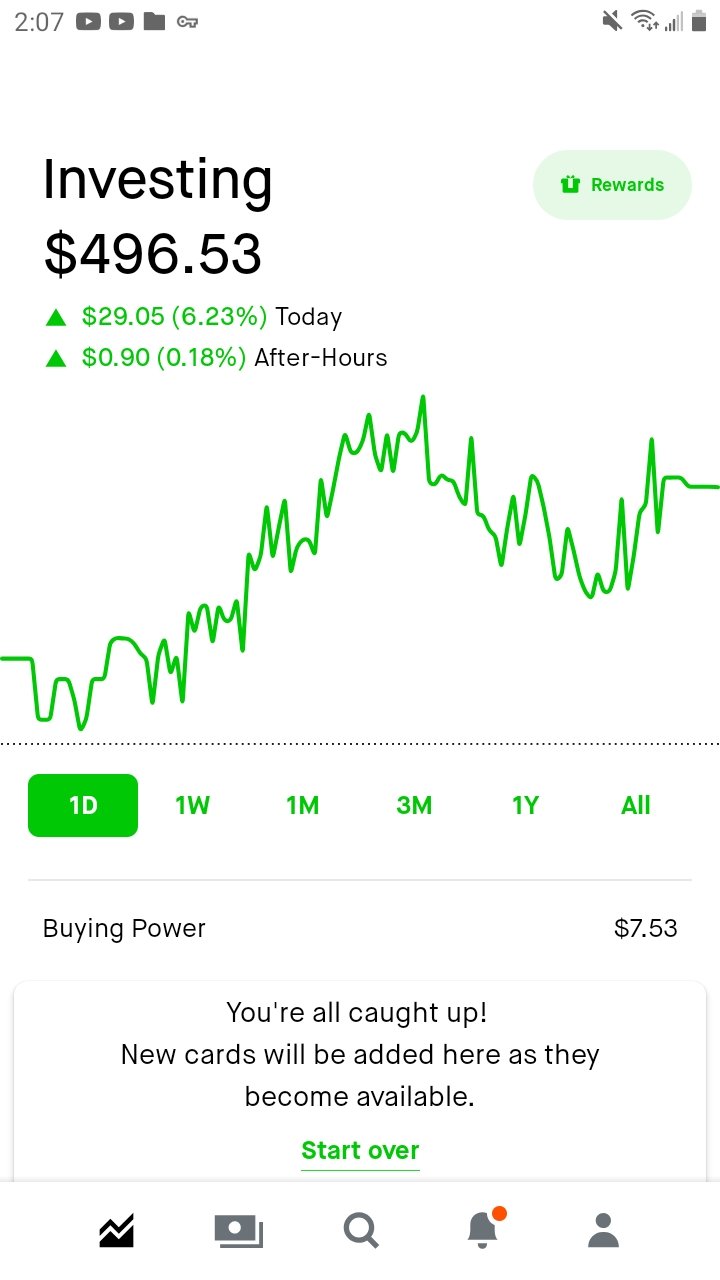

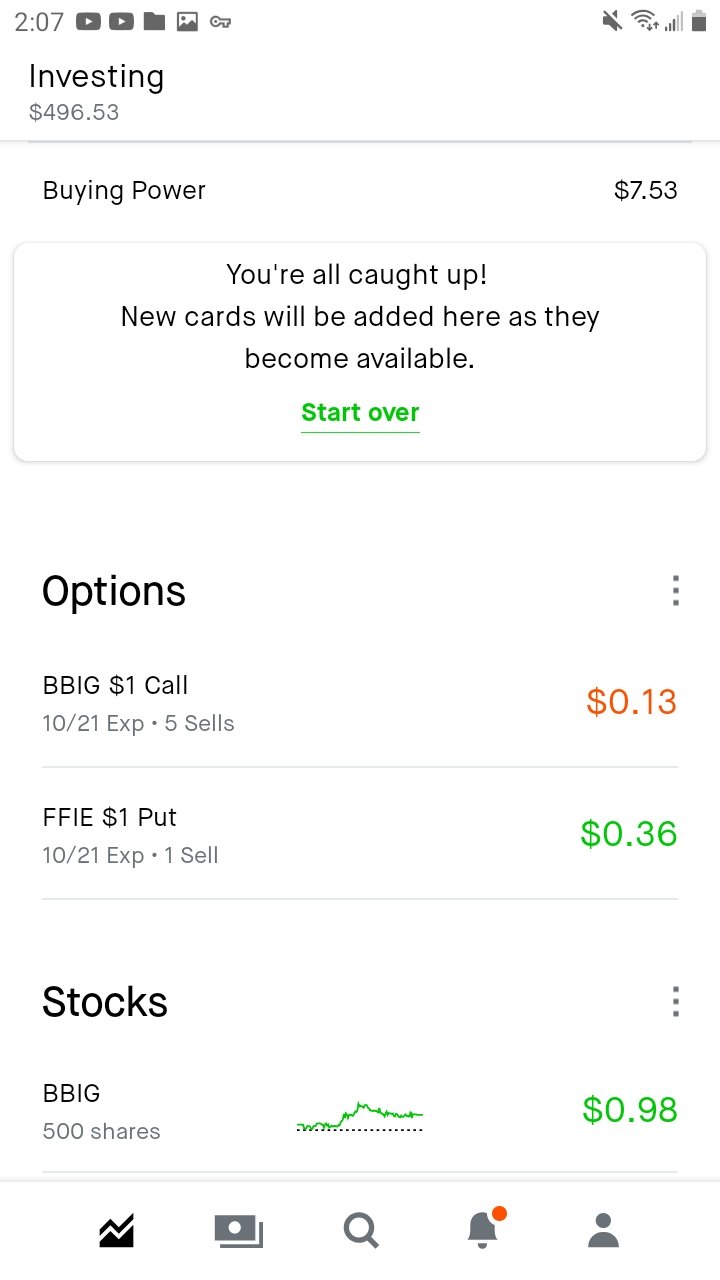

My 500 shares of $BBIG have helped bring my portfolio back to $500 levels. I may in fact be getting called away in a few weeks by the looks of things. Not going to close out my covered calls just yet as they havent decayed at all with the recent price jumps.

My cash covered put on $FFIE is still in profit but has a few weeks to pan out. I might let myself get assigned to these 100 shares to have more diversity in the portfolio.

@ecosaint Please bless this post