March 29th, 2022, Crypto Chartbook – Bitcoin wins the race

Globalization, a cultural and trade exchange process in an interconnected world, is endangered by recent political events. Interrupted business through sanctions affects the value of fiat currencies as well as alliances between nations. With a race between various possible electronic payment systems but a need for instant payments for oil and energy supplies, bitcoin has recently come to the forefront. Pavel Zavalny, a top Russian government official, announced that Russia would take Bitcoin as payment for oil, a response to being blocked out of the swift system, which has made it impossible for other nations to pay for oil in the US Dollar. Bitcoin wins the race.

While Russia accepts hard currencies like gold, a move like this shows that the efficient attributes of bitcoin come to the forefront in times of crisis and are accepted for large business transactions between nations.

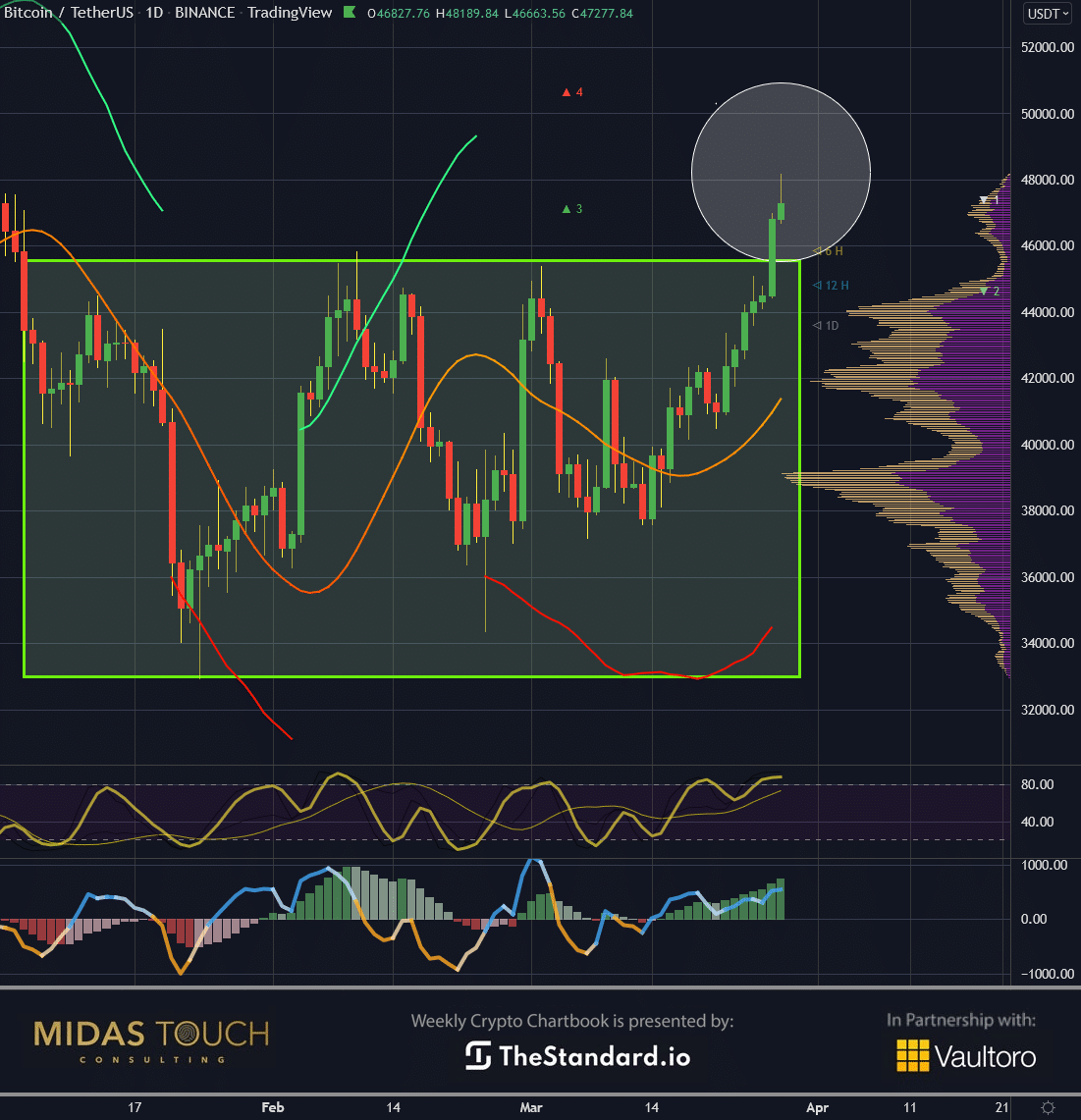

Bitcoin, daily chart, price breakout:

Bitcoin in USD, daily chart as of March 29th, 2022.

Shortly after, president Putin confirmed this new way of doing business. In addition, China and Russia agreed to a thirty-year contract in the gas sector, transacted in Euros. We can see that we find ourselves in times of currency warfare and that it is essential to pay close attention to where and in what form we store our values.

The daily chart above reflects this recent news in a price advance of bitcoin from US$37,567 to US$47,701. A 28% advance in just two weeks. Bitcoin broke through the sideways range, and this week shall show whether this breakout will be a successful one or not. In this case, the bulls have their odds much in favor over the bears.

Bitcoin, weekly chart, price left the station:

Bitcoin in USD, weekly chart as of March 29th, 2022.

We have now left the entry zone (green box) compared to last week’s chart book and the published weekly chart. While the crowd now chases a trade, struggling with the typical inefficiencies of volatility breakouts (bad fills, slippage, being late), we are established in our positioning with the sum of 9 accumulated runners. The runners being the last 25% of each initial position. A fully de-risked or more precisely no-risk venture (see quad exit)! Looking at the weekly chart, we find the resistance distribution zones at a round US$49,650 and US$52,430.

We place additional entries if the price returns to the entry box top.

Bitcoin, monthly chart, if March closes strong:

Bitcoin in USD, monthly chart as of March 28th, 2022.

The price has entered the confirmed buy zone from a monthly perspective. The dual chart shows the progression from last week’s anticipation to this week’s chart book release. Should prices within this week stay within the green box, all-time frames are in alignment. A picture of a confirmed bullish bitcoin trend. It is a rare occurrence and confirmation for larger time frame traders and a call to look for low-risk entries, if no sufficient exposure is at play yet.

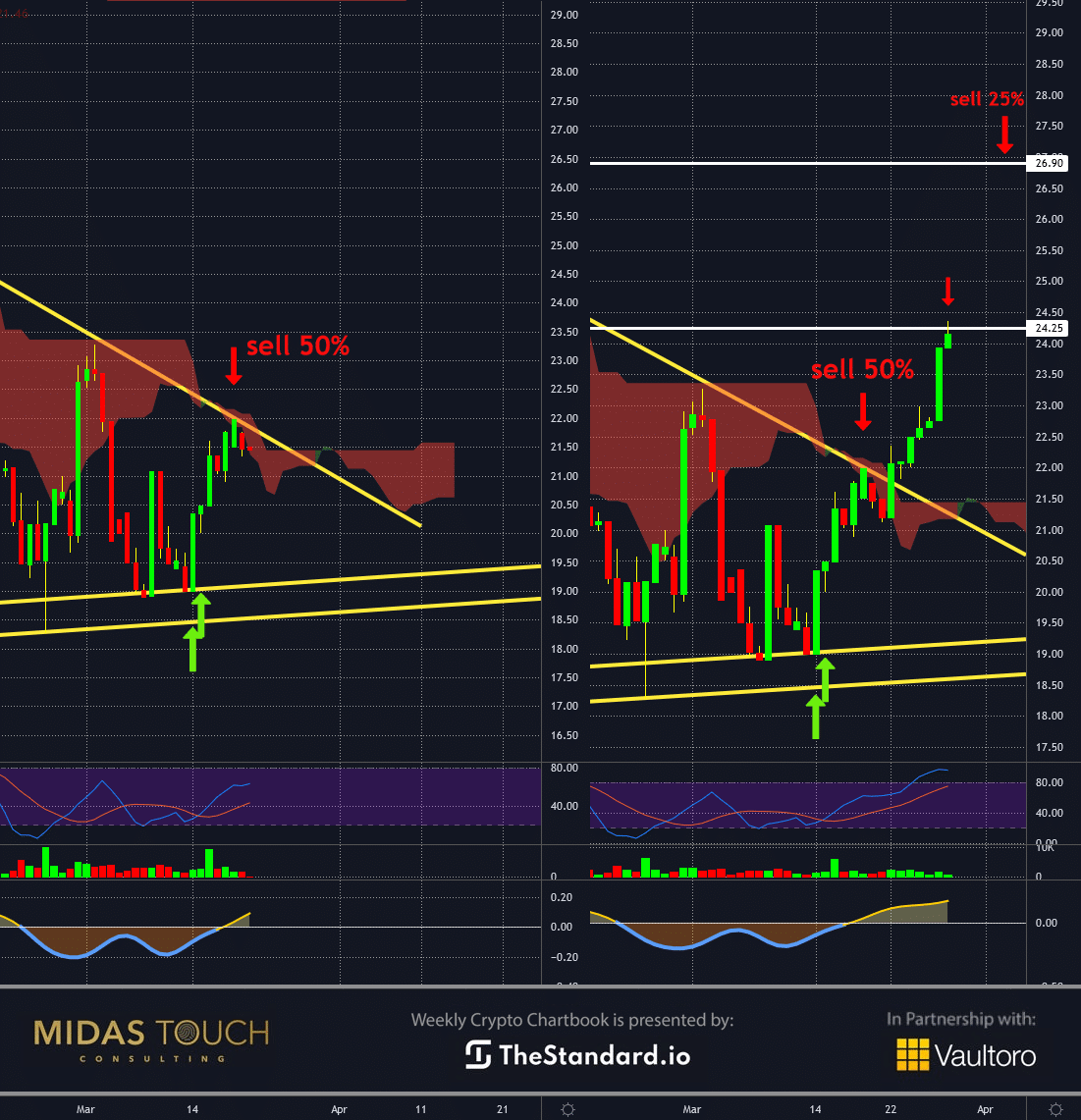

Bitcoin/Gold-Ratio, daily chart, Bitcoin wins the race:

Bitcoin/Gold-Ratio, daily chart as of March 28th, 2022.

Another split-screen view of a chart (a daily chart of the bitcoin/gold ratio) shows the progression of last week’s chart book publication and the situation right now. We had a triangle breakout last week and a substantial advance since then. The suggested rotation out of gold and into bitcoin was/is a successful one. The overall move was 30% in just two weeks. One can use this relationship as well to indicate bitcoins’ recent gain in strength and direction.

Bitcoin wins the race:

Change is never accepted lightly. We typically resist change and prefer an existing state of affairs as human beings. Nevertheless, we find ourselves in less than average circumstances with a worldwide pandemic, a never-ending war, and a general divide in opinions. Russia’s recent move towards approval of bitcoin shows that when the rubber meets the road, what works and is practical in times of crisis and need, wins the race. While governments around the globe feverishly try to get their electronic payment systems developed, bitcoin already finds its use spreading, and successfully so.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment!

Nice keep it up.

if you haven't receive 300 HIVE than vote Drakos for witness

Drakos is a well known and great guy so i am vouching for him

Vote for Drakos and get 300 HIVE

VOTE NOW CLICK HERE