🗣Yesterday’s sell-off matched the FTX crash in terms of BTC sold at a loss. However, according to traders, the worst is over, and it’s time to start drawing charts with a reversal to $156k 🤑

Bitcoin ETFs saw an expected sell-off of $168 million yesterday, while ETH ETFs surprised with an inflow of $48.7 million (the best result since the start of trading, excluding the first day) 🤑

The Japanese stock index Nikkei 225, which started yesterday’s crash, recovered by 10% today. We are waiting to see how the S&P 500 will open. For now, the mood is positive as the media has paused the FUD about a U.S. recession.

🧪 Top-3 for the last 24 hours:

Brett - $0.09198 (↑30.92%)

Bittensor - $254 (↑26.65%)

Ondo - $0.7134 (↑26.00%)

Bitcoin remains on the right track

Analysts at Bernstein note that institutional adoption of Bitcoin remains on track despite market turbulence.

✔️ The current market correction is explained by fears in the stock market and broader economic issues, rather than problems related to cryptocurrency.

From a long-term perspective, analysts remain optimistic.

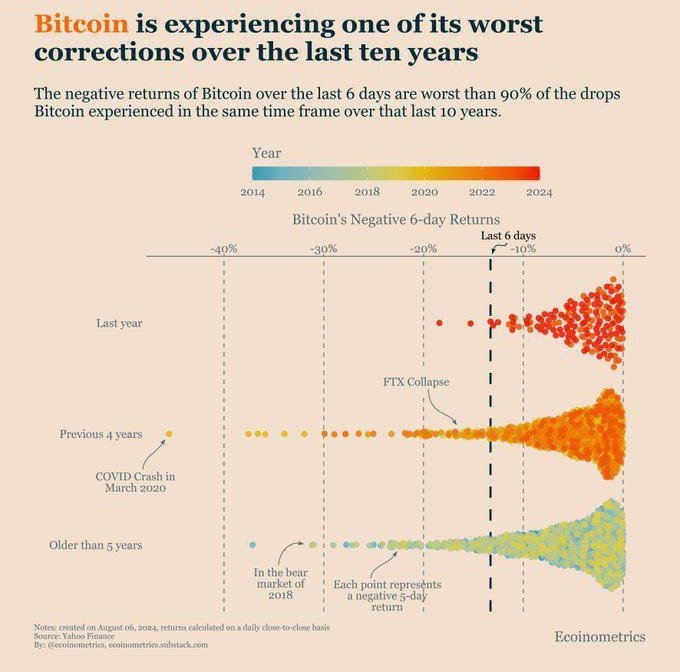

Weekly Bitcoin correction turned out to be one of the harshest in the last decade! 📉🪓

Similar panic sales occurred during the FTX exchange scam against its clients, the March 2020 COVID crash, and the mining ban in China. 🤔