PVM went mainstream on Soneium with Sake Finance, the integrated liquidity protocol on Soneium, ushering in a new era of decentralized finance through seamless modular integration. The exploration continued as the ecosystem added new protocols!

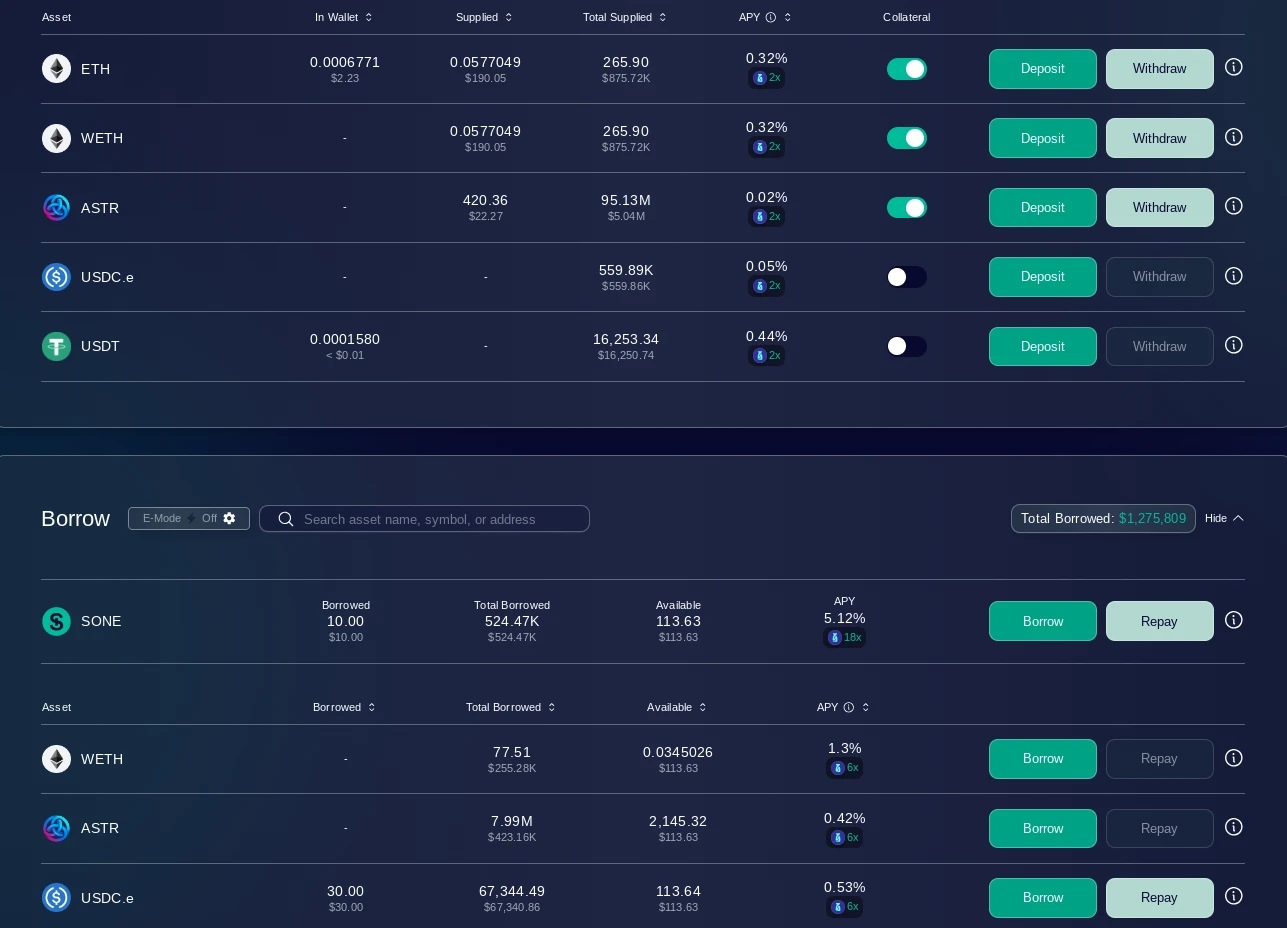

The lending and borrowing protocol forms the foundation of the Sake ecosystem, offering a diverse range of assets and driving liquidity throughout the platform. With features like E-Mode, it enhances portfolio returns and efficiency. Complementing this is an overcollateralized stablecoin, securely backed by yield-bearing tokens from the lending module.

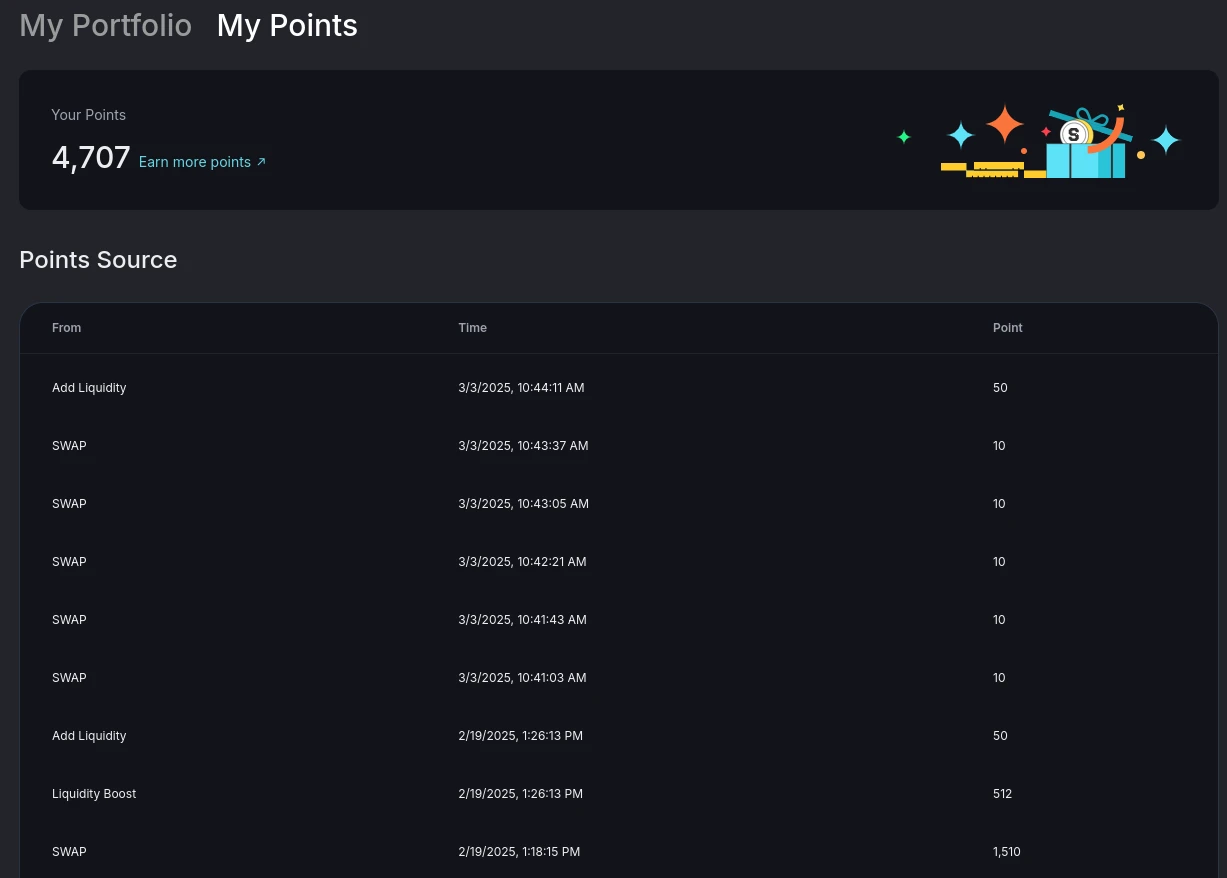

Sake Points will play a key role in decentralized governance, shaping the future of the Sake Finance ecosystem. Updates on their utility and additional features are coming soon. You can start earning Sake Points by depositing into Sake Finance, with more opportunities to earn as new partnerships and integrations are introduced.

PVM has dug deep and explored the trenches to bring you a strategy that'll have your portfolio poppin’! I used multiple protocols in a perfect synergy and I manage to earn rewards across Sake, Neemo, SoneFi, Kyo and Sonex! This cross-chain play is where the action's at, and may bring eligibility for several airdrops!

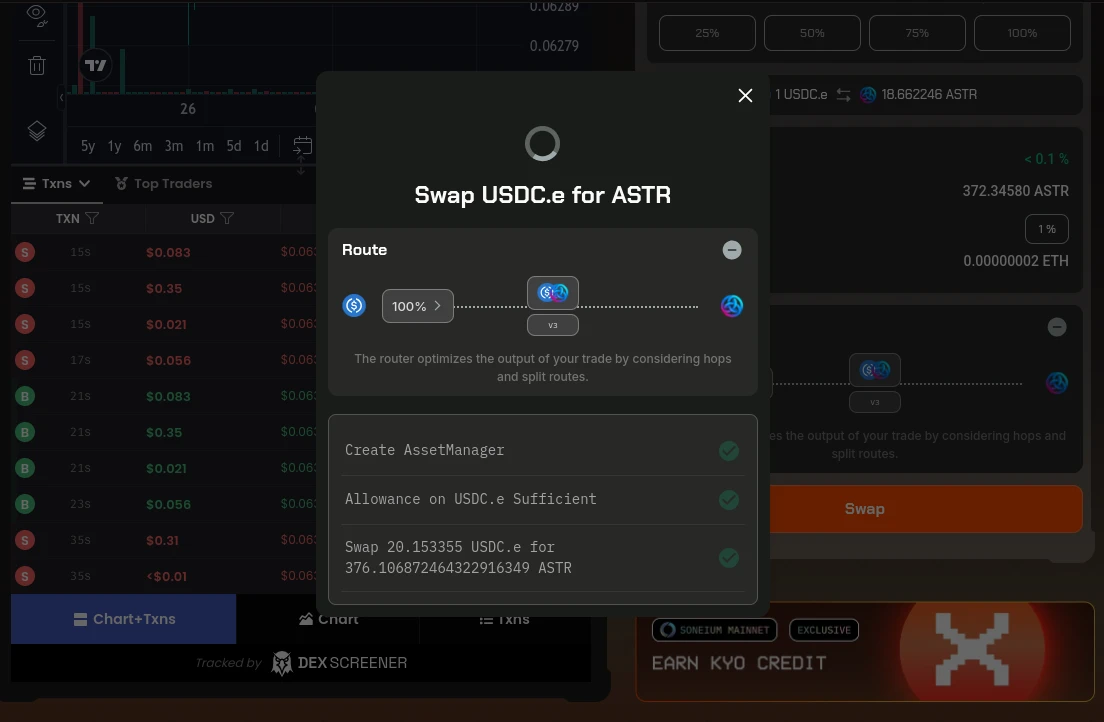

The magic started with swapping USDC into ASTR, and I used both SoneFi and Kyo for this task! Why? More transactions, more "footprints" on the blockchain, plus activity and points on both protocols!

Kyo Finance focuses on democratizing decentralized finance with user-centric products like yield optimization, crosschain liquidity solutions, and tokenized assets tailored for the entertainment industry. With a sleek, intuitive interface and lightning-fast transaction speeds powered by Soneium, the dApp aims to lower barriers for adoption, making DeFi accessible to a global audience.

By harnessing Soneium’s scalability and low transaction costs, SoneFi empowers users to access DeFi with greater efficiency and minimal fees. But the real game-changer? The chads are invited to earn points by trading, launching memecoins, and completing tasks!

For the next steps I needed both ASTR and the Neemo Finance staked nsASTR, but I decided to play a bit and maximize the gains! I went to Sake and staked some ASTR and then borrowed the same amount of ASTR for extra Sake points.

This loop gave me the same asset but with a 8x multiplier for my points on Sake Finance. I want more points and a bigger chance in case Sake will launch their native token! If not, I am sure there's something cooking behind the scene... because their team is awesome!

The next stop was on Neemo Finance, where I staked half of the ASTR, and got nsASTR that I used to supply liquidity! The DeFi protocol is offering liquidity pools, staking, and yield farming opportunities across multiple blockchains.

It lets users earn rewards by providing liquidity, staking tokens, and farming yields. With cross-chain support, Neemo bridges ecosystems, making it easier to maximize returns across platforms. Its native token is used for governance and incentivizing participants.

Neemo is a powerful tool for boosting your DeFi strategy with high yields and multi-chain access, but for this strategy I was only interested in the nsASTR staking.

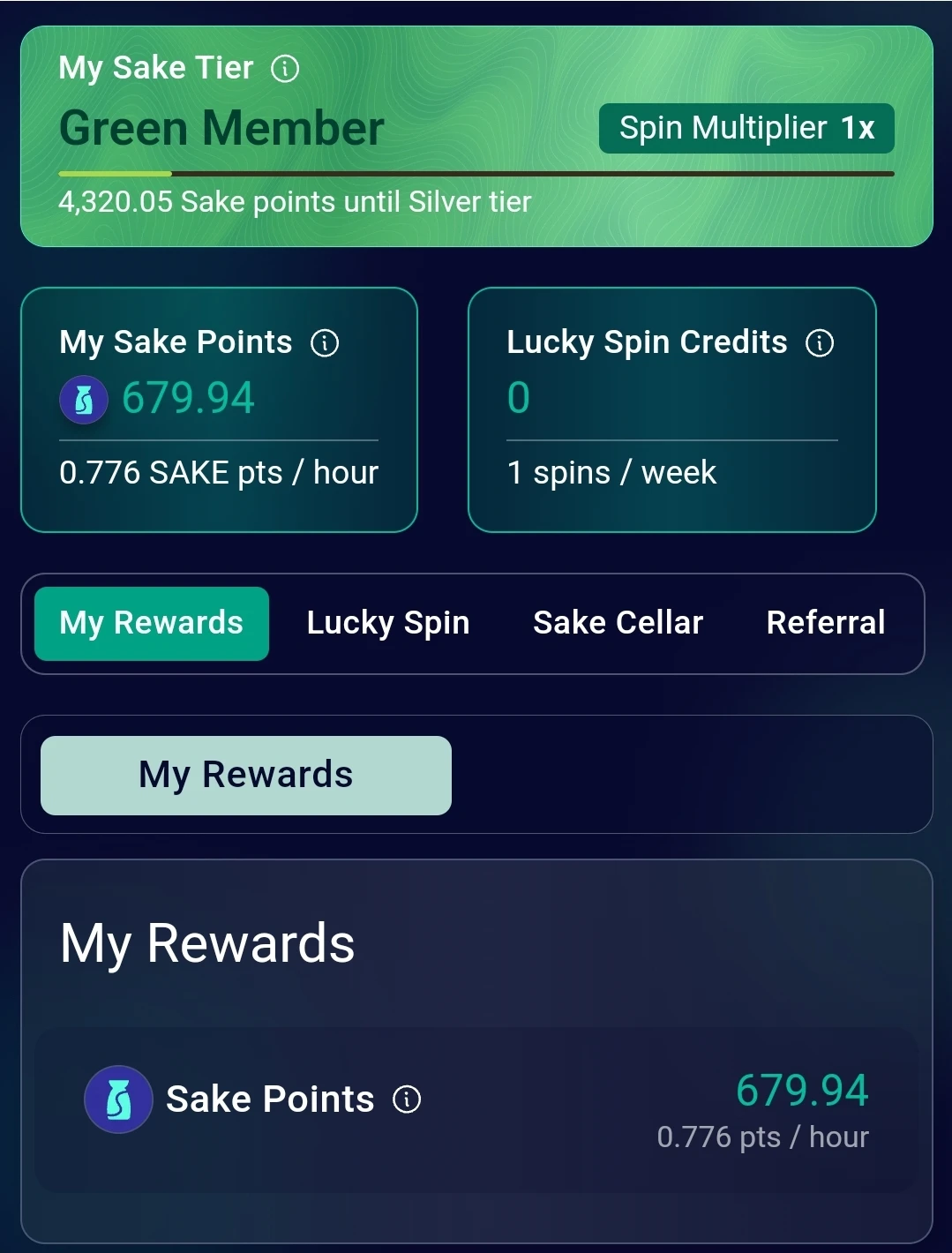

Back to Kyo Finance where the LP for ASTR - nsASTR has a 10% Kyo credits boost, and dived into yield magic. So far I earned SoneFi points, amplified my Sake points 8x, activated 3x Neemo Points from the nsASTR staking yield, and tapped into Kyo points at 1.1x for the liquidity I supplied.

The Sonex strategy is the same, suppling the remaining ASTR - nsASTR as liquidity! There are 5x SONEX points for the LP, plus 8x Sake points and 3x Neemo points from the previous actions.

However, Sonex has more points to offer to crypto savvy people! There are extra points for swaps and LPs, and done few swaps to top-up my ASTR balance. I didn't use my whole ASTR and nsASTR balance in one go, instead making the LP and then adding liquidity for extra transactions (and points!)

There's a third place where the ASTR - nsASTR strategy can be applied, but my funds were limited so I skipped QuickSwap. If you want to give it a try, there a plethora of rewards as well. Liquidity providers will earn $QUICK for their deposits, along the Neemo and Sake points by using the same steps from before.

Time will tell how efficient my webbed strategy was, but until then I am farming on Sake Finance and other protocols like a boss! My points keep adding sip by sip, at 0.776 pts/hour! The second season of Kyo credits started and my LP help me stack them, while SoneFi will soon launch $SOFIA! Best time to be a farmer!

Residual Income:

Claim your Zerion XP!

Sonium: Sake Fi / SoneFi / Kyo

Airdrop Hunting: Layer3

Play2Earn: Splinterlands & Holozing

Cashback Cards: GnosisPay & Plutus

PVM The Author - My Amazon Books