Hello!

A couple of days ago, Simply Bitcoin, one of my favorite Bitcoin shows published this image in one of their videos. I recommend you to follow them in youtube, they cover Bitcoin and crypto news. It's one of the videos I try not to miss. From 10 to 20 minutes daily, for those that don't have time to check all the news.

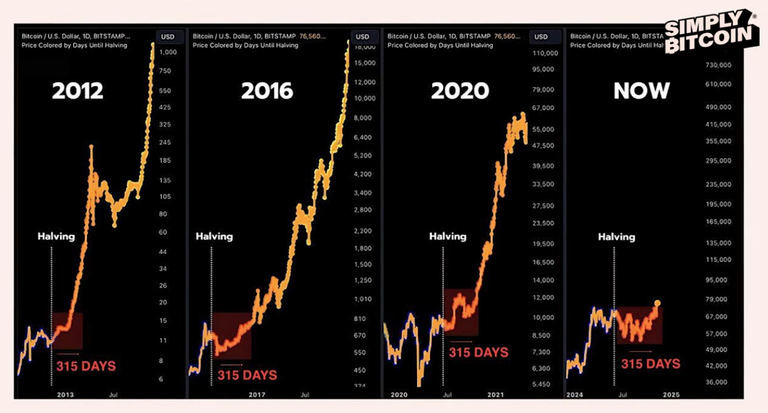

Well, the chart below shows that 315 days after the halving the Bitcoin price usually goes parabolic. In fact, it happened the last 3 cycles, in 2012, 2016 and 2020. Will history repeat itself again this 2024/25 cycle?

I think we are at the verge of a big move upwards. I hope this bull market doesn't end here, we've waited for a long time. I don't think that 105k will be the top with all this macro events happening. The United States is making a lot of moves in favor of criptocurrency adoption. They want to make a Strategic Crypto Reserve and have committed to that publicly.

The next steps are the meeting that will happen this Friday at the White House.

The Swan account said that maybe the Strategic #Bitcoin Reserve could be announced at White House Crypto Summit on Friday according to the U.S. Commerce Secretary Howard Lutnick. This would be HUGE NEWS for the market!

Here you have a list of the attendees:

Do you think that possible updates on the U.S. Crypto Reserve will be announced this friday?

If they announce it, will the just move and use the Bitcoin seized by authorities that the United States is currently hodling? Or they will also annouce that they will buy Bitcoin from the market?

Either of this 2 options is massively bullish for the hardest asset on earth.

The game theory will start to play out as other countries will be forced to join this race or risk being priced out from the future of finance.

I hope you have a great day!

Posted Using INLEO

I checked the chart and it's really worth checking. The Halving was last year April, and I think before the end of this month we're on the cusp of a decent pump..

We are so close my friend!

just a little bit more...

These cycles are so precise, and it is amazing how well they overlay with the liquidity cycle. M2 money supply is on the rise once again, and interest rates are going down, and that means risk on assets are about to have their well-deserved show. I have no clue where the peak will be but I have a hunch we will see that sometime in late Q3-Q4 of this year.

Hopefully @acesontop !

I like to monitor the M2 money supply, I think it's one of the main indicators to follow!

yep. m2 looks good.

Thanks for sharing about the meeting today in White House! I didn't know.