Hello!

Why we are not going up? Easy, there are more sellers than buyers. Things are easy, humans are moved by emotions, and sometimes it's hard to figure out if you are acting emotionally or rationally. Most of the big movements of the market are motivated by emotions. Fear of missing out (FOMO) when there is too much excitement or Fear Uncertainty and Doubt (FUD) when there is irrational panic in the market.

I all of these situations, those who get rid of the emotions and are able to zoom out and examine the market are able to find opportunities where everybody else sees garbage. When there is volatility I try to be one of those people, but it's hard.

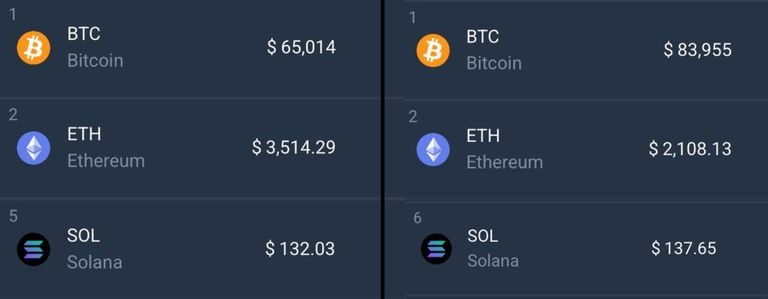

I've seen this photo published by KookCapitalLLC at his twitter account:

Left column is March 4th of 2024 and right column is March 4th of 2025. One year after, Bitcoin is higher than it was before:

Solana is almost at the price it was 1 year ago and Ethereum took a big hit losing -40% of it's value after 1 year. If you are able to examine the market without the emotions that are all over twitter you can see that Bitcoin is in a better spot than it was before.

One could argue that we should be higher, yes, probably. But sometimes it's not a straight road to success. There is a lot of volatility in Bitcoin and it can move very very fast. Some days ago we had a GOD CANDLE which is a 10k candle at the daily chart. HUGE!

Take a look at this other photo published by BritishHodl, a Bitcoin OG that is pushing everybody to get to 1 Bitcoin as soon as possible:

This photo is from BlackRock advising it’s Ulta High Net Worth individuals (UHNW) on Bitcoin. They are creating FOMO to the richest people in the world. Soon they will be adding Bitcoin to their portfolios, it doesn't make sense they don't. This new asset class is set to build the future of hard money.

Have a great day!

Posted Using INLEO

Well some of us is not only emotions, is needs. But this is the exact point, more sellers then buyers.

Yep, invest only what you can afford to lose.

It's just as the popular saying goes: if it was easy then everyone will be rich. The sad things is many people will buy at the top very soon, of course they have the opportunity now, but no, most people want to buy an asset only when it's moving up

Yes. Those people who buy at the top are our "exit liquidity".

don't be the exit liquidity of somebody else.