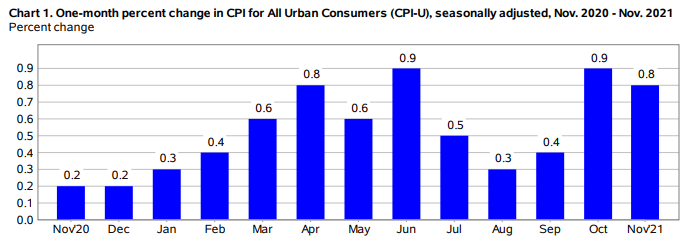

The inflation chart says it all really and with CPI at around 6% which is way above the 2% targeted by the Fed, you know that they will taper at their next meeting.

Is it the right move? I think so. The cheap financial conditions are causing bubbles everywhere and what's needed is targeted spending. Not a bazooka of cash that hits everything.

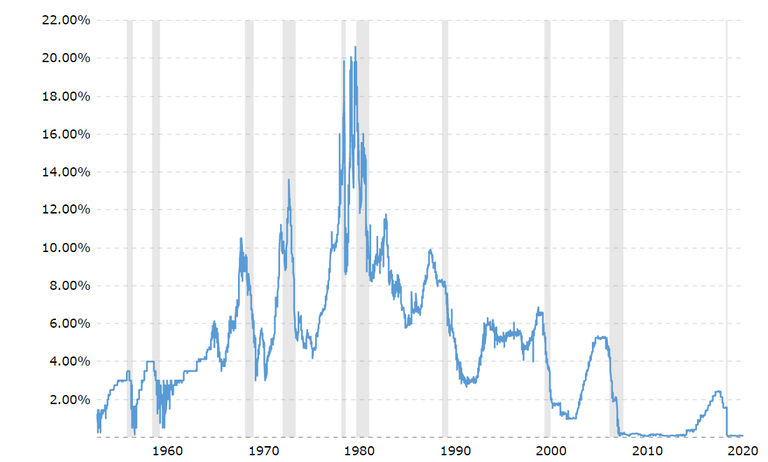

CPI is also the highest since 1982 which if you're old enough to remember was when the US interest rates went really high.

Anyone fancy a 20% interest rate? I think we could easily see 2-3% by the end of the next year which will be healthy and present a buying opportunity if there's a knee jerk drop in prices.

After all, the first couple of rate increases are free and the market only starts to panic after you get to higher interest rates. If stocks offer 5-6% and the deposits only offer 3%, the choice would still be stocks.

Congratulations @rexmillerson! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!