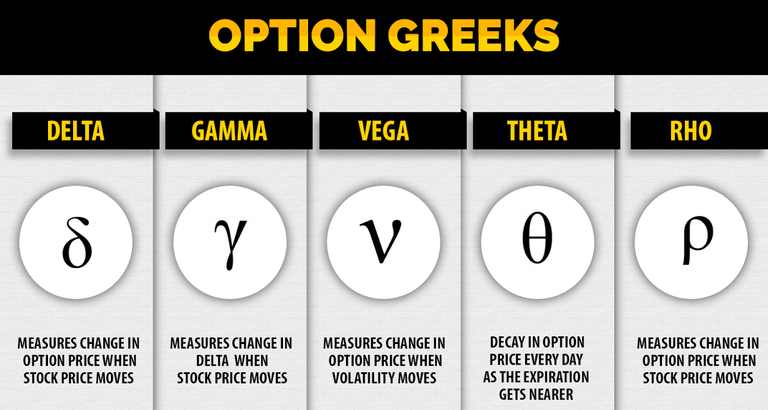

Before buying a contract I'd advice anyone to look at the delta and gamma. To my knowledge delta tells you more or less how much the contract changes in price for each dollar the underlying stock moves and gamma is how much delta increase after the underlying has moved a dollar. So in your something with a higher delta (let's say .50-.70) and higher gamma (maybe .08-.13) and buying less contracts would be more ideal. On stock options these are usually pretty cheap and can be found with even higher deltas. However, this can be risky as if it moves against you, you have to cut very quick losses. But if you let your winners run and cut your losses very quickly it could be beneficial for you as you say you are able to call the direction right a lot. But when you are wrong you have to be able to admit it and not hold and hope as price on these moves fast. For this trade you can make something like 60-80$ with this idea on 1 contract before commission. There's commission though which I don't like, but depending on what country you are in commissions may differ.

Congratulations @sm-traveller! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 3000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!