Today I decided to invest in the Index token because it sounded too good to be true.

Recent trade history: As you can see it did hit 1 before.

According to research, the token is valued based on the holdings it represents. From their website we have this:

Current holdings:

https://he-index.io/holdings/

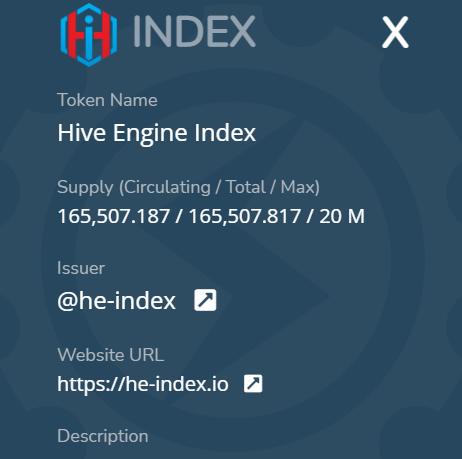

There are two numbers for the amount of tokens in circulation. The website itself gives us this number:

116,529.653

https://he-index.io/richlist/

The supply (which I assume also represents tokens in circulation) gives us this:

165,507.187

Even if we take the higher number, it gives us a value vastly above the current market price for these tokens. (152696.522 /165507.187) Which is about 0.92 which translates to above 1 HIVE.

1 Hive = 0.816

I think the reason for the index's decline is due to the extremely large sell order. If stuff ever rebalances then it should be easy profit.

Am I missing something with this analysis?