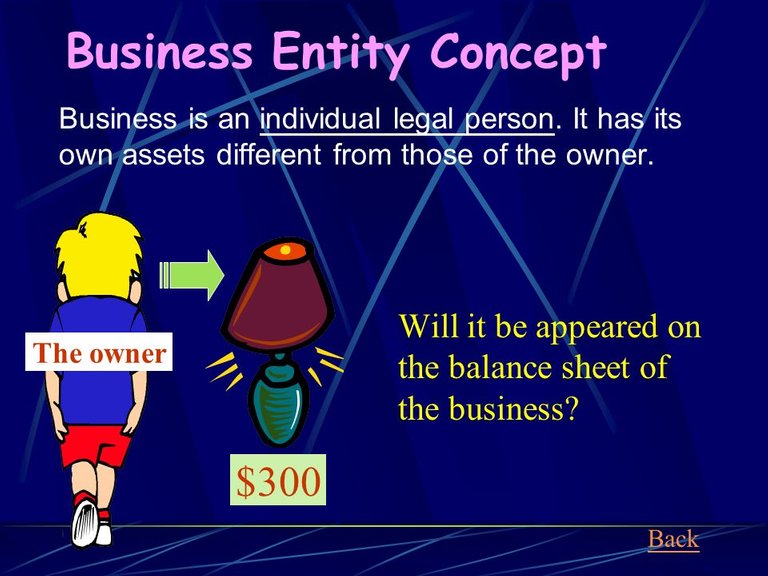

Business Entity Concept : In accounting, business is treated as separate entity from its owners.

Accounts are prepared to give information about the business and not about those who own it. A

distinction is made between business transactions and personal transactions. Without such a

distinction, the affairs of the business will be mixed up with the private affairs of the proprietor and

the true picture of the firm will not be available.

The 'business' and 'owner' are taken as two

separate entities. The accountant is interested to record transactions relating to business only. The

private transactions of the owner will be recorded separately and will have no bearing on the

business transactions. All the transactions of the business are recorded in the books of the business

from the point of view of the business as an entity and even the proprietor is treated as a creditor to

the extent of his capital. The concept of separate entity is applicable to all of business organizations.

For example, in case of a sole proprietorship business or partnership business, though the sole

proprietor or partners are not considered as separate entities in the eyes of law, yet for accounting

purposes they will be considered as separate entities. In the case of Joint Stock Company, the

business has a separate legal entity than the shareholders. The coming and going shareholders do

not affect the entity of the business. Thus, the distinction between owner and the business unit has

helped accounting in reporting profitability more objectively and fairly. It has also led to the

development of ‘responsibility accounting’ which enables us to find out the profitability of even the

different sub-units of the main business.