Margin trading is a popular but risky investment practice whereby an investor/trader borrows funds from a broker to trade financial (or digital asset in cryptocurrencies) asset which forms the collateral for the loan from the broker. While it can potentially increase the value of gains of the investors, margin trading is risky because it can potentially lead to huge losses should the investment not be successful. Margin is the value of the assets that the investor must own and which forms a percentage of the total purchase of the margin trade. Assets which can be margin traded include stocks, commodities, futures, short sales and now, cryptocurrencies. Margin trading cryptocurrencies is just gaining prevalence, with users able to multiply their gains using leverage on cryptocurrencies available on several exchanges including Huobi Pro.

Margin trading on other cryptocurrency exchanges

The most popular platform is Bitmex. Others include Bitfinex, Plus500, Poloniex and AVAtrade. Bitcoin markets are the most common, even offered exclusively on some of the above exchanges. The amount of leverage varies from exchange to exchange with rates such as 3.3x on Bitfinex to upto 100x on Bitmex.

Margin trading can result in short-term gains, hence making it more relevant for experienced high-net worth traders who can cushion themselves. It is best practice for average traders to take a more long-term approach in comparison. In addition, the more volatile the asset being traded the larger the amount of margin required of the investor.

MARGIN TRADING ON HUOBI PRO

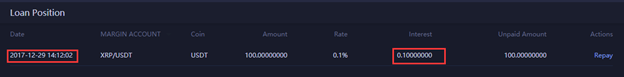

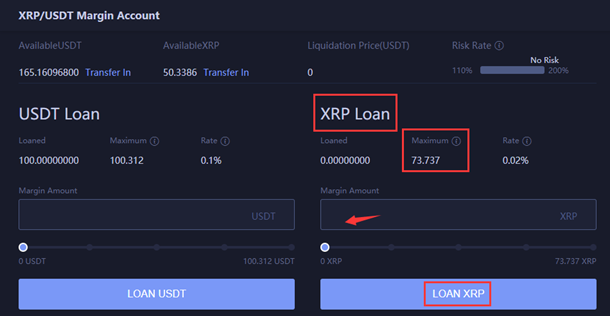

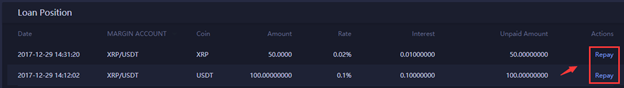

You will need an account on Huobi Pro. Huobi Pro supports leverage of up to 3x. Daily rate of loaning USDT is 0.1%. Daily rate of loaning BCC, ETH, LTC, ETC, DASH, XRP, EOS, OMG, ZEC is 0.02%. This interest starts as soon as you loan. One day/24 hours is considered as a unit. Any time less than 24 hours will be considered as 24 hours. When you repay the loan, you also need to repay the interest. More information can be found here https://huobiglobal.zendesk.com/hc/en-us/articles/360000077812-Margin-Trading-Tutorial

I will offer a quick demonstration of how to loan funds, how to long, how to short and how to repay loans on Huobi Pro using the XRP/USDT pair.

How to loan funds

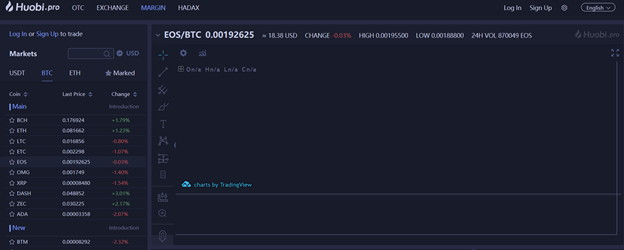

- On the main page, click on the “Margin” button. You will enter the “Margin Trading” Page.

- On the left are the available trading pairs for margin trading

- You can deposit your funds(margin) to the margin account, after choosing your trading pair of choice

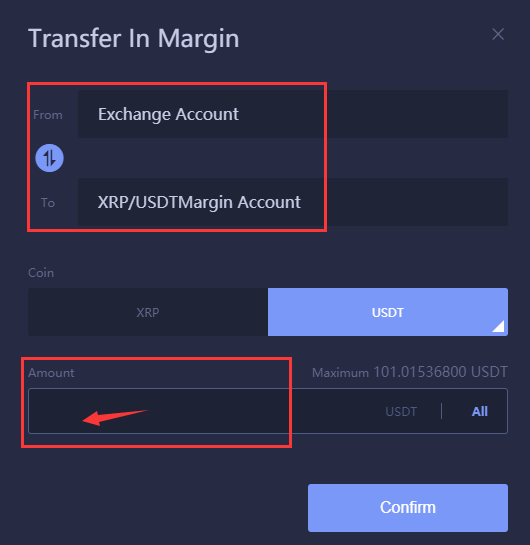

- Click on the “Transfer” button which will lead you to a page saying “Transfer In Margin / From Exchange Account To Margin Account” as shown below. You then need to confirm the coin and amount, then click on “Confirm.”

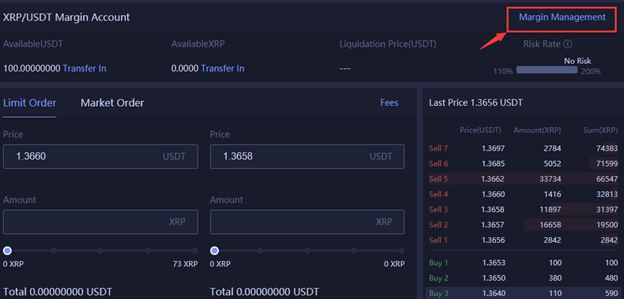

- Once margin deposit is successful you can begin margin trading by clicking on the “Margin Management” button on the right.

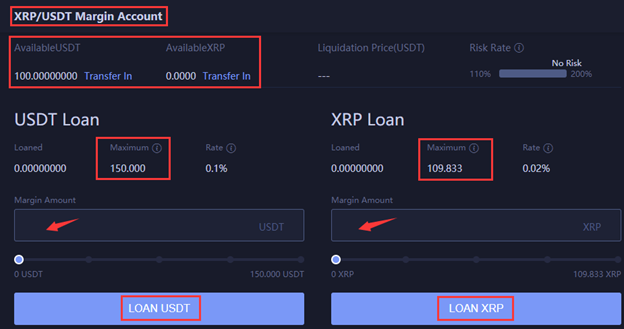

- In the “Margin Trading” page, the available amount is based on your Margin amount and leverage time; you can loan as you need. When there are insufficient funds, please decrease the loan amount. When there are sufficient funds, loans can arrive at your account in real time.

- You can view the details such as Loan Date and Rate, etc. in the Loan Position as soon as you complete the loan position.

How to profit by longing on margin trading

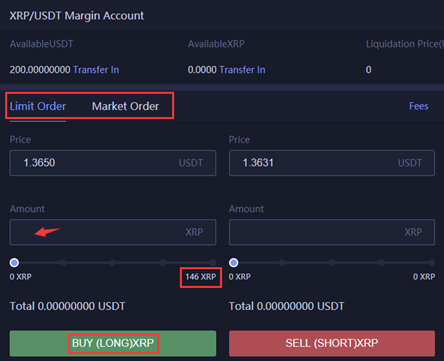

In tradingspeak, ‘long’ means ‘buy’. You can be able to take advantage of bullish trend using Huobi’s margin platform, buying at a low price and selling later when you meet certain targets. Using the example of XRP/USDT, loan USDT and use it to buy XRP following the process below.

- In the “Margin” Page, set the buy amount and click on “Buy.”

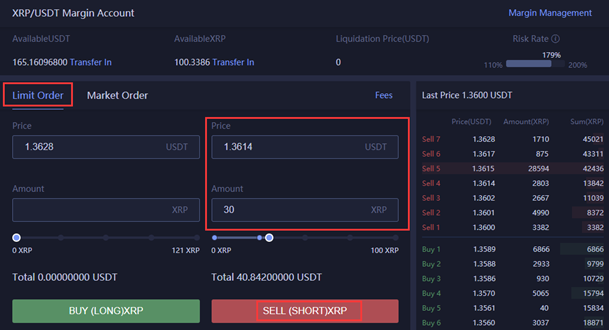

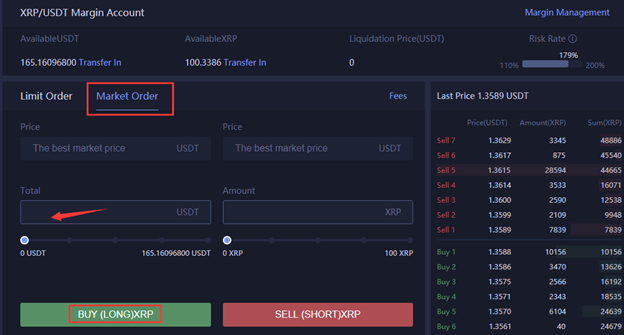

- When the coin price meets your target, sell by choosing “Limit Order” or “Market Order”. “Limit Order,” automatically sets your coin upon reaching the price you set.

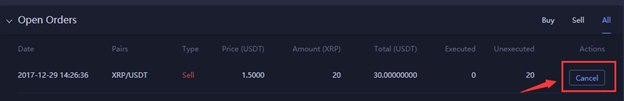

- You can successfully cancel any limit order you have already set at anytime. Click on “Cancel” to the right of your order detail in the “Open Orders” Page.

Things to note:

‘Market order’ sells at the optimal market price, usually executed in real time.

Buy at low price and sell at high price. Repay the loan and interest. Once your Margin and interest are paid, the balance left is your profits.

How to profit by shorting on margin trading

‘Short’ means ‘sell’. In a bearish trend, you can buy coins at a high price and sell them later at a low price. After repaying interest, you remain with profits.

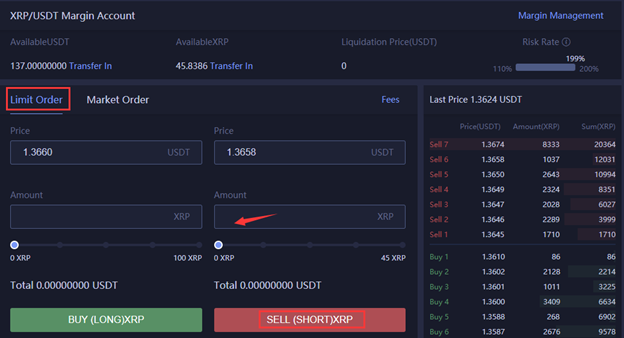

When you want to short a coin, loan it, then sell it at a high price and buy at low price. You can follow these steps:

- Loan a certain amount of XRP in the “Margin” Page.

- Short the completed loan in the “Margin” page (sell it at a higher price) using “Limit order” or “Market order”.

- Let’s say the XRP price drops to meet your target. In the “Margin” page, you can buy a certain amount of XRP at a low price to repay the loan and interest.

How to Repay The Loan and Interest

- Click on “Margin Management” button and view the repay list on the page.

- Click on the “Repay” button. On the “Repay” page, enter the repay amount and click on “Confirm.” If there are insufficient funds for repayment, please transfer funds into Margin Account.

More information on margin trading on Huobi Pro can be found here

https://huobiglobal.zendesk.com/hc/en-us/articles/360000077872-Margin-Trading-Instruction

MARGIN CALL WARNING

Margin trading cryptocurrency is very risky and Huobi.Pro tries to limit the loss that can be incurred by offering warnings to investors should the position be risky. More on that here

https://huobiglobal.zendesk.com/hc/en-us/articles/360000072991-Margin-Call-Warning

yes it is very risky trading in crypto. thats why other user are choosing to hodl. Speaking of hodling iiblockhain drop 4 altcoins to be good on hodling one of them is SPHTX. Check this tweet from sophiaTX