Should Countries Try And Lower The Wealth Gap Among Citizens

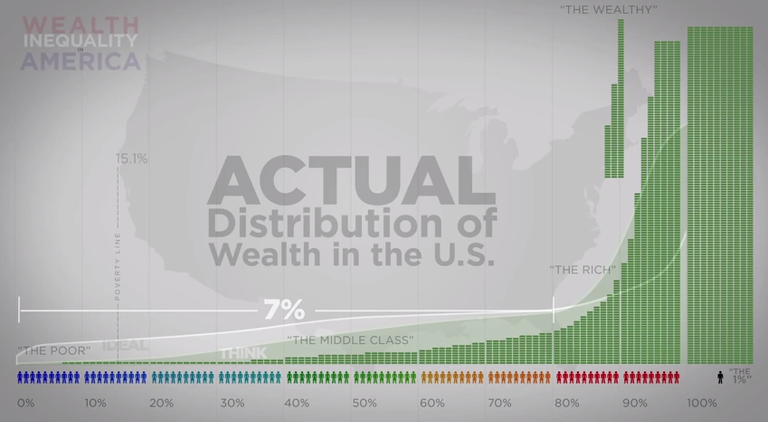

It is no surprise to anyone that in many countries around the world and specifically in the United States,massive wealth gaps exist amongst the population. For example in the US, the New York Times reportedthat the richest 1% own more wealth than the bottom 90% combined.(1) The financial crisis only helped make the wealth gap worse and now the gap is the second largest since the great depression. We live in a capitalist society, so we encourage making as much as possible, but should governments actively try and keep the wealth gap at an average rate or should they take a complete hands off approach? How could the government even go about lowering the wealth gap effectively? This post rides along a fine line of what you believe politically and what you believe economically, which only further makes things more difficult.

Ideologically financial freedom should be available to those in the US, especially the wealthiest, but is it the best option for the country as a whole? The US has a benefit that most of the country is extremely optimistic with almost 1/3 believing they will one day have enough money they don’t have to work (excluding retirement) and another 1/3 believing they will have enough money to not have to worry about money as a problem.(2) These statistics however don’t match up with the actual wealth distribution in America at all. If people knew the real statistics, they would realize that their chances of transitioning into the upper class are slim to none. While it is possible to make a sufficient savings for yourself during retirement, the chances of actually transitioning into the upper class or retiring and a younger age are slim. So say the government wanted to fix this problem, how would they even go about

it?

If we take the US as the example to use, which take in mind is not nearly as bad as some developing countries, there are constantly debates about taxing the wealthier more, or giving them tax breaks because they create the businesses that benefit us all. However there are problems with both theories.On the side of taxing the rich more, economic minds have basically come to a conclusion that the tax rate can only be so high until the rich seek other options such as hiding income in off shore accounts.

When you are rich enough, you unavoidably become a bit like an international citizen, as there are countries that are willing to act as a tax haven and you can afford the necessary lawyers to abide by the legal rules. The tax rate in the US now is actually pretty low compared to past rates, but a more international and technological world comes with the advantage of making hiding money easier. Making hiding money easier means that the tax rate which would cause the rich to look for tax havens becomes lower and lower. While we were able to have a marginal tax rate at 70% on the richest in the 60s, now a 40% rate is even too much to keep money inside the country to be taxed by the US government.

On the flip side the Trickle Down Economic Theory which has been cited by many politicians in the past has almost entirely been discounted. The truth is that there is only so much people can purchase with their money and many of the rich avoid investing directly into new businesses and infrastructure that would create jobs. Too many people with a hundred million or even a billion dollars are choosing to sit back and retire rather than invest in the future. There are some exceptions but for the most part these people are hording money and buying up everything in the US. If you wonder why a studio apartment in NYC is 2 million dollars, its because the entire market is owned and horded by a small group of people.So is there really a way to even lower the wealth gap in the US without pushing those who pay the majority of the taxes out? Im not so sure.

I think that taxing the wealthier a higher percentage is justified, just because of how many opportunities they have to make more income than the regular person. The returns on investment with people who have large amounts of money usually exceeds the average person, the S&P 500 and the DJIA. For example if I had five million dollars, I could buy a block of apartments and with rental income make my money back completely in 10-20 years. However, im not completely sure that we should raise taxes more than they already are because it might push the wealthy towards capital flight. I think there is probably room to tax them, but how much I don’t think anyone knows. We would need extensive data and some testing available to make an informed decision. Im curious what people here think, I read all the comments, and even if I don’t respond right away I do get around to it before I post my article the next day. I posted some sources below for any who are interested.

-Calaber24p

1- http://www.nytimes.com/2014/07/24/opinion/nicholas-kristof-idiots-guide-to-inequality-pikettycapital.html?_r=0

2- http://www.bankrate.com/finance/financial-literacy/do-you-think-you-will-be-rich-one-day-1.aspx

3- https://www.washingtonpost.com/news/wonk/wp/2015/05/21/the-top-10-of-americans-own-76-ofthe-stuff-and-its-dragging-our-economy-down/

Sorry If you saw this when it had a formatting problem. I fixed it, sorry I didnt see it sooner.

Indeed, these things can be difficult because people often have a preconceived notion based on whatever fits together their political beliefs.

I'll declare myself as a complete voluntary anarchist, but I hope that's the wagon behind the horse and that I'd change if someone showed me reason to do so.

I think the way the government could lower the wealth gap would be to roll back all the things it does that cause the wealth gap in the first place.

I notice (not in your post at all, just in general) that people often have this dichotomy in their head where they accept the foundations of the economic system as the way that it is and then assume taxes is the only way to bridge the gap. Even putting aside moral etc disagreements with taxation, that seems like attacking a problem with a squirt gun. It's nothing compared to the underlying things that cause the gap. (And of course in practice, to actually tax enough to correct it in a meaningful way, it gets messy as the mega-rich would just hide wealth and leave the country and get buddy-buddy with the political class at a higher rate.)

In a natural laissez-faire state, to me it seems like most businesses would be run by people who are intimately in touch with the local clientele. It would be a competition of passion. But minimum wage laws and licensing requirements and complicated tax and legal codes warp it into like a careful game of numbers with really thin margins for profit, so it's won by major groups who have enough money to invest in the proper strategy. And in turn so much of the economy is top-heavy.

And of course there are entire industries like the banking sector (and their cousin, the war sector) that wouldn't exist without government monetary policy. And a lot of the rich emerge from these areas.

In general, like if you just think of an island of 200 people, it'll be pretty tough for anyone to be drastically better off than someone else. One might work harder, be a little stronger, etc. It won't be completely even, but one person isn't exponentially better than others by nature. But if one person has a gun and is allowed to make rules (about where you can build, when you can pick coconuts, how and etc), those who are friends with this power source have an avenue to riches that's way disproportionate to what they'd have without it.

And US law, littered with protectionist policies, is I think an extension of this concept, and over time bound to result in a top-heavy distribution.

Since I'm not rich hehe, I personally have no visceral dislike for taxing the rich. But I just don't think it's actually the way that this would get corrected. It would be like getting stabbed and putting a bandaid on it. I appreciate your post and just want to share this perspective, I think the roots of the imbalance is really important and sometimes ignored by people who are interested in this.

Wow..A whole post within a comment. I agree with all you say and reckon it would make a valuable post in itself!

Thanks! Ya I got a little carried away lol. It probably is more visible on calaber's page as a comment than it would be on mine as a blog :p but ya maybe I should toss up a new post about this at some point!

I agree with the majority of what you said, with this exception:

They don't choose to sit back. It's like a disease, they have to sit back. They've spent their lives having wealth, and building wealth. To invest in the future and possibly lose wealth, is not a risk they are willing to take.

That's why they don't invest in the future. :(

Top Post

Congratulations. Your post received the most upvotes yesterday.

https://steemit.com/stats/@steempowerwhale/key-stats-for-authors-friday-october-07-2016

I think that we need to use the blockchain to provide transparency in the business world.

But there is a genious solution to incentivice people to pay taxes, made by the Steemian @johan-nygren

https://steemit.com/ethereum/@johan-nygren/the-resilience-protocol-darwinian-basic-income#@johan-nygren/re-capitalism-re-johan-nygren-the-resilience-protocol-darwinian-basic-income-20160815t003247017z

this was the best piece I read all day

This post has been linked to from another place on Steem.

Learn more about linkback bot v0.4. Upvote if you want the bot to continue posting linkbacks for your posts. Flag if otherwise.

Built by @ontofractal

getting everything you produce would fix the problem easily

It's the government's fault. They tax people, which is effectively stealing.

Then they punish people who want to create by licensing, regulating and outlawing certain things. People are controlled, and they cannot excersize their creative powers.

The 1% just bought themselves the freedom, but the others are enslaved. Reduce the government, and poverty will be reduced.

TL;DR

Is it politically acceptable to wage nerf?

Public and private bureaucrats are the problem. You can manipulate men with booze,drugs, and hookers. They are easily "hackable." What we need is a system that is impenetrable where full trust is impeccable. What we need is smart organizational models. Wha we need is Blockchain.